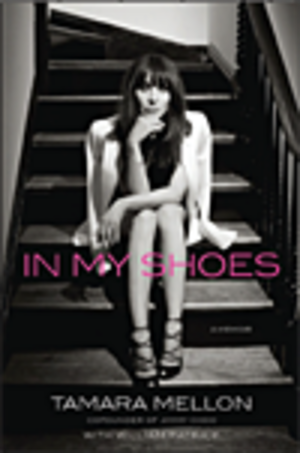

In My Shoes: A Memoir By Tamara Mellon (with William Patrick)

Book review: In My Shoes, by Tamara Mellon The story of fashion entrepreneur and Jimmy Choo founder Tamara Mellon is one that other entrepreneurs would do well to take note of.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In My Shoes: A Memoir

By Tamara Mellon (with William Patrick)

Published by Portfolio (£20)Buy from Amazon

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Business books have a reputation for being worthy but dull. In My Shoes, the autobiography of fashion entrepreneur and Jimmy Choo founder Tamara Mellon, certainly breaks this mould. It's a "wonderfully bling memoir", says Helen Davies in The Sunday Times "pure Danielle Steel, with added MBA". While it focuses mainly on Mellon's "creation of one of the world's most famous shoe companies", the book also looks at her childhood and early life as a socialite. "The list of people who get a stiletto in the neck is a long one."

So much so, says Businessweek's Susan Berfield, that the book "often comes off as the rant someone might write to an ex-boyfriend or boss and then never send". Mellon evidently believes that she "was unappreciated by executives at the company and exploited by the private-equity investors who funded itsexpansion". But the fact that she bears grudges may make potential backers think again it is certainly likely to "complicate the prospects for her new project".

It's true that "Ms Mellon seems to live on a permanent war-footing with half of the names in her Rolodex", says The Economist. But the book is also "an object lesson about an alchemist who won applause, within the industry and beyond, by being prepared to fashion a brand out of a stylish product and female chutzpah". It also highlights the ways in which the "comically irreconcilable" cultures of high fashion and high finance can collide.

Other entrepreneurs should take note of Mellon's story, says Kim Winser in Management Today. Her problems with business partner Jimmy Choo and the private-equity backers who bankrolled her serve "as a cautionary tale for anyone stepping into the world of business partnerships and equity investments". But Mellon seems wiser for the experience. She ends this "fascinating narrative of entrepreneurial grit... with a sense of humility: a precis of the lessons she has learnedand a description of how she will apply them to the launch of a fashion business, this time under her own name".

And while "Mellon takes no prisoners", says Harper's Bazaar's Sam Baker, attacking "all the men who patronised her over the years", this isn't "all about settling old scores". For "every bit of juicy backstabbing gossip, there is a handy morsel of MBA-lite to wash it down". Perhaps more to the point, while there may be "two sides to every story... I'm willing to bet [that] not one of them will be anywhere near as entertaining as In My Shoes".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.