Shares in focus: Smiths’ strange mash-up

Engineering firm Smith Group is a solid business, but it lacks focus, says Phil Oakley. So, should you buy the shares?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The conglomerate needs breaking up, but don't hold your breath or the shares, says Phil Oakley.

In some ways Smiths Group is a strange company. Having started out in 1851 as a watchmaker, it has now become a collection of five different specialist engineering businesses. From making seals that keep equipment on oil rigs and power stations working well, to medical devices, bomb detection kits, security scanners and hoses and tubes that move fuel around aircraft, Smiths has some solid businesses. They make decent profits and reasonable returns on the money that has been invested in them.

The trouble is that the City struggles to see the logic in Smiths having to own all these businesses under one roof. I can see why. They don't seem to fit together very well. So it's not surprising that many experts think Smiths should be broken up and sold off to make more money for shareholders. Some are surprised that this hasn't happened already. Six years ago it appointed Philip Bowman as chief executive. He had sold the last two businesses that he worked for Scottish Power and drinks firm Allied Domecq. Surely he'd do the same with Smiths.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So far he has not. That's not for lack of opportunity. Over the last couple of years, buyers have approached Smiths aiming to buy its medical unit. The sums of money involved have been rumoured to be as high as £3bn. That's more than half the entire company's stock market value, for just under a third of its profits. Yet no deal has been done.

It raises the question of whether Smiths will ever be turned into a pot of gold. If it isn't, are the shares worth bothering with?

Is a break-up on the cards?

Talks to sell the medical business broke down at the start of August. Based on how much money it is making, a price tag of £3bn would have looked very generous a punchy 16 times trading profits for a business where profits fell 7% during the last year. Most of its customers are hospitals in cash-strapped Western markets, which generally have less money to spend on the products than Smiths makes. A tax on medical devices in the US is not helpful either. If this business is to be sold then it would be a big surprise if it went for a higher price. With profits growth hard to come by, shareholders may end up being disappointed.

Of course, a sale would have left the rest of Smiths looking cheap, and led to further sales or takeover speculation. That said, the company's pension fund has been deeply in the red for a while now, and soaks up a lot of cash each year to keep it well funded. The deficit has more than halved during the last year, but it's not difficult to see why it would deter buyers. There's also the issue of asbestos liabilities, where the company has set aside £200m to cover the costs of claims from former workers that used some of its previous gasket products years ago.

So if Smiths is not going to be broken up, you have to believe that it can deliver decent profits growth in the years ahead. This is by no means certain. Profits should continue to grow at John Crane which contributes about 40% of total profits given that it sells into healthy long-term markets, such as energy, power generation and petrochemicals. But its detection business faces similar government budget pressures to the medical division.

Its remaining businesses don't look big enough to make a difference to the overall group, even though there should be some decent opportunities from a pick up in the housing market and the continued move towards more fuel-efficient aircraft.

Its recent full-year results bear this out. Sales grew by only 2% in the year to July 2013, and fell during the last six months. Pre-tax profits were the same as the year before as falling profits in the medical and detection units offset growth elsewhere. The company is trying to keep shareholders happy. It's stepping up efforts to develop new products by increasing the amount of money it spends on research and development.

There's also some big plans to cut costs. Just over £100m will be spent over the next three years, with the aim of saving £50m a year in four years' time. Then there's a 30p special dividend on top of this year's regular payout, with a possibility of more one-off cash bonuses in future.

What to do with the shares

The trouble is, while it's always possible, the Smiths break-up and sell-off story looks a bit tired these days. Without it, it's hard to argue that the shares look compellingly cheap. Smiths is a decent firm, but it probably has too much of its business in mature Western markets and is too exposed to government spending cuts to thrive at the moment. The company looks as if it knows this and is trying to get more commercial customers on board. But this will take time. With the shares on 14 times next year's earnings and a 3% dividend yield, paying up to wait doesn't look a great investment.

Verdict: avoid

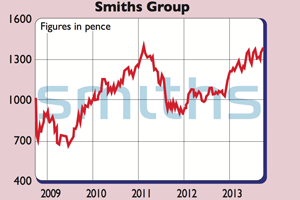

Smiths Group (LSE: SMIN)Share price: 1,396pMarket cap: £5.5bnNet assets (July 2013): £1.5bnNet debt (July 2013): £744mP/e (current year estimate)14 timesYield (prospective): 3.0%Interest cover: 8.7 times

What the analysts sayBuy: 7Hold: 8Sell: 5Target price: 1,400p

Directors' shareholdings

P Bowman (CEO): 435,197P Turner (CFO): 40,870D Brydon (chair): 8,000

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.