Tip updates: Rentokil and Darty

Phil Oakley reviews two of his riskier share tips from earlier this year to see how they've fared, and what action - if any - investors should take.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

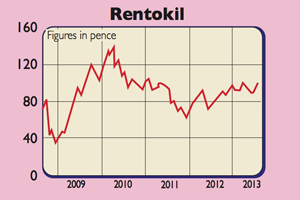

Rentokil

Rentokil (LSE: RTO)

Quite a bit has happened in the last few weeks. Alan Brown, the current chief executive, has announced that he is leaving. Meanwhile, the company has delivered a reassuring set of half-year results. The shares have bounced nicely to 103p, which now rates the company on a higher forward price/earnings multiple of 12.1 times. A quick gain of 15.7% on the shares is nice to have but I think there's more to go for with Rentokil.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

First and foremost, I believe there's room for a new chief executive to make further improvements to the business. Now that City Link has gone, he can finish tidying up the company by getting rid of the facilities management business which does things like catering, cleaning and security for the government and commercial customers. It doesn't make a lot of money and has much lower margins than the rest of the business.

The new boss will be under pressure to boost the profits of these businesses. Despite its good financial performance, many investors think that Rentokil should be doing better than it is. There's always the chance that a management team from another company might think they could do a better job, and so attempt to buy Rentokil outright. If the facilities management business is sold, it makes for a cleaner purchase. That said, even ignoring potential bid hopes, City analysts still expect earnings growth of 11% next year and increased cost savings could see this rise. The shares still look worth buying.

Verdict: keep buying

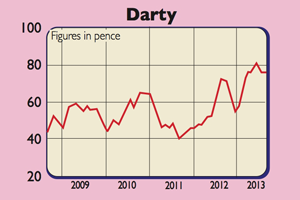

Darty

Darty (LSE: DRTY)

Yet Darty has three decent businesses, in France, Belgium and the Netherlands. It has got out of Italy and shut all its shops in Spain. If it can get out of Turkey, the Czech Republic and Slovakia, then it will have a profitable business that could still look cheap at the current share price. But recent trading has been weak, with product margins under pressure and debt edging up. So it's tempting to take profits.

Darty is also still a contrarian investment, with only one out of the 14 analysts covering the stock rating the shares a buy. It will only take one or two of these to turn positive to see the shares spike up again. Despite the temptation to cash in, I think Darty shares are still an interesting gamble.

Verdict: hold on to your shares

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson