Gamble of the week: A solid company going cheap

Cut backs and sell offs could see this business services group return to profit, says Phil Oakley. Brave investors should buy in now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Business services group Rentokil has had to cope with tough markets particularly in Europe over the last few years and has been fighting fires on a number of fronts. Its troublesome City Link parcel-delivery business has kept on losing money, which has weighed heavily on the whole company's profits. As far as many investors are concerned, Rentokil shares are too much trouble for too little return. Yet I think they look quite interesting.

Rentokil has persuaded someone to buy City Link for the princely sum of £1, thus relieving the company of a major source of trouble. There's talk that Rentokil's facilities management business could be sold too. If that went, Rentokil would be left with three very solid businesses.

Its pest control, hygiene and work-wear divisions have decent market positions and can probably grow over the long haul. What's particularly attractive about these businesses is that they are very profitable.Pest control and hygiene have profit margins of more than 20%. The workwear business is having a tough time in Europe at the moment and management is cutting costs, but its profit margins still come in at 16%. This contrasts with the 4%-5% margins made by many support services businesses.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Even with City Link losing money and facilities management (FM) having low margins, Rentokil still had a return on capital employed (ROCE) of more than 20% last year, which is far from shabby. With City Link gone and FM possibly to be sold for a decent sum, ROCE could increase and debt would come down too. This may make Rentokil much more tempting to a corporate buyer.

While trading is currently tough, the impact of cost savings and recent acquisitions means that City analysts still expect earnings growth of 10% for the next two years. On 10.5 times 2013 forecast earnings, I think that Rentokil's shares are worth a gamble.

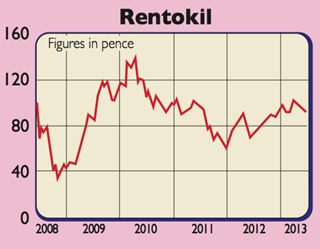

Verdict: speculative buy at 89p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

The downfall of Peter Mandelson

The downfall of Peter MandelsonPeter Mandelson is used to penning resignation statements, but his latest might well be his last. He might even face time in prison.

-

Default pension funds: what’s in your workplace pension?

Default pension funds: what’s in your workplace pension?Default pension funds will often not be the best option for young savers or experienced investors