Gamble of the week: An out-of-favour oil play

Investors have overreacted to this oil firm's problems, says Phil Oakley. Although the shares aren't without risk, they look to be worth a gamble.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

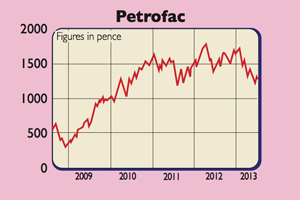

The stock market can be a fickle place. Companies' shares can be loved one minute and hated the next. It's not hard to see oil services company Petrofac (LSE: PFC) as one of these cases. The shares, which were trading as high as 1,752p in January, have since fallen by over a quarter.

Petrofac specialises in building infrastructure for the oil and gas sector. Once it has finished building, it often takes over the managing and maintenance of facilities. It also trains oilfield workers.

This has been a nice business to be in over the last few years. High oil prices have seen oil companies spend lots of money looking for the black stuff and getting it out of the ground. Companies such as Petrofac have had lots of work, which has led to a boom in sales and profits. With a big and growing order book, the company became popular with investors and the share price soared.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Panic often spells opportunity for investors. I've had my eyes on Petrofac shares for a while, but have always thought the market was in love with them too much. At the current lower price, I think the shares are worth a look now.

A lot of the fundamental attractions behind Petrofac's business are still intact. For one, oil companies are still expected to keep spending money. This is evidenced by the fact that Petrofac is still winning new orders and has an outstanding order book of $11.9bn almost twice last year's sales. Petrofac also says it has tight control of project costs and should not experience the same problems as some of its peers.

Although profits are only expected to grow modestly this year with City analysts expecting earnings per share (EPS) of around $1.90 the company says that it is still on track to double net profits between 2010 and 2015. This implies 30% profit growth over the next two years and EPS of over $2.50 in 2015.

With a lot of work coming from places such as the Middle East, Africa and former Soviet states, these shares are not without risks, but are cheap if the profit targets can be met. Trading on a price/earnings ratio of 10.2 in 2013, falling to 7.7 times in 2015, the shares look worth a gamble.

Verdict: buy at 1,259p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how