As China slumps and inflation rises, it’s time to go digging for bargains

As inflation rises, you want hard assets in your portfolio, or the companies that control them. That means miners, says John Stepek. Here, he tips the best shares to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As inflation rises, you want hard assets in your portfolio, or the companies that control them. That means miners, says John Stepek.

Here at MoneyWeek, we started to worry seriously about a slowdown in China a couple of years ago. We couldn't see how an economy that was so imbalanced on so many levels with rocketing property prices, huge local government debts, and an over-reliance on building bridges to nowhere could continue to grow at a rate of 8% a year (then seen as the minimum acceptable rate to the ruling Communist party).

Nor could we understand how its incredible appetite for commodities could continue to grow, given that the most intense phase of urbanisation was already behind it, and its demographic picture was already starting to look ugly, with a rapidly ageing population supported by fewer and fewer workers. As a result, we suggested you avoid mining stocks, and stay away from other areas that might be vulnerable, such as Australia's economy.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In 2011, this was a minority view. Most analysts admired China's brand of command capitalism'. A slowdown wasn't on the cards because the government simply wouldn't allow it. China was still going to be the most powerful economy in the world within a few short years. Besides, with the developed-world economies looking grim, analysts with funds to sell needed to pin their hopes for global growth on something. That something was China.

Since then, everything's changed. A Chinese slowdown is now reality. Chinese government commentators say that the magic number' for growth the minimum acceptable' rate, if you like is now a once-unthinkable 7%. It could already be even lower than that. And the message has finally begun to sink in with big institutions. As recently as December 2012, 67% of fund managers around the world reckoned that Chinese growth would accelerate this year, according to the widely followed Bank of America Merrill Lynch monthly sentiment survey. But in the latest survey, almost as many (65%) believe China will slow.

This swing from rampant bullishness to panicked bearishness has had a big impact on markets too. The Chinese stock market is hovering near its lowest level since 2008. Commodities are hugely out of favour as an asset class according to Barclays, investors' holdings of commodities dropped by $63bn in the second quarter of this year. That's the worst drop ever worse even than the collapse seen "at the height of the 2008 financial crisis", reports Jack Farchy in the Financial Times. Total assets under management fell to $349bn, the lowest in nearly three years. The commodity-dependent Australian dollar has slid from a high against its US rival of just above $1.10, to around 90 cents.

Meanwhile, America has replaced China as the place to be'. An incredible net 83% of fund managers expect the US dollar to strengthen over the next 12 months. That's the most ever recorded. And the US stock market is now among the most expensive in the world (out of 40 countries only Indonesia and Colombia are more expensive) judged by the cyclically adjusted price/earnings (cape) measure, according to investment manager Mebane Faber.

Perhaps the clearest example of how far this long US, short China and emerging markets' trade has come can be seen by comparing the strength of the US financials sector with the weakness of emerging resources stocks. As Ralph Atkins and Keith Fray note in the FT, "just ahead of the collapse of Lehman Brothers [in 2008], the market capitalisation of US banks fell below the value of energy, materials and mining companies from the Brics'... Brazil, Russia, India and China". Now investors believe US banks, with a total market capitalisation of more than $1trn, are worth more than twice as much as all the diggers and drillers in the Bric nations put together.

Don't get us wrong. China faces a potentially serious slump. The idea that it would overtake the US as the largest economy in the world has always struck us as rather overstated. And the US has many advantages that explain why it has proved popular with investors, including the shale gas revolution, the fact it had something resembling a proper housing crash, and the fact that it made an effort to patch up its banks' balance sheets quicker than everywhere else.

But it looks increasingly as though much of this could be in the price. We wouldn't want to invest in Chinese stocks yet they've dropped a lot, but they're not quite cheap enough for our liking. However, now could be a good time to get back into the mining sector. Miners have taken a hammering on the back of concerns about demand. But many are already taking action to tighten their belts and be more fussy about projects they invest in. Investors may also be overlooking one key reason to have some exposure to commodities in your portfolio: the threat of inflation.

The return of inflation

"Inflation is set to make a comeback in the next five years," writes Luca Paolini, of Pictet Asset Management, in the FT. Why? For one, central banks in developed countries and Britain in particular have shed any pretence of trying to hit inflation targets. In fact, they'd rather like a prolonged period of higher-than-usual inflation to get rid of their debts. "Higher inflation and negative real interest rates present heavily indebted countries with a less disruptive way to reduce the real value of government debt compared with alternatives such as sovereign default or deep public spending cuts." This is what's known as financial repression', and it's the classic solution to a government debt crisis in the developed world.

One reason why investors have become so bullish on the US dollar is that the Federal Reserve has recently hinted that it might stop printing quite as much money in the near future. However, investors might have jumped the gun somewhat. Following a rapid jump in US government bond yields (ie, prices have fallen and borrowing costs have risen), Fed chief Ben Bernanke has been at pains to emphasise his intention to keep interest rates at exceptionally low levels' until inflation is well above 2%.

Of course, when you're using such an unsual monetary tool, there's plenty of "scope for policy mistakes, particularly in the timing of the withdrawal of monetary stimulus," says Paolini. "It is not inconceivable that policy makers fail to detect an improvement in credit conditions when it comes, maintain loose policies for too long, and inadvertently allow inflation to become entrenched."

We'd say he's being optimistic. History suggests that central bankers almost always keep policy too loose for too long. Why? Monetary policy acts with a lag any move you make now will only really start to have an impact a year later. So if you want to prevent inflation from taking off, you have to start tightening rates before inflation actually becomes an obvious problem. If you only start raising rates when inflation is hitting the headlines, then you have to raise faster and further than you otherwise would.

So it's better to act early. The trouble is, if you act when there's no sign of inflation, people start to ask why you are hobbling the economy. Politicians don't like that and ultimately central banking is about politics. That means it is almost impossible to rein in monetary policy during the good times, or a recovery, for fear of being a party-pooper. It doesn't help that central bankers around the world and Bernanke in particular believe that premature monetary tightening is what extended the Great Depression in America, as well as Japan's lost decades. In short, central bankers are very, very unlikely to tighten too early' in this economic cycle, for fear of destroying what bounce they've created. Instead, they are almost certain to be far too late.

Ironically enough, China will be one of the drivers of this inflation. Wages are growing at double-digit rates in many areas, while the labour force is shrinking, which will only push wages up further. We've been used to years of cheap goods and cheap labour in China driving prices around the world lower. That's not going to be with us for much longer.

Inflation is terrible news for bonds. In its early stages it can be good news for stocks, but when it accelerates, it starts to hurt stocks too. If inflation really gets going, you want to have some exposure to real assets and the companies that mine and control those assets. It may be a while in coming, but given how hard the mining sector has been hit in recent years, we'd suggest that now is a good time to start adding miners back into your portfolio. We look at the most promising options below.

Seven of the best investments

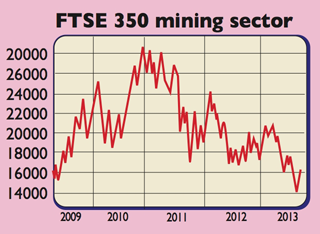

The FTSE 350 mining sector has had a tough few years. In early 2011, the sector almost regained its 2008 high. But since then, it's been downhill all the way. Earlier this month, the index had shed half of its value since its 2011 high. One of the most notable features of this sell-off is that it has left many of the biggest miners not generally viewed as income stocks paying out surprsingly attractive dividend yields.

Mining giant BHP Billiton (LSE: BLT), for example, now yields around 4.2%. BHP is among the most diversified of miners it has exposure to the energy sector, and to food production via potash as well which means it is not vulnerable to declines in the value of any one metal. The weakening in the Australian dollar (in which many of BHP's costs are denominated) should also help the company it even managed to raise its dividend throughout the financial crisis.

If you're looking for broader exposure, but want to stick to larger miners, the Blackrock World Mining Trust (LSE: BRWM) is a good option. The investment trust has seen its discount to net asset value (NAV the underlying value of its shares) close somewhat this month, but it still trades at a 4% discount, and yields around 4%.

Commodities expert Rick Rule believes that the junior mining sector is one of the most promising areas. However, it's also one of the most difficult to go stock-picking in given the risks involved, you need to build a substantial portfolio to spread your risk. So we'd suggest that if you want to buy into the sector, you should take a look at a fund. One high-risk option is the Baker Steel Resources Trust (LSE: BSRT).

It invests in small and unlisted resources companies, and currently trades at a 36% discount to its net asset value. Rule also likes the beaten-down uranium sector. You can invest in uranium mining via the Geiger Counter investment trust (LSE: GCL), which trades at a discount of 26%. However, be aware that charges are high, with a total expense ratio of 2.6%. If you're willing to take the risk of investing in an individual miner instead, you could buy uranium giant Cameco (NYSE: CCJ).

Another intriguing area is coal. Coal has been beaten down badly, and with good reason. In 2013, China accounted for half of global consumption. Last year consumption grew by 6.1%, according to Motley Fool's Matt DiLallo, while in the rest of the world, demand fell by 4.2%. That makes China vital to the coal business.

With fears over its growth, coal producers have plunged US producer Arch Coal (NYSE: ACI) has fallen in half this year, for example. But don't be too quick to write off coal. China is short of one crucial resource: water. As Bloomberg reports, coal and power stations use as much as 17% of China's water. One short-term solution would be for China to cut its own coal production and to increase imports from the rest of the world. That should be good for prices, and producers such as Arch and Peabody Energy (NYSE: BTU).

Picks and shovels' plays on the mining sector should also benefit if sentiment picks up. Phil Oakley looks at a particularly promising option here. Another area that could profit from any commodities comeback is emerging markets. There are ways to play commodity prices directly you can spreadbet or you can buy exchange-traded funds (ETFs) that track specific metal prices but we'd avoid those.

Taking a punt on the commodity itself is pure speculation, and before you consider doing that you need to understand how the market works. Put it this way, if you have to Google backwardation' and contango', then don't even think about trying to play commodity prices directly.

The miners to buy into now

When it comes to the mining sector, few metals have taken the pounding that gold has. As Rick Rule notes, gold miners look very cheap compared to their history. Indeed, "gold mining stocks are probably the ultimate contrarian play," reckons Erste Group analyst and gold fan Ronald-Peter Stoeferle. In America, the Market Vectors Junior Gold Miners exchange-traded fund (ETF) recently hit an all-time low, falling below $40, having been over $150 a share in 2011. It's been a similar story for even the larger gold miners, as represented by the GDX ETF.

However, the gold price itself has started to rebound from its recent low below $1,200 an ounce. And many analysts believe gold stocks have the potential to follow the yellow metal higher. JP Morgan Cazenove this week argued that "investors underappreciate the potential for self-help among UK gold producers; leverage is low, growth is imminent, and [several miners] have flexibility to reduce costs and protect free cash flow." Among the stocks highlighted were Randgold Resources (LSE: RRS), silver giant Fresnillo (LSE: FRES), Polymetal (LSE: POLY) and African Barrick Gold (LSE: ABG).

If you're willing to look outside Britain for your precious metals stocks, then Simon Popple of the Metals and Miners newsletter has a few options. Popple specialises in looking for "supply kings" these are companies that are already producing some metal, so they aren't out-and-out high-risk explorers. But they also have the potential to grow their resources. Simon particularly likes Australia-listed Beadell Resources (ASX: BDR) and Silver Lake (ASX: SLR), and Canada-listed Yamana Gold (TSX: YRI). You can learn more about his newsletter here.

Alternatively, you could invest in a gold mining fund. You could look at the ETFs in America if you would prefer a tracker fund. In Britain, the BlackRock Gold & General Fund (LSE: BLKGGDI) is the classic option for playing the sector.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.