Shares in focus: Should you buy into Google?

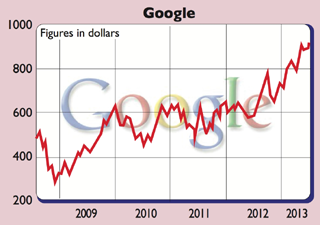

Google's shares have soared in recent years. Can they go still higher, and should you buy in? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The shares have soared, but future growth prospects mean they're still cheap, says Phil Oakley.

Professional investors can be a funny bunch. Share prices are expected to reflect the market's best guess of the current value of all the profits a company can make over its lifetime. Now, we know that's not true most of the time. The market dominated by these professionals has a tendency to act like a manic depressive. It swings from moods of extreme optimism to extreme pessimism and then has periods of calm in between. It also focuses too much on a company's most recent results. If a firm doesn't want its share price hammered, it has to keep meeting the profit expectations of the influential herd of analysts who work for investment banks.

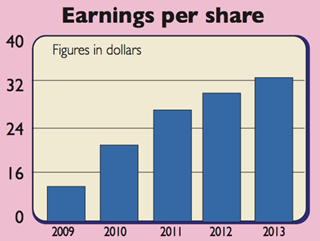

Take Google. Last week its shares fell sharply after second-quarter revenues and profits failed to meet Wall Street forecasts. Revenues were still 19% higher than a year ago, but profit margins were 5% lower and the all-important earnings per share (EPS) number was lower too. Analysts quickly revised down their estimates of how much money they thought Google could make in the future, which is what triggered the fall. But is Google really running out of steam, or is this just Wall Street short-termism?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The titan of the internet age

Google is one of the most successful companies of the internet age. Anyone who looks something up onthe internet particularly in the Western world will probably use Google's search engine to do so. Other search engines haven't come close to challenging its dominance except in places such as Russia or China. Yahoo! is still struggling, while Microsoft's Bing search engine hasn't really wooed users, or, more importantly, advertisers.

Google's strength in online search has given it a robust business model. Unlike Apple, which has to keep fighting the laws of consumer electronics that prices eventually fall a lot Google has concentrated on making money from online advertising, which provides nearly all its profits.

Products win customers if not profit

The company's product offerings email, office software, music, videos, cheap tablet computers, laptops and smartphones are more to keep users on board than to make huge profits. By offering good products that are cheap, or often free, it can bring more and more people to advertisers and therefore make more money. But the market is worried that customers will pay less for each online advertisement known in the trade as the cost per click (CPC).

CPCs are 6% lower than a year ago. More people are using smaller mobile devices, such as smartphones and tablets, to go online and this is changing the price of online advertising. The reasoning behind this is that advertisements on smaller screens have less impact than advertisements on big screens and so don't cost as much.

But this may not matter too much if you can sell more advertisements. Google's paid clicks (the number of times a person clicked on an advertisement) are 23% higher than last year.

Growing revenue

I think Google is still in a good position to keep growing its advertising revenues and profits. That's because it has a growing number of products and services that are good and that make life easier for its users and this will keep them using Google. Youtube, its video-sharing website, has become a powerful marketing tool for companies and advertisers.

Its Chrome browser now has 750 million users, while its Android mobile operating system has just exceeded 900 million users and is adding 1.5 million every day. Five million companies are now using its Google Docs productivity software.

Google is also making great strides in selling the devices that people use to connect to the internet. Chromebooks cheap, simple but very effective laptops are finally gaining traction with consumers, while a new version of the popular Nexus 7 tablet was due to be launched this week. Having bought Motorola last year, a new smartphone, the Moto X, is rumoured to be coming to the market in August.

The competition is not even close to matching Google's offer. The main business threat to the company seems to come from regulators in Europe, who say that Google discriminates against other companies in favour of its own websites. As with Microsoft before it, action by regulators is unlikely to blow this company off course.

Should you buy the shares?

Then we come to the price of Google's shares. Some may argue that they are expensive, as they trade on 20 times 2013 forecast earnings. This is not cheap, but nor should they be. Analysts still expect profit growth of more than 15% per year going forward. Just as high debt lowers price-to-earnings (p/e) ratios and makes companies look cheaper than they really are (because debt reduces a company's equity value faster than the interest on it reduces profits), big cash piles make companies look more expensive.

Google has $50bn of net cash (cash less debt). Strip this cash pile out and Google is trading on about 15.7 times earnings that looks good value.

Yes, the company has challenges to face up to, but its ability to grow means that the shares are still a long-term buy.

Verdict: buy

Google (Nasdaq: GOOG)

Share price: $896.6Market cap: $297.5bnNet assets (June 2013): $78.9bnNet cash (June 2013): $49.4bnP/e (current year estimate): 20.0 timesYield (prospective): 0%

What the analysts say

Buy: 32Hold: 12Sell: 0Target price: $1,000

Directors' shareholdings

L Page (CEO): 39,778E Schmidt (chair): 10,000S Brin (founder): 8,420

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.