Shares in focus: There’s money in London offices

Britain’s commercial landlord weathered the storm of crisis well, but is it a buy? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain's commercial landlord weathered the storm of crisis well, says Phil Oakley. But is it a buy?

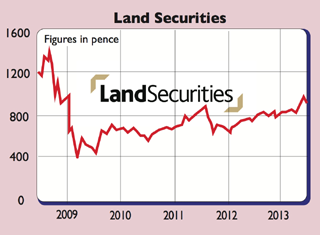

The financial crisis of 2008-2009 blew a big hole in this business. Land Securities' experience of those times offers a valuable lesson in the risks of investing in commercial property. Its portfolio of shopping centres and central London offices felt the full force of the financial storm.

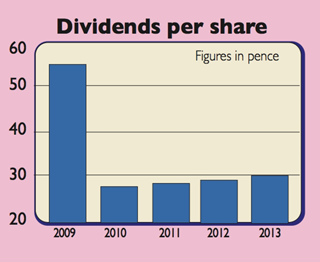

As shoppers kept their hands in their pockets and the City laid off workers, Land Securities' rental income took a battering as interest rates surged. The value of its property portfolio fell by over a third. In September 2008, its shares were changing hands for over £14 six months later the price was below £5. Shareholders saw their dividends slashed and were asked to cough up £756m to get its finances back on track.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Land Securities weathered the storm and has recovered its poise. But with the British economy struggling to grow and storm clouds gathering in the financial markets, should investors stay on board or look for the exits?

Land Securities is Britain's biggest real-estate investment trust (Reit) and is exposed to the largest, most sensitive bits of the economy: the retail sector and London. Its property portfolio is valued at £11.45bn. Its London properties are currently worth £6.1bn, with a large amount of that coming from West End and City offices. The retail portfolio is worth £5.35bn, with most of that attributable to 22 shopping centres, retail warehouses, leisure and hotel outlets.

It's difficult to be upbeat about the British retail sector. A combination of cash-strapped customers and the internet has seen off some well-known high-street names and created a big headache for landlords.Land Securities is making less money from its retail tenants and the value of its retail portfolio fell last year.

But it is also doing a good job of moving with the times and giving its tenants what they need to remain competitive. The company owns lots of shopping centres based in decent out-of-town locations. It has also been helping retailers adapt to the internet by setting up click and collect' centres. Crucially, Land Securities is not overly reliant on one big retail client; Arcadia is its biggest customer and accounts for only 2.3% of the rent roll.

Despite lots of retailers closing their doors, Land Securities has been good at re-letting empty shops, with voids falling to 2.9% last year. So, while I struggle to see retail driving much additional value for now, it may not collapse either. More money is being put into cafes, cinemas and restaurants, which can still do well. The company also has new developments coming on stream in the next year or so. Low build costs should see it make good returns.

London, however, is a different story. Rents have been rising and property values increasing as the capital attracts lots of interest from abroad. Land Securities has been making hay from its quality portfolio of offices in the West End and central London, plus its retail outlets. It was also brave enough to start building offices during the downturn in prime locations such as St Paul's and Victoria, and this strategy is paying off, given the shortage of good quality space.

Throw in the firm's strong finances (its loans to property value is a conservative 37%) and the fact that the shares trade below their adjusted book value per share of 903p, and I'm tempted to tip the shares as a buy. So what's stopping me?

Rising bond yields caused by the recent sell-off. Higher bond yields may reduce investor returns if panic spreads to stocks. It's still a good business to consider buying, but not at the current price.

Verdict: put it on your watch list and wait for a better entry point; I'd buy below 800p

Land Securities (LSE: LAND)

What the analysts say

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King