Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Commercial property has had a terrible few years as business tenants have struggled to pay rents or gone bust. British commercial property returns in 2012 fell by around 3%, says Katie Morley in Investors Chronicle. And total returns for the sector over a five-year period were a measly 0.5% a year on average. But now there are signs that confidence is returning.

The IMA Property sector recorded £98m in net retail sales during April 2013 compared to £33m for March. There also seems to be a shift taking place in the sector. In the wake of the credit crisis, prices for the type of prime (trophy') commercial properties generally found in central London survived, thanks largely to an influx of foreign capital. But this money didn't reach the less prestigious commercial properties in other parts of the country, where prices fell heavily. The problem was exacerbated as high-profile retailers fell victim to online shopping. But now there are signs that the trend is reversing and the gap is starting to close.

The main reason for this, says Ruth Sullivan in the Financial Times, is yield. "High prices and low yields on trophy assets have been the trigger for the trend [with] trophy office assets now typically yielding between 2.5% and 5%, depending on the city and property." The falls in prices for secondary properties means they now offer tempting yields, even reaching into "the teens for some secondary commercial units", says Zoe Dare Hall in The Daily Telegraph.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Retailers are also investing in larger distribution centres and warehouses to accommodate their growing online business. This can have a snowball effect, says Philip Marsden from property group Jones Lang LaSalle in the FT. "As assets get conglomerated and warehouses get bigger, so larger players such as sovereign wealth funds are coming in." Last week, Norway's $720bn oil wealth fund bought a £250m portfolio of UK warehouses.

Any sort of pick up in the British economy will help too. Recent data from the manufacturing, construction and services sectors signal growth even a glimmer may be enough to stimulate a sector where values are still 30% below pre-crisis levels. Further, as Legal & General's research director, Rob Martin, tells Investors Chronicle, banks are starting to lend to the sector again.

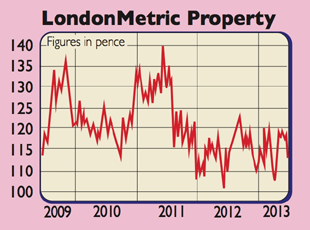

So how to play it? One option is LondonMetric (LSE: LMP). The listed real-estate investment trust is selling off its prime London assets and using the cash to buy up high-yielding non-trophy property. On a forward yield of 6.3%, it offers a good way to make money from Britain's less glamourous commercial properties.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how