Daily gold report: Thursday 5th July

Spot gold prices continued to trade in a tight range early on Thursday, just breaking $656.50 at the London opening – barely $1 away from where the US markets left gold...

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Spot gold prices moved gently higher against the US Dollar in London on Thursday, adding $2 per ounce from the overnight start in Asia to break $656 just before the US open.

'People are reluctant to take new positions ahead of New York trade today after the Fourth of July holiday,' reckoned Shuji Sugata at Mitsubishi Corp. Futures in Tokyo, to Bloomberg earlier.

'But the gold market remains bullish,' he added, 'supported by the falling Dollar and rising oil prices.'

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Brent crude oil traded in London rose above $73 per barrel this morning. US crude oil held near its own 10-month highs. The Dollar dropped 0.3% against the Japanese Yen.

After the Bank of England raised UK interest rates to a six-year high of 5.75%, the European Central Bank also did as the markets expected, holding Eurozone rates at 4.0%.

'People don't want to trade gold too heavily ahead of the US payroll data due Friday,' said another Tokyo analyst to Reuters. 'Gold will stay range-bound until we confirm the outcome of these events.'

For Australian investors wanting to buy gold today, the metal held at A$765 per ounce, unchanged after the Reserve Bank of Australia chose not to raise its interest rates from their current 6.25% the seventh month of 'no change' in a row.

The Bank of England's move was widely expected, since 'credit and broad money continue to grow rapidly,' as the Bank admitted in its accompanying statement. That underplays the rate of credit expansion in the UK, however, where broad M4 has now grown at double-digits annually since spring 2005.

Eighteen of the world's top 20 central banks are in fact presiding over double-digit rates of annualized growth in their local money supply. Accounting for tax and inflation, however, this fifth 'baby-step' inside 12 months from the Bank of England still leaves real interest rates at just 0.3% per annum for basic-rate UK taxpayers. Higher-rate savers are suffering negative real interest rates of 0.85% based on May's retail price index.

With today's rate decision already priced into the currency markets, the Pound Sterling pulled back from yesterday's fresh 26-year high against the Dollar to trade as low as $2.0120. That dip put the Sterling price of gold at £325.50 per ounce some 0.4% higher from Wednesday's opening.

The Euro meantime rose above $1.3660 its highest level against the Dollar since April 30th. That pulled the price of gold in Euros back to €480.60 from an earlier spike above €482 per ounce.

Even though few analysts had expected a surprise change from the ECB's 4.0% interest rate, Eurozone bond prices slipped in early trade, pushing the 10-year yield up to 4.62% in the bond market. US Treasury bonds also slipped in price, pushing the 10-year yield four points higher to 5.08% at the London opening. In the corporate debt markets, meantime, last month's move through the 5.0% barrier continues to rattle investors.

'There are some very scary analogies between high yield corporate bonds and the mortgage market,' says Kevin Lorenz, a fund manager who runs $2.5 billion of high-yield assets at TIAA-CREF in New York, one of the world's largest bond funds. 'You cannot do fundamental analysis and believe that those are creditworthy companies.'

Twelve high-yield bond issues have now been pulled through lack of demand in the last week, according to Bloomberg data. Between Jan. and June, high-yield debt issues had risen by 70% to a record $1 trillion. 'More securities than ever have the lowest credit rankings,' says the newswire, 'with CCC ratings assigned to 26.5% of the new debt.'

In 2006, triple-C rating were assigned to just 15% of all corporate bond issues. That rating, says Fitch the credit ratings agency means the debt carries a 'high default risk'.

If leveraged investors can't borrow to fund their next buy-out, they can always try the equity market instead. Kohlberg Kravis Roberts & Co., the leveraged private equity firm which pulled a $1.55 billion bond issue last week, said Wednesday it plans to float as a listed stock, following the lead of its rival Blackstone Group.

KKR could be worth around $30 billion according to The Times of London. Blackstone's shares are already trading below the IPO price of two weeks ago.

Adrian Ash is editor of Gold News and head of research at www.BullionVault.com, the fastest growing gold bullion service online

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Adrian has written all things gold related from if it’s worth buying, what the real price of gold should be and what’s the point of gold for MoneyWeek. He has also written for other leading money titles on his gold expertise including Business Insider, Forbes, City A.M, Yahoo Finance and What Investment Magazine. Now Adrian is head of the research desk at BullionVault, a physical market for gold and silver for private investors online.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

How have central banks evolved in the last century – and are they still fit for purpose?

How have central banks evolved in the last century – and are they still fit for purpose?The rise to power and dominance of the central banks has been a key theme in MoneyWeek in its 25 years. Has their rule been benign?

-

France’s government collapses – could it trigger the next euro crisis?

France’s government collapses – could it trigger the next euro crisis?Briefings France’s government has toppled after losing a vote of no-confidence, plunging the euro zone’s second-largest economy into turmoil. Is this 2012 all over again and should Europe be worried?

-

The junk-bond bubble bursts

The junk-bond bubble burstsNews Yields in the US high-yield bond market (AKA junk bonds) have soared to more than 8% since the start of the year as prices collapse.

-

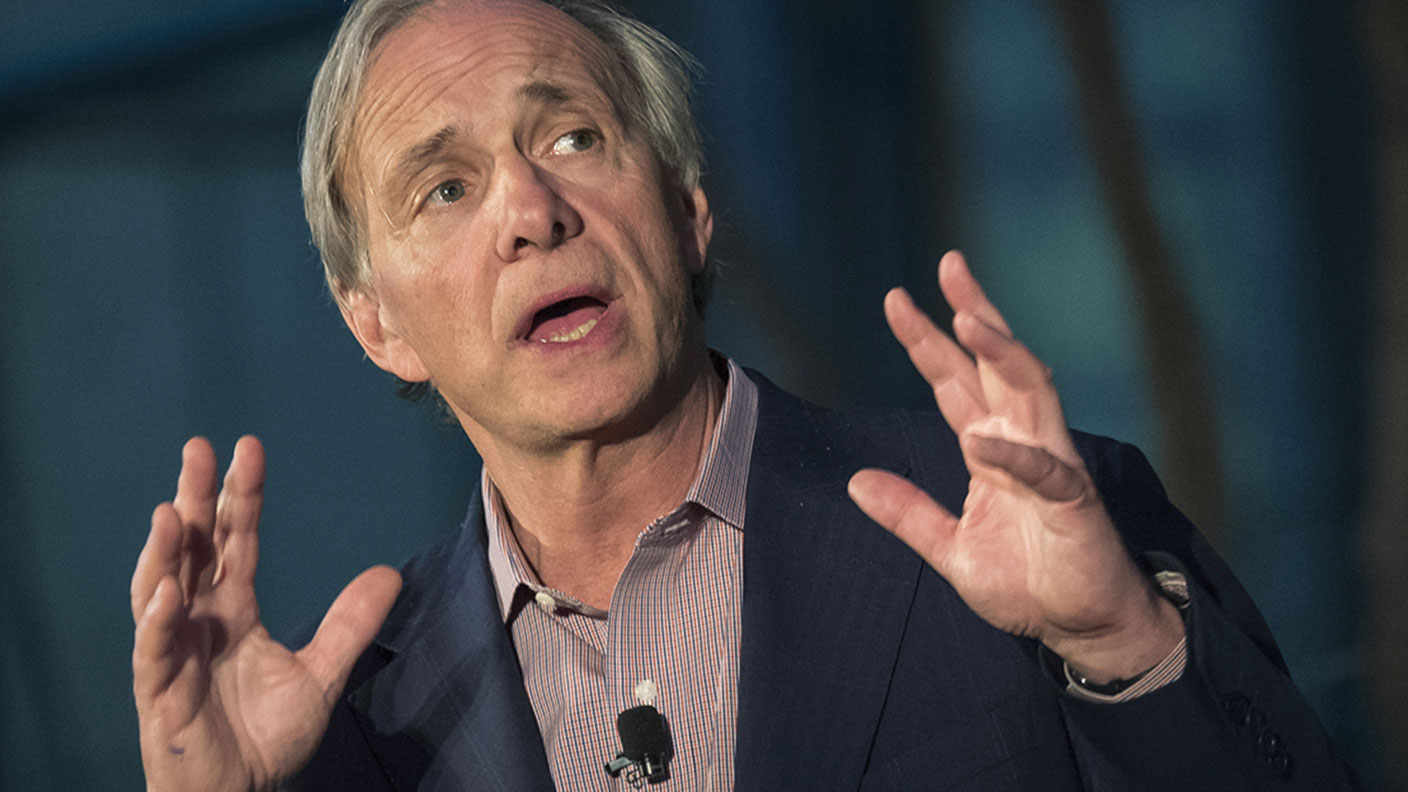

Ray Dalio’s shrewd $10bn bet on the collapse of European stocks

Ray Dalio’s shrewd $10bn bet on the collapse of European stocksOpinion Ray Dalio’s Bridgewater hedge fund is putting its money on a collapse in European stocks. It’s likely to pay off, says Matthew Lynn.

-

French stocks are back in fashion

French stocks are back in fashionNews France’s CAC 40 stockmarket index gained 29% in 2021, making it the world’s best performing major market.

-

Has Italy’s economy turned the corner?

Has Italy’s economy turned the corner?News Italy’s FTSE MIB stockmarket index has returned 23% so far this year, more than double the FTSE 100’s performance over the same period.

-

Overlooked European stocks are a solid bargain

Overlooked European stocks are a solid bargainNews The lack of speculative exuberance in European stocks compared to US markets bodes well for investors seeking less tech-heavy drama and more deep value.

-

Too embarrassed to ask: what are negative interest rates?

Too embarrassed to ask: what are negative interest rates?Videos There’s been a lot of talk from the Bank of England recently about introducing “negative interest rates”. So what on earth are they, and what would they mean for your money?