How to find good quality emerging market stocks

Finding cheap emerging market stocks is one thing, but how do you know if what you’ve found is any good? Cris Sholto Heaton explains how to hunt for quality stocks.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Any emerging-market fund manager you care to listen to will tell you that his sector is ideally suited to active fund management. Emerging markets are fast-changing and full of promise, but are also risky, volatile and inefficient in other words, available information about companies is often not priced into markets very rapidly. As a result, they say, a good active manager can beat the market while taking fewer risks far more easily in the emerging world than in the staid, well-researched developed markets.

It's a convincing theory. Sadly, the evidence doesn't support it. Fewer than 25% of emerging-market funds beat their index over the five years to the end of 2012, according to Standard & Poor's. The average emerging-markets investor would have been better off buying a cheap tracker fund, even though the average emerging-market index is itself far from perfect (they tend to be too heavily weighted to sectors such as financials and commodities, and full of state-owned or tycoon-controlled stocks with poor corporate governance).

That said, there are a handful of emerging-market managers who are respected for their consistently solid performance, such as the Aberdeen teams headed by Hugh Young and Devan Kaloo, and the First State teams headed by Angus Tulloch and Jonathan Asante. These managers have long careers, spanning a wide range of investment conditions. Tulloch and Young both began managing money in the 1980s, so their track records include the early 1990s Asian miracle that turned into the 1997-1998 Asian crisis, the tech bubble and bust, the spectacular rise of China, the economic liberalisation of India and the 2008 global financial crisis, among many other events.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As a rule, you should never get too carried away with copying high-profile managers, many of whom see their fortunes wane as market conditions change. But it's worth considering whether there are any lessons to learn from managers like these, who have been consistently successful through ups and downs. In the case of the Aberdeen and First State teams, there's one obvious factor that probably plays a large part in their success: a focus on high quality'.

Buy the best

Quality investing is not as easy to define as some other investing styles, such as value'. You can read a more detailed outline in the box on page 26. But in short, such investing involves buying outstanding companies at a fair price, rather than stocks that just look cheap. So rather than take the everything has a price' approach of a value investor, the quality-focused investor typically screens out many companies perhaps even the majority of the market on the basis of bad business models, low profitability or poor corporate governance, before even considering valuations.

This sounds like a conservative, safety-first strategy. In many ways, it is. Legendary value investor Benjamin Graham cautioned that the greatest losses come not from paying too much for good companies, but from buying bad firms that seemed cheap because they were flattered by favourable business conditions. Quality investing takes this to heart, trying to reduce the risk of falling into this trap by screening out such firms.

However, according to investment theory, if you want to get higher returns you have to take more risk. This suggests that by investing in quality companies, rather than riskier ones, you'll be resigning yourself to getting lower returns. Yes, you might enjoy a less hair-raising ride with quality stocks, but those bold enough to take riskier bets should outperform on average. So what really makes quality investing interesting and may explain the success of the managers who practise it is that, like many financial theories, this one does not seem to hold true in the real world.

When quality shines

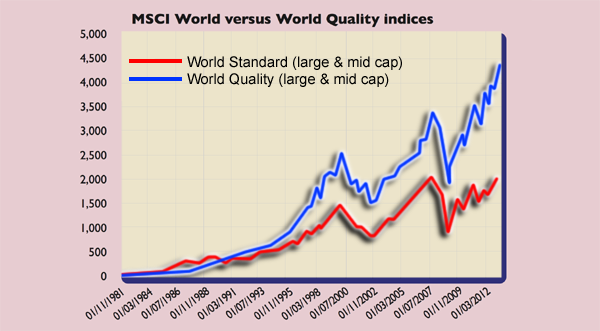

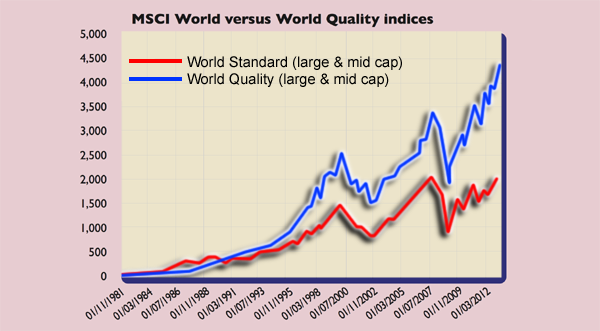

Over the long run, quality companies seem to have beaten lower-quality ones. The MSCI World Quality index filters companies on three criteria commonly used by quality investors: return on equity (ROE), stability of earnings and leverage (borrowing). Since its start date in 1981, this index has outperformed the wider MSCI World by around 2.5% a year (see chart). Obviously, quality hasn't outperformed at every point over that time, but looking at rolling returns, the MSCI World Quality has beaten the MSCI World roughly 60% of the time over one-year periods and 70% over five-year periods.

For emerging markets specifically the track record is shorter. But since 1998, the MSCI Emerging Markets Quality index has again beaten the MSCI Emerging Markets index by around 2.5% a year and outperformed in almost 75% of rolling one-year periods. In other words, quality consistently delivers better returns than the overall market in both developed and emerging markets, while at the same time exposing investors to less risk. So why is this the case? And why is quality a particularly sensible focus for emerging-market investors?

There are several reasons why quality companies seem to outperform, but one of the main ones might be that, to put it simply, these companies are boring. If a company is to make it through a quality filter, then it probably means it shows steady profitability, with few surprises both positive and negative. These stocks plod along, doing what they say they'll do, with monotonous reliability.

That's great for long-term investors, but it's dull for the short-term players who often make the most noise in markets. Traders favour stocks that are more volatile, and offer big potential pay-offs (known as the lottery ticket effect'). Brokers who want people to trade as much as possible prefer stocks that generate lots of news, so they can produce a stream of research recommendations. And fund managers are also arguably attracted to stocks that come with good stories', as these are a great way to sell funds to clients, and also to explain their often-excessive and value-destroying portfolio turnover. This general financial-industry bias towards exciting' stocks could well be enough to push up the price of lower-quality stocks relative to higher-quality ones, making them frequently too expensive, and ensuring they deliver lower returns over the long term.

Inefficient markets

It's fair to say that emerging markets probably suffer from this excitement bias' even more than developed ones. There's a greater focus on rumour and supposed inside information in these markets. In that sort of torrid investment environment, duller, high-quality companies are likely to be persistently undervalued relatively to racy ones. (Other against-the-crowd strategies, such as value investing, also seem to work well in emerging markets for this reason.)

Emerging economies also tend to be more volatile and prone to upsets than developed ones. This favours firms with robust business models and solid balance sheets, which are better placed to survive downturns. A low-cost exporter or highly leveraged property developer may do very well in a boom, but when export markets dry up or credit becomes scarce, investors could lose everything. Quality stocks will suffer in any crunch, but are more likely to come out of the other side, and may even benefit from the demise of rivals.

A final factor that makes emerging markets intrinsically riskier is the lack of transparency and patchy corporate governance. By investing in higher-quality firms, you can reduce some of these risks.

Is quality expensive?

Of course, just because quality stocks have often outperformed in developed and emerging markets in the past, this doesn't mean they will continue to do so. While quality businesses will probably continue to outshine weaker peers, their stock prices could still underperform if they start from a position of being too expensive compared to the rest of the market. In general, this happens at the very bottom of a crisis, when investors dump the riskiest assets and flee to the most defensive stocks. The point at which nobody wants to buy low quality is usually the one time it pays to do it. We're not facing those conditions right now. Yet some investors argue that higher-quality stocks seem unusually expensive relative to the market than in the past.

At first glance, the data don't seem to support that. For example, the MSCI Emerging Markets Quality Index is on a forecast price/earnings ratio of around 11, versus around ten for the MSCI Emerging Markets Index. Similarly, the MSCI World Quality Index is on an estimated p/e of around 14, compared with 13.5 for the MSCI World Index.

But on closer inspection many of the highest-quality stocks seem more expensive. For example, a basket of the top emerging-market consumer staples and healthcare firms would trade on an average p/e of 25-30, with many individual stocks being significantly higher. Many are excellent firms and, given the long-term growth prospects of this sector, may not be quite as expensive as they sound but they are obviously not cheap and are vulnerable if their earnings growth falters.

However, there are still sectors where very good firms trade at reasonable valuations. In particular, with investors focusing on defensive sectors in this uncertain climate, some high-quality cyclical businesses look relatively good value. For example, the global financial crisis has led many investors to shun banks, leaving many well-run emerging-market financials looking more attractive than other plays on domestic demand.

We look at some potential candidates and quality-focused funds below.

The eight investments to buy into now

If you're after a fund that focuses on higher-quality emerging-market stocks, the best bet is often a global or regional fund, rather than a country-specific one. Even the most-focused managers may need to relax their quality standards to fill a single-country fund. The Asia and global emerging-markets funds from Aberdeen and First State are among the most obvious choices, but because these funds have attracted a lot of money in recent years, several are being soft closed'. This means investors have to pay an entry charge, to dissuade new investments.

For example, Aberdeen has imposed a 2% charge on its Emerging Markets Fund and may do the same with its Asia Pacific Fund. First State's Global Emerging Market Leaders will be subject to a 4% charge from September and it may do the same for its Asia Pacific Leaders fund if inflows continue. If you're after a large-cap-focused fund, these funds are probably still the best choice. But if you're looking for a smaller, more flexible fund, try the Somerset Emerging Markets Dividend Growth Fund. Although this is an income fund, its focus on finding companies that should be able to sustain and grow dividends over the long term, rather than just pay a high yield right now, means it should typically invest in stocks that have classic quality characteristics, such as a strong competitive position, good cash flow and a desire to reward shareholders. It has a total expense ratio of 1.36% and an estimated yield of 3.3%.

For investors looking to buy stocks directly, financials look like the most obviously out-of-favour sector. While banks in the developed world are unlikely to see a return to the good times for years to come, the outlook in many emerging markets is more upbeat. Relatively conservative firms such as Singapore's OCBC (SP: OCBC) and UOB (SP: UOB) are attractive ways to invest in fast-growing Southeast Asia. Poland's Bank Pekao (LSE: BPKD) and Brazil's Banco Bradesco (US: BBD) currently face less favourable conditions growth has been sluggish in both countries recently but look well placed for when the economy picks up.

Technology has also lagged behind more defensive sectors, such as consumer staples and healthcare, in recent years. Emerging-market tech-sector firms have often struggled to establish highly profitable business models. Most end up as low-cost manufacturers, with the bulk of the sector's profits going to intellectual property owners such as Apple or Microsoft. But there are exceptions. Taiwan Semiconductor Manufacturing Company (US: TSM) is the world's largest independent semiconductor foundry, making microchips for most of the world's leading semiconductor firms. Samsung Electronics (LSE: SMSN) is an increasingly ubiquitous consumer electronics brand, although its impressive business strength is let down by less-than-perfect corporate governance. On the software and services side, Indian outsourcing giant Infosys (US: INFY) has been through a tough few years in the face of growing competition, but remains a strong business and may be a good turnaround play.

What is quality?

Quality' is a less exact concept than many other ways of classifying stocks, such as size (large cap versus small cap), value/growth (low valuations versus high valuations), or share-price volatility, all of which can be summed up in a single metric. There are several criteria that go into assessing whether a stock is high or low quality and many investors focus on different factors.

However, since high-quality stocks are those that are expected to be consistently profitable, deliver a minimum of nasty surprises, and reward shareholders reliably over time, they share a number of traits. The most widely cited quality criteria are return on equity (ROE), low leverage (borrowing) and fairly stable earnings. Many investors would also want to see a good track record of paying dividends: high-quality firms are rarely the highest-yielding stocks, but they often have a history of steadily growing the dividend.

Some investors also add soft' factors, such as good corporate governance. This is harder to measure, but broadly means acting in the interests of all shareholders. Emerging-market firms often fall down on this score, with family-controlled or state-run businesses doing deals that benefit the controlling shareholder at the expense of minority shareholders.

Since the definition of quality prioritises stability and steadiness, high-quality companies are often found in industries where they have pricing power and can maintain a competitive advantage. Sectors such as consumer staples, healthcare and information technology feature heavily, since these firms often control influential consumer brands or own the rights to valuable patents or other intellectual property.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

UK interest rates live: experts expect MPC to hold rates

UK interest rates live: experts expect MPC to hold ratesThe Bank of England’s Monetary Policy Committee (MPC) meets today to decide UK interest rates. The last meeting resulted in a cut, but experts think there is little chance of interest rates falling today.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.