Gamble of the week: A bargain broker

Current trading conditions are proving tricky, but this inter-dealer broken is biding its time, says Phil Oakley. Investors with an appetite for risk should buy in now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Buying the shares of financial companies is risky because the financial system itself is full of risk. The financial crisis has taught us that you can think everything is OK and then something happens and you find out very quickly that it isn't. Do you really know what a bank owns and owes, for example? Can you trust even a big insurance company not to slash its dividends? Then there is regulation.

To stop financial firms taking the kind of big risks that taxpayers end up paying for if things go wrong, they are being asked to hold a lot more reserves to act as a buffer. This means that they can't make as much money as they did in the past. In short, investing in financial companies is a minefield. You need to tread carefully.

So what to make of inter-dealer broker Tullett Prebon? It makes money acting as a middleman between the buyers and sellers of products such as bonds, currencies, shares and derivatives. As some of these are tricky to trade, the inter-dealer broker provides the necessary liquidity (by tracking down buyers and sellers) to make trading easier. An inter-dealer broker also provides anonymity and allows big customers to buy and sell without revealing who they are.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Tullett Prebon (LSE: TLPR)

This type of business has been going through a rough patch largely because the big banks and hedge funds aren't trading as much as they used to. Inter-dealer brokers do well when financial markets move around a lot, as this leads to more activity. The trouble is that the money printing by central banks has calmed the markets and volatility is low.

Low interest rates have subdued the bond markets. The regulation of risky derivatives means that more of the trades in them have to be done electronically rather than over the telephone.

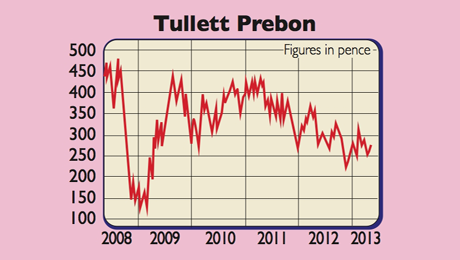

Competition is also increasing, with firms such as Bloomberg looking to have a slice of the pie. This has led to sharp falls in the profits and share prices of brokers. Tullett's shares are down 12% during the last 12 months compared with a rise of 30% for the FTSE 250 over the same period.

But there will always be a role for skilful inter-dealer brokers that can place difficult trades. And the markets are unlikely to be calm forever. Unlike many banks, Tullett has a flexible cost base (if it makes less money its traders get paid less) and has net cash on the balance sheet rather than debt. It also made a healthy return on capital of 29% last year.

Yes, there are lots of uncertainties. But on the upside you can buy the shares for just seven times projected earnings with a 6.4% dividend yield that is well covered. For that reason, I think Tullett shares are worth a punt.

Verdict: speculative buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?