Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

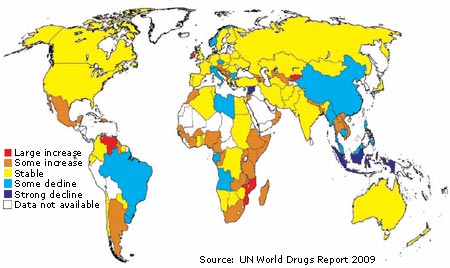

After a series of record harvests since 2001, the cultivation of crops used to make illegal drugs is falling at last, according to the annual UN World Drugs Report[pdf].

Opium poppy cultivation is down 19% in Afghanistan, which produces 93% of the world's opium, while coca leaf cultivation has fallen 18% in Columbia, which produces more than half of the world's cocaine. And despite falling production, opium prices have halved in Afghanistan to about $75 per kilo in the past five years, further reducing the incentive to grow it.

And the "global cocaine market is undergoing seismic shifts... purity levels and seizures in the main consumer countries are down, prices are up", says Antonio Maria Costa, director of the UN Office on Drugs and Crime (UNODC).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So, is the "war on drugs" finally having an impact on illicit drug use and cultivation?

Let's not get too excited, says Tom Coghlan in The Times. "Self-congratulation on the part of the West should be tempered by an acknowledgement that elementary market forces were as significant a factor in the reduction as the billions poured into counter-narcotics programmes."

The supply of opium in Afghanistan has outstripped demand fundamental economics dictates that this will result in a fall in price. "Afghanistan's drug industry has become a victim of its own success." Another factor has been last year's rise in wheat prices many farmers who once cultivated opium "opted to focus on basic food production" instead.

But can it last? Wheat prices have already started to fall and the shortage of heroin will soon push prices higher. "The drugs trade is free-market economics in its purest form" and "constant demand" will ensure that trade continues.

Indeed, says Alan Travis in The Guardian. Costa has a "passionate, abusive approach to those who argue for drug legalisation". But while the report may offer some solace to supporters of UNODC policies, it does not represent a sustainable change in global illicit drug cultivation or act as proof of successful policies.

"Despite the ongoing attempts to put positive spin on the data there is no hiding the reality the UNODC oversees the system that gifts the vast illegal drug market to violent criminal profiteers."

The good news is that "the taboo on questioning drug prohibition" has been broken by the countries most affected, says The Economist.

The Latin American Commission on Drugs and Democracy, headed by three former presidents, recently published a report [pdf] arguing that the "violent crime and corruption generated by drug prohibition is undermining democracy".

They also said that the war on drugs has "failed" and called for a debate on the alternatives, including the decriminalising of marijuana.

Costa "smears his critics as pro-drug" and implies that supporters of legalisation are just looking for easy sources of tax revenue to bail out banks. But "this kind of hysteria smacks of an organisation that is not just losing an unwinnable war but losing the argument".

How heroin use has changed since 2008

[click image for larger version]

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn