Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

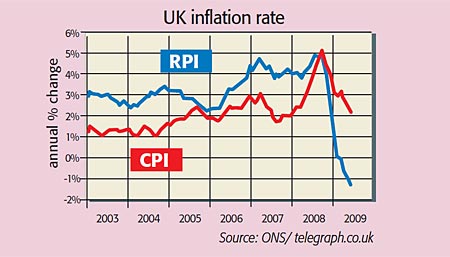

For the 11th time in 14 months, inflation has beaten expectations. In May, the annual rate of consumer price inflation (CPI) fell to just 2.2% from April's 2.3% as food and energy prices eased. Core inflation stripping out food and energy edged up to 1.6%. Meanwhile, retail price index (RPI) inflation, which includes mortgage costs, eased from 1.2% to 1.1% on rising mortgage rates.

What the commentators said

"Despite what may still turn out to be the worst recession since the war", inflation remains "stubbornly above" the 2% target, said Jeremy Warner in The Independent. Chalk it up to tax rises on alcohol and tobacco and the slump in sterling over the past year, which is increasing the price of imported goods.

What's more, inflation is expected to fall further as rising unemployment crimps demand, while "the full price effects of the sharp slowdown in the economy have yet to be felt", said Capital Economics. Inflation looks set to drop to around 1%, "but hardly anyone expects" outright CPI deflation, noted Warner. Indeed, there may still be "quite a bit of inflationary pressure in the pipeline".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gains in import prices will continue to feed through, agreed Michael Saunders of Citigroup, while VAT is set to rise again in December. The oil price, meanwhile, has more than doubled this year, heralding higher petrol prices. Saunders reckons CPI could be back to over 3% next year; Allan Monks of JPMorgan has pencilled in 3.1% in January.

What next?

Everyone was hoping for a strong recovery and low inflation, but "I don't think that option is going to be available to us", said Saunders. The danger now is that the Bank of England will be forced to raise interest rates and clamp down on quantitative easing which stokes inflationary pressure as more money in the system drives up prices before the recovery is firmly established.

As Vince Cable pointed out in The Independent, the economy is still very weak. Banks continue to restrict credit, consumers' massive debt load militates against a "spending spree", and there is also little sign that "business is contemplating investment beyond the rebuilding of stocks". With the economy hardly likely to grow at a healthy pace anytime soon, withdrawing the monetary stimulus would cause a relapse. "There is a plausible scenario of prolonged stagflation in which recovery is aborted by anti-inflationary interest rate rises." All in all, monetary policymaking, said Colin Ellis of Daiwa Securities, "is not going to be boring again for some time".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson