Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Back in 2003, Alan Greenspan, the last chairman of the Federal Reserve, slashed interest rates to 1%. He was aiming to protect the American economy from recession. However, an unintended consequence of this policy was to fire up the US housing bubble, which eventually caused the 2008 crisis.

Now the Fed is doing it again. The official aim of its quantitative easing (QE) programme is to reduce bond yields and pump up asset prices. On the latter front, QE has proved a resounding success at least in the commodities market. Spot copper prices blasted through all-time highs of $10,000 a ton last week.

But QE's unintended side-effects are now seeping through. As commodity and food prices have soared, so governments in politically sensitive regions are toppling. There has been an uprising in Egypt, one of America's staunchest allies in the area close to the Middle East. And several other countries, including Jordan, look vulnerable.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This has to be a huge security worry for Washington. It could even trigger a reappraisal of its economic policy. So what's the biggest danger? Ending QE and watching US GDP drop by, say, 1% to 2%? Or commencing QE3, and perhaps allowing much of the Arab world, and maybe parts of Asia too, to fall into revolution? Sure, the arrival of democracy in dictatorships might sound great. But there's also the risk that anti-Western regimes ride into power.

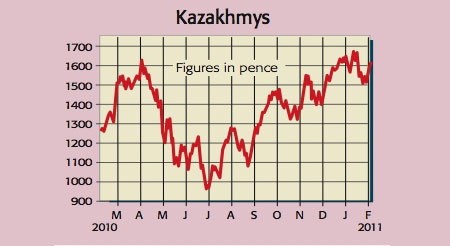

As a result, I believe the odds of the Fed extending QE beyond June have decreased. Assuming I'm right, then without the abundant supply of free money, the juiced-up commodity markets are heading for a crash. That would be bad news for shareholders of Kazakhmys, whose share price has ballooned eightfold since November 2008.

Kazakhmys is Kazakhstan's top copper producer (60% of earnings before interest, tax, depreciation and amortisation, or EBITDA) and the tenth-largest worldwide. It has 16 mines across the country and sells around 40% of its output to China. It also produces significant quantities of other metals, including zinc, silver and gold. It spent $1.5bn in 2008 buying local power stations to secure its electricity supply. The group also owns a 26% stake in its compatriot, Eurasian Natural Resources whose shares have also shot up.

Kazakhmys (LSE: KAZ), rated OUTPERFORM by Macquarie

Kazakhmys is clearly heavily exposed to the metals bubble. But on top of this, there's the substantial geopolitical risk. Most of its assets are located in Kazakhstan, which was a former Soviet Republic and could even be affected by the current mess in north Africa. Worse still, as the local government owns a quarter of the group, there's the chance of a super-tax being introduced to fund social improvement schemes.

In terms of valuation, the stock is far too expensive for my liking. I would rate it on a through-cycle EBITDA multiple of five. After factoring in net debt of $585m, that gives an intrinsic worth of around £11 a share. A pre-close trading update is scheduled for 3 March, with the prelims out on the 29 March.

Recommendation: SELL at £16.00

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how