Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

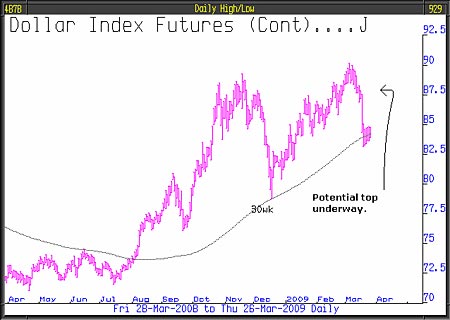

Currency markets were shocked to hear the Fed announce its intention to purchase $300bn of US treasuries and follow Switzerland, Japan and Great Britain into the murky territory of quantitative easing the purchase of government bonds with money created for that purpose that previously did not exist. It triggered an immediate sharp fall of the dollar by 3.1% on a trade weighted basis, the biggest single move since 1985.

A glance at the chart below suggests a decisive top has now formed and the expected deterioration of the dollar is underway. Happily for portfolios, as the dollar fell sharply, gold rose significantly. The willingness of the US authorities to create as many dollars as they think necessary, irrespective of the consequence, is finally weighing on the currency as we would expect and driving investors to gold.

Not surprising, China, who hold $739bn of US treasuries are concerned that Washington puts its domestic economy needs before its creditors; inflation, should it occur, would cost them dear. The Governor of the Chinese central bank, Zhou Xiauchuan, has said that a reserve super currency could be created to replace the dollar's role as the reserve currency of the world. This would take the form of further issuance of International Monetary Fund's Special Drawing Rights. The SDR is a reserve asset that was created by the IMF in 1969 and has the potential to act as a reserve currency. To everyone's surprise, Tim Geithner then put his head above the parapet and said that Washington was open to China's proposals. He clearly got his bottom slapped and went back on his statement.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The point is this, the dollar's future is subject to growing uncertainty; Washington, as China realise, will just do what they have to do to save its banks and stop a deflationary depression from developing, they will worry about the status of the dollar later. They have decided that any risk is worth taking, the die is cast and it can't be stopped. Greenspan cut interest rates and held them too low, too long to put off what would have only been a bad recession. The very consequences of that policy encouraged the banks to stuff their balance sheets with colossal amounts of rotten lending. Now, endeavouring to save those banks and the economy from a deflationary depression America has put the dollar, as the reserve currency of the world, at risk.

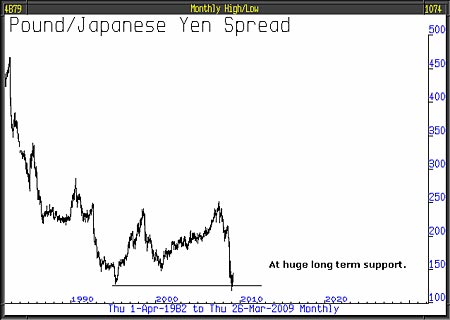

For some time, we have been suggesting that not only has the dollar's run of strength ended but pound weakness would probably reverse. Two weeks ago we said that the yen was on the edge of delivering an important signal of weakness against the pound. As the chart below signifies, that signal has been forthcoming. It certainly seems that the pound's decline has ended and probably reversed. This has important implications for future inflation as costs of imports stabilise, not cheapen.

This article was written by Full Circle Asset Management,and waspublished in the threesixty Newsletteron 27 March 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge