Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The price disparity between the Nymex crude oil and natural gas markets is startling. Based purely on energy content, a barrel of oil is now roughly four times more expensive than an equivalent amount of gas the biggest premium in a generation.

True, there's a fair dose of speculative froth in the black stuff, yet there is no doubt that as an alternative energy source, gas looks too cheap.

As gas demand has plummeted, producers have cut output and slowed development of new fields. Eventually this supply destruction will lead to shortages and a surge in prices (although perhaps not imminently).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

When it does, one beneficiary should be Hamworthy, the Poole-based marine engineer. It is the world's number-one or number-two supplier of niche pumps and water systems used for transporting fluids at sea, such as liquid natural gas.

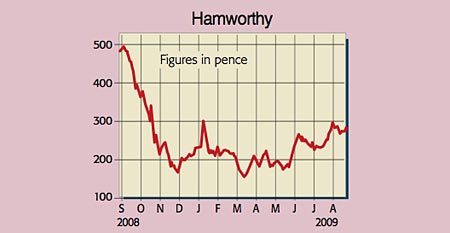

Hamworthy (Aim: HMY)

That's a market that's expected to grow by 7% a year for the next 20 years. The firm also owns patented liquefaction technology, which improves a vessel's safety and fuel efficiency by refreezing air-borne (or evaporated) gas back to -160C. And apart from the oil and gas sector, Hamworthy is beefing up operations in other areas, such as desalination, sanitation and engine-room systems for cruise and container ships. Greater environmental awareness should be good news for the group, as it is now mandatory on cruise liners to use water treatment systems to clean effluent before it is bilged into the oceans.

Of course, the shipping and leisure industries are currently on the rocks, and this could put a spanner in the works. That said, Hamworthy is winning new business; it's cutting costs (for example, headcount has been cut by 13%); it has a £222m order book; and as of March, it possessed net funds of £37m (worth 81p a share, excluding customer deposits). Looking ahead, the City expects turnover and underlying earnings per share of £230m and 30p respectively for the year ending March 2010, on top of a 9.2p dividend. That puts the stock on an undemanding p/e ratio of 9.5, while paying a 3.2% yield. Encouragingly, in mid-July, chief executive Joe Oatley said the company was not only "confident of hitting its numbers", but was also aiming to raise profit margins from 9% today to double digits by 2012.

What's also interesting, especially for investors wishing to diversify away from the sickly pound, is that more than 90% of revenues are derived from overseas, mostly in the Far East, China and continental Europe. Hence with the long-term fundamentals still intact, this looks a good way in for the more adventurous investor who is prepared to sail through the short-term storms.

Recommendation: SPECULATIVE BUY at 285p (market cap. £130m)

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

RICS: UK housing market showing signs of 'tentative recovery'

RICS: UK housing market showing signs of 'tentative recovery'RICS members are becoming less negative about property sales and house prices. What does the latest data mean for the property market?

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.