Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If, like me, you have a couple of tech-crazy children, you may know that the new iPhone has just gone on sale at $99, below its estimated manufacturing cost of $130 a unit.

This seems suicidal, yet in fact makes commercial sense. At this price, sales will soar, boosting Apple's income from lucrative usage deals and handset subsidies negotiated with the mobile operators.

The iPhone's ability to generate online traffic has already been proved. When it first launched in 2007, it single-handedly log-jammed many parts of AT&T's wireless network.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

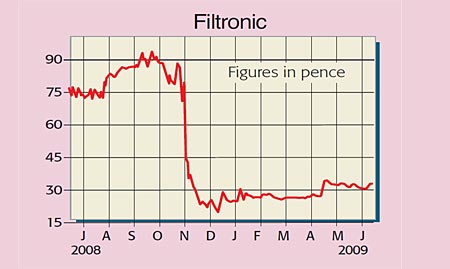

One beneficiary of spiralling internet use will be Filtronic. It supplies components used to raise the capacity of mobile base stations. Telecoms equipment spending has been lacklustre lately, but we're reaching a tipping point when bandwidth upgrades can no longer be put off.

Filtronic (LSE: FTC), rated BUY by Panmure Gordon

Just last week, BT, with its state-of-the-art optical fibre network, complained that the popularity of websites such as YouTube was hurting performance.

The industry's problems have been worsened by destocking. However, this temporary brake has now largely been lifted as customers are forced to replenish inventories. That's not to say demand for new kit will rocket anytime soon.

We'll see a return to more normal conditions in late 2009, with order flow increasing in 2010. Further out, demand will be boosted by the implementation of 4G mobile technology and ongoing growth in emerging nations, where wireless is often the only viable option.

For the year ending May 2010, house broker Panmure Gordon expects turnover and underlying operating profits (earnings before interest, tax and amortisation EBITA) of £27m and £2m respectively. That puts the shares on a miserly forward enterprise value (EV)/EBITA multiple of 4.5. So there's also every chance that Filtronic will be acquired over the next two years, as compelling cost savings are available.

A trade buyer could almost certainly strip out the firm's £1.5m a year in central costs, along with £3m more in divisional overheads. Adjusting for its £16.1m cash pile and valuing the stock on an eight times EBITA multiple, the business is worth about 42p a share on a standalone basis, but nearer 60p if taken private.

So what are the risks? Conditions are tough, on top of possible profit margin compression from Chinese rivals. But Filtronic has taken action on costs and is expected to be profitable regardless.

There are also foreign-exchange issues, and a large chunk of revenues comes from just a few customers (eg, Nokia/Siemens, Alcatel-Lucent and Ericsson). With a solid balance sheet, good opportunities and leading technology, Filtronic looks a winner for patient investors. Preliminary results are due on 27 July.

Recommendation: BUY at 30.5p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

ISA quiz: How much do you know about the tax wrapper?

ISA quiz: How much do you know about the tax wrapper?Quiz One of the most efficient ways to keep your savings or investments free from tax is by putting them in an Individual Savings Account (ISA). How much do you know about ISAs?