Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In 2004 the British government launched a 15-year plan to upgrade 3,500 schools, with £4.5bn earmarked for information, computing and technology (ICT). That's equivalent to £1,675 per pupil.

Despite delays in rolling-out the programme, one firm set to benefit is RM Group. It has around a 30% share of Britain's ICT education market (worth £1.1bn). It's also won an estimated 34% of all the Building Schools for the Future (BSF) contracts tendered more than twice the number won by its closest competitor, Ramesys.

Indeed,RM recently secured a prestigious £16.5m deal in Hull, together with renewing its agreement to run Scotland's educational intranet service. The group is also moving away from standard hardware sales, towards higher-margin products and services.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

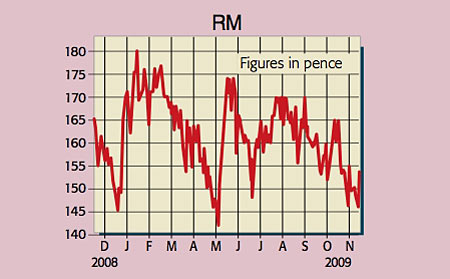

RM Group (LSE: RM. ), rated a BUY by Investec

The City is forecasting 2009 turnover and underlying earnings per share (EPS) of just £330m and 13.9p respectively, rising to £347m and 15.9p in 2010. So RM trades on miserly price/earnings (p/e) ratios of 10.4 and 9.1, while offering a 4% dividend yield. Its balance sheet is solid with low net debt, and future earnings visibility is good due to a £425m order book. Costs are being tightly managed with 250 employees already based in India to give low-cost IT support.

So what are the risks? The City's biggest worry is what happens to the BSF programme after the 2010 general election. I think that whichever party wins, it is unlikely that education budgets will be slashed. The UK Treasury seems to agree: it has already underwritten £2.4bn of funding for BSF projects that have been hit by the credit crunch.

#Another concern is that RM Group's cash flow could be affected by the heavy working capital requirements of the scheme, given its high seasonal dependence on the busy summer period. There is also a £5.9m pension deficit (net of tax) hanging over the group.

All the same, with a strong position in a nationally important sector, plus opportunities aboard (12% of turnover), this Grade A stock is a buy. As a bonus, RM Group already has a foothold in America the Obama administration has allocated $100bn for education spending through the American Recovery and Reinvestment Act. Preliminary results are due out on 23 November.

Recommendation: BUY at 150p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

The UK regions with the highest proportion of homes above the inheritance tax threshold

The UK regions with the highest proportion of homes above the inheritance tax thresholdHigh house prices are pushing more families into the inheritance tax trap across the country

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.