Computing industry set for a shocking change

Just as the discovery of alternating current revolutionised electricity, so 'cloud computing' will transform IT, says Eoin Gleeson.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Electricity was an exciting but untamed force when, in September 1879, Thomas Edison said he'd use it to light up New York. Nobody believed he could do it inventing lightbulbs was one thing, but working out how to make and distribute electricity on a commercial scale was quite another.

So journalists and politicians were left blinking in disbelief when he used underground mains to flood his Menlo Park laboratory with light. And the crowds swarmed into Pearl Street power station a couple of years later, as Edison instructed his chief electrician to throw a switch sending electricity bounding along underground tubes to light up the city's financial district for the first time. In that moment, the electricity utility was born.

But one group of observers remained unconvinced the city's manufacturers. After decades of building mammoth waterwheels and electric generators to power their factories, they were reluctant to risk their businesses on the promise of utility-supplied electricity.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Designed to supply lighting to local homes and shops, Edison's direct current (DC) power stations couldn't be trusted to serve the needs of big factories the current was weak and would cut out frequently, it was unable to travel over long distances, and it was expensive. So they continued to use their own power supplies.

They would soon change their minds. Alternating Current (AC), dreamed up by unhinged genius Nikola Tesla, made electricity cheap, powerful, reliable, and capable of travelling long distances. Suddenly the idea of wasting six months and lots of cash on building a giant waterwheel no longer appealed. And despite Edison's best efforts to halt the progress of AC power, sales of electricity rocketed.

As Nicholas Carr notes in his recent book, The Big Switch Rewiring the World, from Edison to Google , suddenly thousands of waterwheels, steam engines and electric generators were rendered obsolete. By 1907, more than 40% of America's electricity came from central power stations.

The new computing revolution

Today, something similar is happening in the computer industry. "What happened to the generation of power a century ago is now happening to the processing of information," says Carr. Companies are finding that the vast IT systems they have built up over decades with all their customer data and software packages stored on hard drives and servers in-house can be supplanted by services offered online by centralised providers.

As Carr puts it: "The World Wide Web has turned into the World Wide Computer". Computing is moving towards being a utility-like system with the internet acting like an online electric grid, distributing computing power. This shift is most widely referred to as 'cloud computing' a reference to the ever-shifting cloud of data, software and devices that make up the global computer network. And it threatens an almighty shakeup in the computer industry.

A tidal wave of services

It's certainly got Bill Gates worried. In a memo to Microsoft executives in 2005, he warned that "the next sea change is upon us" sounding the alarm that the rise of utility computing would unleash a "services wave" that threatened to destroy the software business that Gates had spent most of his life building up. Gates had watched the PC democratise computing liberating it from corporate data centres and turning it into a universal business tool. But now he recognised that the process was reversing, with increasing centralisation the new big theme in computing. "This new wave," Gates concluded. "will be very disruptive."

Gates had recognised what the factory owners saw at the turn of the 20th century. Once firms could access computing cheaply and reliably over the internet, they could do away with the hulking hardware and army of IT staff they depended on to run their computer systems. Soon high-end IT services would become much more affordable to all rendering the old-style PC, with its software packages and data files all loaded on to a packed hard drive, obsolete.

And while it's easy to get carried away every time the technology industry heralds a new revolution, the truth is that Gates was right to be worried. There has already been a big shift towards using data processing and IT services online. A sum of $16bn was spent on cloud software, storage and services last year, according to research house IDC, who reckon the industry will be worth $42bn a year by 2012.

There are two sides to this utility computing business. First there's the mammoth raw computing power that firms can now access online. Over the last decade, internet giants such as Google and Amazon have been building vast computer farms housed in warehouses and abandoned factories. They are now renting these out for use over the internet.

So when The New York Times realised that it didn't have enough computing power of its own to upload the 11 million articles in its archive on to the web in 2007, the publisher called up Amazon. In a matter of 24 hours, programmers at The Times were able to upload the 11 million articles dating back to 1851 on to the newspaper's site by renting space on Amazon's servers. The entire bill for the service came to $240.

That kind of value has not been lost on other industries. Stock exchanges that relied on huge humming rooms of computers to process trades are now outsourcing data storage to companies that relay the information back to them over the web. Newspapers that used to handle their subscriptions in house are using services offered by Amazon to handle their credit-card transactions.

Secondly, there's the business services that cloud providers can offer online. One of the first companies to do this was Salesforce. Declaring the "end of software", Salesforce offered a simple service a computer programme that helped corporate sales forces keep track of their accounts over the internet. You didn't have to buy a software licence (as you weren't installing the programme on your own computers), and you didn't need to invest in new servers when sales picked up, because you weren't storing the data in-house. Once companies saw that it was reliable, business boomed. According to industry research firm Gartner, the market for internet-based software alone hit $5.1bn last year, and is estimated to rise to $11.5bn by 2011.

The rapid growth in the sector has lit a fire under the computing industry, which is now rushing to invest in the infrastructure needed to fuel this revolution. Before it was beaten to the punch by Oracle (see page 7), IBM was in talks to buy server maker Sun Microsystems. Cisco, the world's biggest maker of routers (which directs information around the internet), has launched into selling servers.

And following Google and Amazon whose efficient data centre networks make them the dominant players in the industry computing giants are racing to build data centres, hunting for abandoned factories in which to stock up on computer servers to back up cloud services.

This year alone, firms will spend about $100bn on data centres, says IDC. According to Rick Rashid, head of research at Microsoft, a handful of internet firms (Google, Microsoft, Yahoo and Amazon) already own a full 20% of the world's server output. "The cloud concept has emerged as the best hope for a maturing computer industry," says Reuters' Eric Auchard.

This won't happen overnight

Still, just as manufacturers in the 1880s didn't take to electricity right away, there's a huge amount of hype around the move to utility computing. For one thing, cloud services are still best suited to small- to medium-sized companies and start-ups. It allows them to build their businesses without the nightmare of constructing data centres and assembling teams of engineers to manage them.

For big companies, the benefits aren't so clear cut. They are not going completely to empty out the data centres they built up over decades. According to a recent survey by consultancy group McKinsey, if a company completely outsourced its existing servers to a cloud provider, it would end up paying more than double the cost of using its in-house servers. And while using cloud services does allow big companies to trim IT staff, we're only talking about a 10%-15% cull, says McKinsey.

There are also serious obstacles to a centralised data-processing system. For one, the security of valuable corporate data is an issue. People are deeply cautious about control of their data, says Anthony Foy, head of data centre group Interxion, who adds that "85% of our customers want to be within a driving distance of their data". And just like Edison's DC electric power, keeping the infrastructure up and running is another obstacle. On 20 July, Amazon suffered a huge embarrassment as its storage service crashed for eight hours.

So we are not about to witness the sudden, dramatic emergence of a fully-functioning computing grid. Cloud computing will emerge in steps. "We see private clouds developing first," says Foy where companies continue to manage their own data storage in-house.

The point is that the likes of Google and Amazon aren't going to swallow up all the 'software as service' business straight away. Smaller data centre groups already provide storage services to the likes of Salesforce.com and NetSuite. And there will be plenty of business to go around for other players in the sector as companies outsource their overworked and cramped IT storage needs.

"But like any utility system, computing becomes more attractive as providers gain scale and are able to push down their prices," says Carr. As the likes of Google and Amazon continue to build their colossal network of server farms squeezing out the smaller data storage outfits the economic advantages of a more centralised system of computing will become all the more real.

As industry giants look to stake their claim, Wall Street is already weighing up "the takeover potential of dozens of downstream technology companies that will need to seek allies in the land of giants", says Auchard. Computing power may not become a utility overnight. But with small groups, start-ups and back-up services driving a $16bn industry growing by 27% a year, this is the first computer revolution in a long time that is worth paying close attention to. We look at the best ways to profit below.

How to get on the cloud

When Amazon made the risky bet to move into delivering computing and data storage three years ago, cloud computing was just a little-known technology term. "Both the hype and perceived value around cloud computing has expanded since that first shot was fired," says Stacey Higginbotham in Business Week. You just have to look at 'software as service' providers Netsuite and Salesforce.com to see that they now trade on forward a p/e of 85 and 49 respectively.

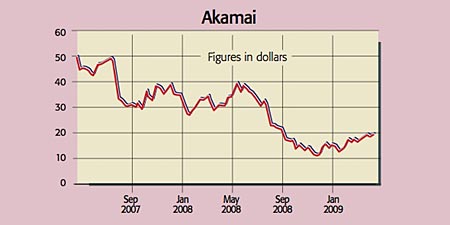

But there is great value in the infrastructure that supports these cloud providers. While Google, Microsoft and IBM scour the earth for data centres, Akamai (Nasdaq:AKAM) has been helping online companies speed up the delivery of everything from videos to text with a formidable network of servers (1,500 locations across 650 cities) deployed around the world.

Instead of using one server farm for serving up a song on iTunes, for example, Akamai replicates the most popular downloads on a local server, so that your download doesn't get stuck in web traffic. Akamai is an infrastructure company that will play a vital role in turning the internet into a stable computing grid, says Nicholas Carr. The company has a strong balance sheet, with no debt and plenty of cash, and long-standing relationships with key cloud players, notes Travis Johnson on Stock Gumshoe.

Akamai is currently valued on a comparatively cheap forward p/e of 11 a legacy of its collapse during the internet bust. But according to research firm Frost & Sullivan, the content delivery market of which Akamai controls 50% is expected to grow to $4.4bn by 2013 from $1bn today. Accordingly, Mark Kelleher on TheStreet.com reckons Akamai will enjoy earnings growth of 20% for the next several years.

The most vital part of the cloud computing infrastructure is the data centre. As The Economist says: "Data centres have become as vital to the functioning of society as power stations." There is huge demand for private data centres and a serious shortage in capacity.

With everyone from telecoms companies to financial groups looking to cut IT spending and outsource their data, demand for data storage is growing by 60% a year, according to McKinsey, and data centre groups are thriving. Equinix, which has 41 data centres and over 3.5 million square feet of sellable space, is currently 78% utilised.

But valued on a forward p/e of 39, it's expensive. A better option would be Digital Realty Trust (US:DLR). This Real Estate Investment Trust has more than 70 properties worldwide. It trades on a forward p/e 11.5 and offers a 3.9% dividend yield.

Of course, businesses aren't going to dismantle in-house data storage overnight. And with energy costs rising, firms that help make them more efficient are prospering. As a large maker of corporate data storage systems, EMC (US:EMC) has both a lot to gain and a lot to lose from cloud computing.

On the one hand, cloud computing will mean less demand for on-site storage in the long run. But its experience and skills in data storage mean "it could transform itself into a central repository for business information, becoming a dominant data utility", says Carr. But for now EMC's data storage business is holding up well: it is valued on a forward p/e of 12.4. EMC also owns a controlling stake in leading cloud computing software company VMware.

Equipment maker Network Appliance (Nasdaq:NTAP) has risen 27% since we tipped it in February. NetApp provides data-storage technology that helps firms manage their data centres more efficiently, supplying software to store documents, emails and videos. It has £1.2bn net cash. And despite being valued on a forward p/e of 15, it is worth holding on to. Both EMC and Network Appliance are prime candidates for takeover by the likes of IBM, says Eric Auchard on Reuters.

However, Soapstone Networks (Nasdaq:SOAP) which sells software that helps businesses handle internet traffic has now risen 40% since we tipped it in December, and now might be a good time to take profits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Eoin came to MoneyWeek in 2006 having graduated with a MLitt in economics from Trinity College, Dublin. He taught economic history for two years at Trinity, while researching a thesis on how herd behaviour destroys financial markets.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.