Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The UK energy regulator Ofgem has warned again that tightening electricity supplies could cause blackouts by 2015. One new solution is the government's Green Deal initiative. This incentivises families to install new energy-saving appliances (boilers, insulation, etc) to reduce power consumption and carbon emissions.

Last week the first scheme was announced by Birmingham City Council. And the firm it chose as its exclusive outsourcing partner under an eight-year, £600m deal was Carillion.

Initially the scheme will cover up to 60,000 households across the city, together with schools and other council properties. Another £900m framework contract allows 35 neighboring councils to buy similar services from Carillion. Other regions such as Southampton and Newcastle are also pushing ahead with similar schemes, and Carillion looks well placed to become the go-to' provider.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The firm's overall strategy is to build up its support-services arm which maintains roads, railways and other essential infrastructure while shrinking its lower-margin, UK construction business. Earlier this year the group signed one of the largest local authority contracts of its kind a £700m agreement to provide services ranging from property management to school catering and cleaning for Oxford county council over ten years.

CEO Richard Howson says the public sector continues to outsource services to improve operational efficiency, which in turn underpins the firm's record £35.6bn pipeline. The firm is bidding on five local-authority contracts this year and is also in pole position to win a £1.5bn contract for the upkeep of the Ministry of Defence's airfields, army bases and naval sites. And outside of the UK, the board is aiming to double revenue from the Middle East and Canada by 2015.

First-half operating margins rose to 4.1% from 3.3% despite sales slipping. The order book held up well too at nearly four years' sales.

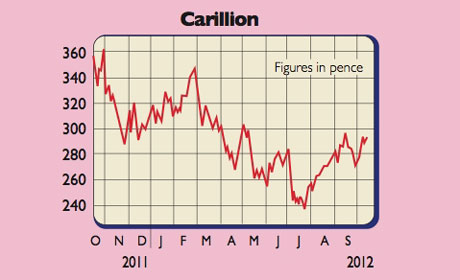

Carillion (LSE: CLLN), rated a BUY by Panmure Gordon

The City is forecasting sales and underlying earnings per share(EPS) of £4.6bn and 41.8p respectively, climbing to £4.8bn and 42.1p by 2013. That puts the shares on a mean price/earnings (p/e) of seven, with a well-covered 5.8% dividend yield. I value the stock on a ten times EBITA multiple. Adjusted for the £163m PFI portfolio, debt of £284m, minority interests, and a £248m pension deficit, that suggests a fair value of 370p a share.

The next update is scheduled for 12 December. Panmure Gordon has a price target of 400p.

Rating: BUY at 287p

Disclosure: I own shares in Carillion.

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments. See www.moneyweek.com/PGIor phone 020-7633 3634.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Somero: trading this overlooked bargain

Somero: trading this overlooked bargainFeatures Mechanical-screed maker Somero dominates its niche and is attractively valued. Matthew Partridge picks the best way to trade it.

-

How to find big profits in small companies

How to find big profits in small companiesCover Story The small- and micro-cap sectors are risky and volatile. But with careful research and patience, investors could make huge gains. Matthew Partridge explains how to find the market’s top tiddlers.

-

The hidden gems on Aim, London's junior market

The hidden gems on Aim, London's junior marketFeatures Aim, London’s junior market, is risky – but you can find solid stocks at low prices. Scott Longley reports.

-

Three Aim-listed firms that will thrive in a post-Brexit world

Opinion Matt Tonge and Victoria Stevens of the Liontrust UK Smaller Companies Fund pick three Aim-listed firms that will survive Brexit turmoil.

-

Fetch! The Chinese small-cap stocks to buy in the Year of the Dog

Opinion Each week, a professional investor tells us where she’d put her money. This week: Tiffany Hsiao of Matthews Asia selects three Chinese small-cap stocks with exciting potential.

-

Small and mid-cap stocks with big potential

Opinion Professional investor Guy Anderson of the Mercantile Investment Trust selects three small and medium-sized firms with promising prospects that the market has missed.

-

Get cheap, reliable growth from smaller companies

Get cheap, reliable growth from smaller companiesFeatures One of the most reliable long-term investment trends is the long-term outperformance of smaller companies over blue chips. Max King picks some of the best ways to buy into this growth.

-

Now the bitcoin bubble’s burst, what’s the next big thing?

Now the bitcoin bubble’s burst, what’s the next big thing?Features Forget bitcoin, if you want to increase your wealth faster than most other people, you need to find the next big thing. Merryn Somerset Webb suggests some places to look.