Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

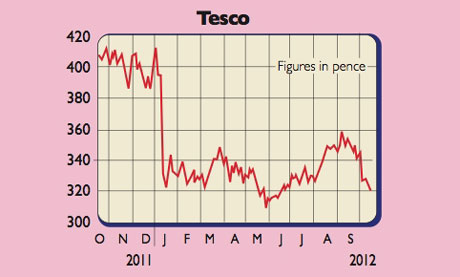

I bet that, out of the big four British supermarkets, Tesco will report the strongest like-for-like sales growth this Christmas. That might seem a little contrarian given the firm's recent woes. So why am I bullish?

Firstly because, although UK sales fell 1.5% in the first quarter (Q1), there are tentative signs that the £1bn turnaround plan dubbed Build a Better Tesco' is beginning to work. Q2 saw like-for-like sales nudge up by 0.1% with its Everyday Value range shooting up 10%, after the grocer recruited 8,000 staff, ramped up promotions, modernised 230 stores and spruced up its fresh meats, fish and bakery counters.

Meanwhile, capital expenditure is being slashed on new hypermarkets. Instead, money is being deployed to expand its smaller Tesco Express format, together with building e-commerce infrastructure such as 90 drive-through, click-and-collect' points. CEO Philip Clarke says that customers have welcomed the changes, and that its UK business "is on time and on track".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Secondly, following last year's bungled £500m Big Price Drop', expectations for this year are low. The group should easily beat year-on-year UK comparables, especially as Clarke took personal command of the UK division back in March. Let's not forget too that Tesco still possesses immense economies of scale. Its market share remains at 30%, that's more thanten percentage points above nearest rival Asda.

Its leadership in web and convenience-store retailing provide it with huge strategic advantages. So successful is the online concept that it is also being rolled out in Prague and Warsaw, and has just launched in Bratislava. Next year is likely to witness a resurgent Tesco looking to make up lost ground.

Clarke certainly has challenges ahead. In South Korea profits are set to dip £100m this year, following a decision by the government to ban Sunday trading for two weekends a month, and restrict opening hours to between 8am and midnight on other days.

Meanwhile, in the US, the troublesome Fresh & Easy chain is still losing money albeit sales were up 5.2% for the first half year and more stores became cash-flow positive. But I'm not the only one who thinks the Tesco tanker is turning around. US investor Warren Buffett has snapped up a 5.1% stake, encouraged by the 4.5% dividend yield and the cheap valuation of ten times earnings.

Tesco (LSE: TSCO), rated a BUY by Cantor Fitzgerald

The City is predicting turnover and underlying earnings per share (EPS) of £66.3bn and 32.7p respectively for the year ending February 2013, rising to £69.3bn and 34.5p 12 months later. On this basis, I rate the stock on a ten times earnings before interest, tax and amortisation (EBITA) multiple. Adjusted for net debt of £7.2bn and a £1.8bn pension deficit, that suggests an intrinsic worth of 365p per share.

Overall, I think Clarke is doing a good job, and the group's value credentials should help it during a period where consumers increasingly use the internet and trade-down to cheaper options. Cantor Fitzgerald has a price target of 443p per share and the Q3 trading statement is scheduled for 5 December.

Disclosure: I own shares in Tesco.

Rating: BUY at 315p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments. See www.moneyweek.com/PGI or phone 020-7633 3634.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Somero: trading this overlooked bargain

Somero: trading this overlooked bargainFeatures Mechanical-screed maker Somero dominates its niche and is attractively valued. Matthew Partridge picks the best way to trade it.

-

How to find big profits in small companies

How to find big profits in small companiesCover Story The small- and micro-cap sectors are risky and volatile. But with careful research and patience, investors could make huge gains. Matthew Partridge explains how to find the market’s top tiddlers.

-

The hidden gems on Aim, London's junior market

The hidden gems on Aim, London's junior marketFeatures Aim, London’s junior market, is risky – but you can find solid stocks at low prices. Scott Longley reports.

-

Three Aim-listed firms that will thrive in a post-Brexit world

Opinion Matt Tonge and Victoria Stevens of the Liontrust UK Smaller Companies Fund pick three Aim-listed firms that will survive Brexit turmoil.

-

Fetch! The Chinese small-cap stocks to buy in the Year of the Dog

Opinion Each week, a professional investor tells us where she’d put her money. This week: Tiffany Hsiao of Matthews Asia selects three Chinese small-cap stocks with exciting potential.

-

Small and mid-cap stocks with big potential

Opinion Professional investor Guy Anderson of the Mercantile Investment Trust selects three small and medium-sized firms with promising prospects that the market has missed.

-

Get cheap, reliable growth from smaller companies

Get cheap, reliable growth from smaller companiesFeatures One of the most reliable long-term investment trends is the long-term outperformance of smaller companies over blue chips. Max King picks some of the best ways to buy into this growth.

-

Now the bitcoin bubble’s burst, what’s the next big thing?

Now the bitcoin bubble’s burst, what’s the next big thing?Features Forget bitcoin, if you want to increase your wealth faster than most other people, you need to find the next big thing. Merryn Somerset Webb suggests some places to look.