Is the gold mining sector about to take off?

Compared to the price of the metal, gold miners have underperformed badly. But interesting changes are afoot in the sector, says Phil Oakley. And neglected gold stocks could soon benefit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Gold has had a quiet year.

Despite the prospect of more money printing by the world's central banks, and minuscule interest rates, it seems that not many people see inflation as a big threat at the moment.

But things can change quickly in the financial world. Often the best time to buy things is when nobody really wants them. It's interesting that renowned investors George Soros and John Paulson have been buying gold recently.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It looks a smart move to us. Gold is worth holding, if only as a form of insurance against paper money going bad which it eventually will, if all the printing continues. We certainly see no reason to hold low-yielding government bonds.

But what about gold mining stocks? If you believe that you should own gold and that it will go up in price, surely gold stocks are a good investment?

Large gold miners have been disappointing investments

The logic behind owning the shares of gold mining companies seems quite sensible. By having a slice of the company's gold in the ground you should benefit from leverage.

By this, I mean that a rise in the gold price - other things being equal - should lead to a bigger proportional rise in the profits of the gold mine. Of course, the same leverage works in reverse when gold prices fall, which makes owning gold stocks a riskier proposition for an investor than owning the metal itself.

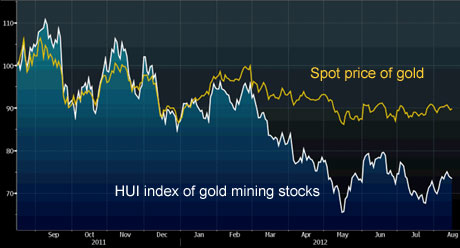

Source: Bloomberg

But the relationship between gold prices and the price of gold stocks has broken down sharply this year. Have a look at the chart above. It tracks the spot price of gold (yellow line) with the HUI index of gold mining stocks (white line) during the last year. It contains a lot of the major players such as Goldcorp Inc and Barrick Gold.

The HUI index includes gold mining companies that do not hedge the price of their gold production beyond 18 months. This means that these companies should see their revenues closely correlated to changes in the price of gold.

Yet as you can see, during the last six months, gold stocks have significantly underperformed against the price of gold bullion. But even over a longer period of time, a broad index of gold stocks like the HUI has done worse than bullion.

It's been better to own physical gold

During the last ten years, the HUI index has gone from 120.8 to 424.3 - an increase of just over 250%. Now that's pretty good, and a lot better than having your money in most stock market funds.

But the price of gold has risen from $308 to $1,604 per troy ounce - an increase of 420%. There have been brief periods when gold stocks have performed better than gold, but it doesn't look like the leverage theory has worked out in practice. Why?

There are several reasons. One is the fact that gold mining companies used to hedge their production by getting another party - typically a bank - to buy their output at a guaranteed price. Scarred by years of low and lacklustre gold prices, they wanted some security for their efforts. As the price of gold surged, many companies lost out on big profits because they had already agreed to sell their output for much lower prices.

Now, of course, hedging is virtually non-existent among most major gold mining companies. But the other big problem they've now encountered is cost. It's costing a lot more money for mining companies to get their gold out of the ground. Cash costs have soared due to high energy prices and the cost of specialised workers.

This has meant that profits have actually been going down at a lot of gold mining companies. It's quite ironic that gold companies that have been seen as beneficiaries of inflation have now become victims of it.

Then there's the growth in exchange traded funds (ETFs), which have made it a lot easier for investors to own physical gold. Some investors have also bought gold royalty companies such as Royal Gold (Nasdaq: RGLD) or Franco Nevada Corp (NYSE: FNV). These companies finance gold mining companies and get a share of their production revenues (a royalty) in return. This means their profits are linked to the price of gold, but are not dragged by cost inflation. As a result their shares have done well, leaving them trading on punchy multiples of expected profits.

So when will gold miners live up to their promise?

You could say that if gold stocks haven't done what they should have done, then why bother with them?

Well, some interesting changes are afoot in the sector. And when gold sees a renewed surge of interest - as we expect it will - neglected gold stocks could benefit.

Looking at the table below, the big companies don't look screamingly cheap on traditional measures such as price/earningsmultiples (although Petropavlovsk's valuation looks intriguing). However, dividend levels at companies such as Newmont Mining are getting towards a reasonable level as miners realise they need to give investors an incentive to buy the stocks rather than an ETF.

| Goldcorp | US$36.71 | 19 | 1.4 |

| Barrick Gold | US$34.69 | 8.1 | 2.2 |

| Newmont Mining | US$46.63 | 11.4 | 3.2 |

| Yamana Gold | US$15.09 | 14.2 | 1.6 |

| African Barrick Gold | £4.37 | 9.4 | 2.4 |

| Petropavlovsk | £4.34 | 4.7 | 2.9 |

With the rest of the mining sector being hit by the slowdown in demand for industrial metals, you also have to wonder how much longer rampant cost inflation will be hurting gold miners. If other big players are cutting back on projects, then the pressure driving up the costs of staff and machinery will ease off.

But there's one other major driver that could ignite the sector and that's takeover activity. The big question is: if the gold assets of these companies are genuinely cheap, then why haven't they been bought by corporate buyers?

Well, now it looks as though they might be. Yesterday, Barrick Gold, which owns 74% of African Barrick Gold, announced that it might consider selling its interest. This morning it has said it's in preliminary' talks with China Gold. (I took a look at African Barrick in detail earlier this month.)

My colleague Simon Popple looked at some other promising gold miners in his recent cover story for MoneyWeek.

This article is taken from the free investment email Money Morning. Sign up to Money Morning here .

Our recommended articles for today

China: forget fancy handbags and look to caustic soda

Luxury goods are booming in China. But as a gauge of the country's economic health, fancy handbag sales won't tell you much, says Merryn Somerset Webb. If you want the truth on China, look to caustic soda sales.

It's time to sell FirstGroup

To win the West Coast rail franchise, FirstGroup had to pay a staggering amount of money. The costs of getting it wrong could be very high indeed, says Phil Oakley. And it doesn't look like the numbers stack up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how