Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investors ignore Africa at their peril. There are risks, but they're probably no worse than those associated with many other parts of the developing world, such as Asia, South America and the Middle East.

There's a lot going for the continent. It has an abundance of natural resources such as oil, metals, gold and diamonds, a young population of almost a billion people, and a consumer market set to reach $1.6 trillion by 2020.

Better still, demand is barely being impacted by global bank deleveraging, since there is practically no personal credit. And while Africa was once an exporter of human capital, many Western-educated Africans are now returning, bringing with them vital knowledge, experience and technical skills. This is all great news for conglomerate Lonrho.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The firm's bread-winner is its agricultural division (71% of sales), which exports fresh fruit, vegetables, fish and meat to European, Asian and American supermarkets (including Costco Marks & Spencer, Tesco and Sainsbury), plus domestic chains such as Shoprite and Pick'n'Pay.

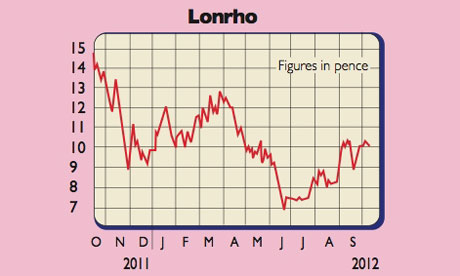

Lonrho (LSE: LONR)

The division recently scooped up an exclusive five-year agreement for rights to catch tuna off the coast of Mozambique, which could add £11m to revenues in 2013 and £22m in 2014.

Lonrho has its fingers in many other pies too, such as hotels, infrastructure and support services. It spun-out its loss-making Fly540 airline over the summer into a separately listed company called Fastjet, in which it owns a 67% stake.

First-half revenues soared 29.1% whilst net debt fell to £78.7m by June from £102.7m in December. Broker Daniel Stewart expects sales to climb 33% to £270.8m in 2013 from £202.8m this year, delivering underlying earnings per share of 1p. I value the group on a price/earnings (p/e) ratio of 15, which suggests an intrinsic worth of 15p per share.

Lonrho could fall foul of geopolitical, foreign exchange, natural disaster, interest rate and/or commodity risks. And it may suffer from being spread too thinly. Nonetheless, the shares offer a brave investor a cheap entry point into a multi-decade growth story. Daniel Stewart has a price target of 20p.

Rating: SPECULATIVE BUY at 10p (market cap £160m)

Disclosure: I own shares in Lonrho.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Somero: trading this overlooked bargain

Somero: trading this overlooked bargainFeatures Mechanical-screed maker Somero dominates its niche and is attractively valued. Matthew Partridge picks the best way to trade it.

-

How to find big profits in small companies

How to find big profits in small companiesCover Story The small- and micro-cap sectors are risky and volatile. But with careful research and patience, investors could make huge gains. Matthew Partridge explains how to find the market’s top tiddlers.

-

The hidden gems on Aim, London's junior market

The hidden gems on Aim, London's junior marketFeatures Aim, London’s junior market, is risky – but you can find solid stocks at low prices. Scott Longley reports.

-

Three Aim-listed firms that will thrive in a post-Brexit world

Opinion Matt Tonge and Victoria Stevens of the Liontrust UK Smaller Companies Fund pick three Aim-listed firms that will survive Brexit turmoil.

-

Fetch! The Chinese small-cap stocks to buy in the Year of the Dog

Opinion Each week, a professional investor tells us where she’d put her money. This week: Tiffany Hsiao of Matthews Asia selects three Chinese small-cap stocks with exciting potential.

-

Small and mid-cap stocks with big potential

Opinion Professional investor Guy Anderson of the Mercantile Investment Trust selects three small and medium-sized firms with promising prospects that the market has missed.

-

Get cheap, reliable growth from smaller companies

Get cheap, reliable growth from smaller companiesFeatures One of the most reliable long-term investment trends is the long-term outperformance of smaller companies over blue chips. Max King picks some of the best ways to buy into this growth.

-

Now the bitcoin bubble’s burst, what’s the next big thing?

Now the bitcoin bubble’s burst, what’s the next big thing?Features Forget bitcoin, if you want to increase your wealth faster than most other people, you need to find the next big thing. Merryn Somerset Webb suggests some places to look.