Convertible bonds: the asset class of 2009?

Many people who would normally invest in shares are putting their money into convertible bonds. Tim Bennett explains what they are, and whether now is the time to get into them.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Lurking between shares and conventional bonds is a "hybrid" beast that Hugo Greenhalgh in the FT says could be "the asset class of 2009": the convertible bond. "Across the spectrum we're seeing crossover buyers who would have traditionally invested in straight equities or straight debt seeing true value in convertibles," notes Dan Mannex at RWC Partners. Even Warren Buffett's recent $5bn investment in Goldman Sachs took the form of a "synthetic convertible" when he bought 10% preference shares and warrants issued by the bank. So what exactly are they, and is now the time to get in?

The strange world of the convertible bond

Convertibles are straightforward in principle. A standard bond offers interest (coupons) at regular intervals and then a fixed redemption payment after, say, five years. Convertibles also pay regular coupons, but here's the twist the holder has the right to swap the bond for a specified number of ordinary shares. This may happen at either a single date, for instance in five years' time, or at a choice of future dates up until then. This means that convertibles can offer "income like bonds with all the upside of stocks".

Convertible bonds: the win-win investment

Many firms need to raise capital but are finding that shareholders are reluctant to provide it. That's hardly surprising when share prices and dividends have been tumbling. But the alternative, straightforward debt, can be expensive to service as lenders want high interest payments in return for the risk.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Enter the convertible. Because these bonds offer a buyer the chance to convert debt into (hopefully) more valuable shares, the initial coupon rate is relatively low. So "instead of having to offer 9%-10%, convertible bonds can offer 6%-7%", says Colin Morton of Rensburg Fund Management. That saves the issuer cash in the short term and may also spare it a big future redemption payment. The upside for the convertible holder is that they rank above equity for repayment should the firm fold. Meanwhile, they get some income and also the prospect of a windfall on conversion. That potential bonus arises because the 'strike' price at which debt is converted into equity is fixed. Should the share price collapse between issue and conversion, the holder can usually demand redemption in cash rather than shares.

One final quirk to avoid having to let valuable shares go for peanuts if a holder converts, issuers often build in the right to buy back the bonds for a fixed price above nominal value.

The conversion premium

No investor gives away something for nothing. A lower initial coupon comes with conversion rights. So say you hold a convertible bond with a £100 nominal value priced at £105. You also have the right to convert it into 50 shares and the issuer's current share price is £1.80. Give up the bond now and you would expect to get shares worth at least £2.10 each back (£105/50). So the current share price needs to rise by at least 30p (£2.10-£1.80), or 17% (30p/£1.80), before you would bother. That's the oft-quoted 'conversion premium'.

Why is now the right time to dive in?

For buyers there are two big enticements. First, issuers are offering convertible bondson attractive terms to secure a deal. Secondly, prices have been depressed by hedge funds frantically dumping assets as they deleverage. Aviva reckons that 70% of convertible bonds were held by hedge funds at the start of 2008 that's now shrunk to 40%, the group estimates. So "compared to straight debt, they are selling very cheaply". Further, as David Coobes at Rathbone Brothers points out, although yields on many convertibles are above high-yield debt, 60% of the market is issued by investment-grade companies. Evidence that negative sentiment is reversing fast comes from the UBS Global Convertible hedged index, which is up by just over 14% in the past two months.

How to buy convertible bonds

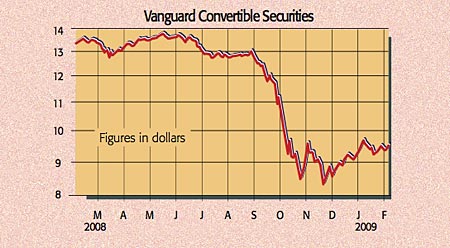

It is possible to buy individual convertible bonds via a broker, but as Kiplinger puts it, "the interplay of interest rates, call provisions, conversion premiums and stock prices is so complex" that they require "more time and attention than most investors are willing to give". So a better bet is a well-established fund, such as the Vanguard Convertible Securities (00 1 800 992 8327). It has had the same manager, Larry Keele, for more than 12 years and has outperformed the category average return over one, three and five years. The yield is 4.9%, with a competitive expense ratio of 0.77% (the sector average is 1.4%) but a minimum investment of $10,000. Richard Shaw on Seekingalpha.com says that investors are "being paid more than twice the Treasury rate to wait for a possible capital gain from a future conversion premium". And right now, that's not to be sniffed at.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

How should a good Catholic invest? Like the Vatican’s new stock index, it seems

How should a good Catholic invest? Like the Vatican’s new stock index, it seemsThe Vatican Bank has launched its first-ever stock index, championing companies that align with “Catholic principles”. But how well would it perform?

-

The most single-friendly areas to buy a property

The most single-friendly areas to buy a propertyThere can be a single premium when it comes to getting on the property ladder but Zoopla has identified parts of the UK that remain affordable if you aren’t coupled-up