How do you know when to sell shares?

If you are looking to buy shares, there's no shortage of advice around. But what's less clear is when to sell. Getting that right is vital. Tim Bennett gives three tips on how to tell when it's time to sell.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you are looking to buy shares, there's no shortage of advice around. But what's sometimes less clear is how and when to sell. Getting that right is vital if a paper profit is ever to become a cash one.

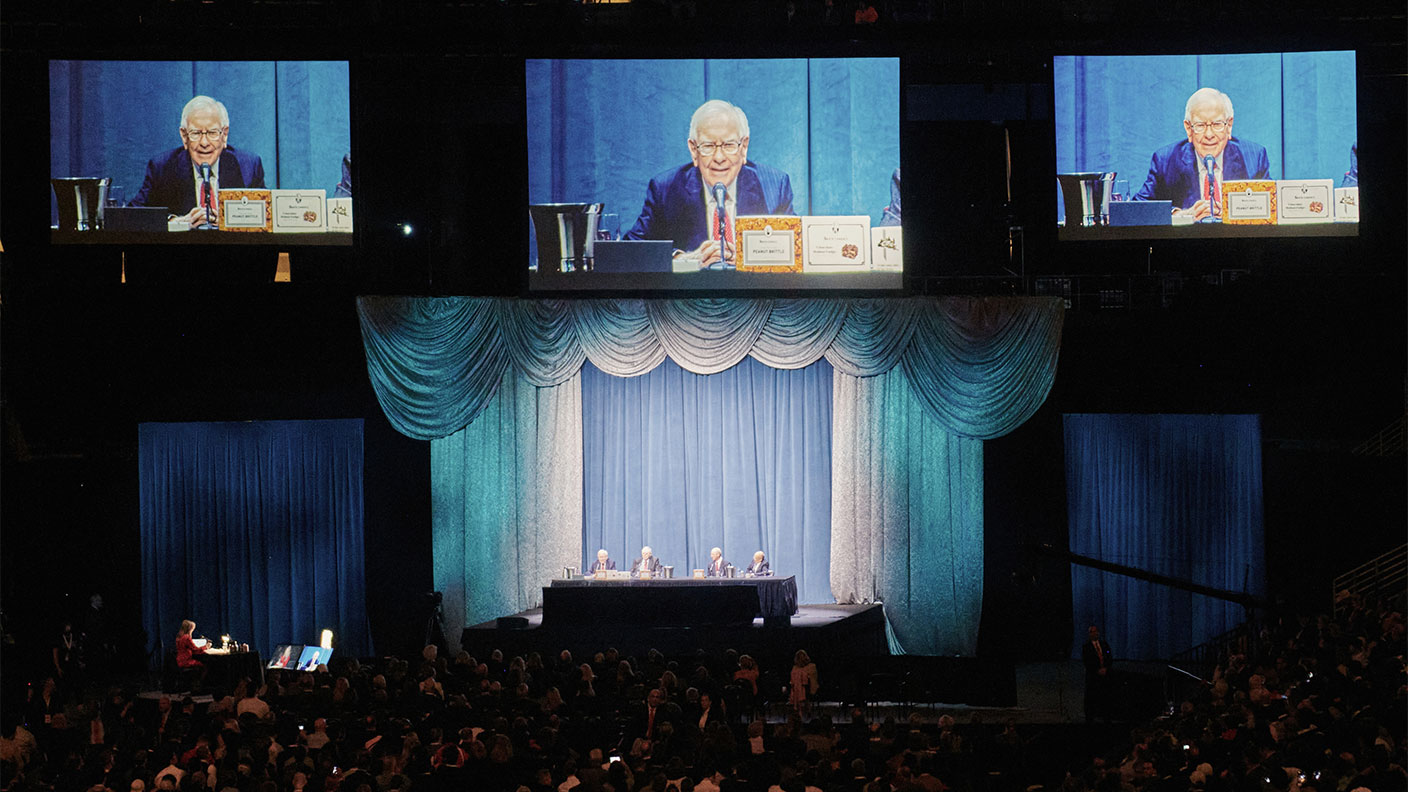

There's nothing wrong with long-term buy-and-hold investing as a strategy. But to make money, rather than just paper gains, you have to sell at some point. Even Warren Buffett, who boasts that his preferred holding period is "forever", has made some sizeable disposals over a long investing career, including stakes in consumer healthcare giants Procter & Gamble and Johnson & Johnson.

One reason why good selling technique matters is because losses are fiendishly difficult to recover. If you start with £1,000 and lose 25% of it, you will need a 33% gain just to break even. The bigger the loss, the worse the numbers get. A one-off loss can also unravel a long period of steady gains in a flash. For instance, you might start with £1,000 then make a 10% gain in year one, followed by a 10% gain in year two, before losing 20% in year three. Have you broken even? No. After one year, £1,000 becomes £1,100 and £1,210 after two years. But £1,210 x 80% is just £968, not the original £1,000. So how do you minimise or, better yet, prevent losses? Here are three tips.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

1. Change when the facts change

Why did you buy the stock? Is the rationale still valid? The fundamentals that once marked a company as a buy for example, a low valuation, great cash flow, growing earnings, high barriers to entry can, and do, change. If you're lucky, it will be because the price has risen to reflect the stock's quality. If the share price reaches the point where it is fully valued, or over-valued, by your criteria, you should take your profits.

But sometimes it's not a numbers thing. Maybe a key director has left. Once-great brands can be targeted by cheaper, better rival products. There's no way to be prescriptive as each share has different characteristics that make it attractive. But it means you can't just switch off from your portfolio. For example, I bought the once-mighty Jarvis (a high-profile public-sector outsourcer) for over £1 a share. It then hit all sorts of trouble and controversy and the share price plunged. Foolishly and stubbornly I bought on the dips' at 25p and 10p, reasoning the share couldn't get any cheaper'. But the facts had changed my attitude hadn't. It eventually sank to 0p. This is why it's important to monitor and review your holdings, say, every quarter.

On the flipside, you mustn't be bullied into selling by short-term noise' from the press and newswires. And you must never panic sell just because everyone else is. As value investor Simon Caufield notes in his True Value newsletter, if stocks are plunging in price, then "find out why... If there's new information which lowers the true value' [your estimation of what the share is really worth], then sell. If not, don't sell. Instead, buy more."

2. Evaluate other options

One of the most important yet least-understood concepts in markets is opportunity cost'. Here's an example. I recently overheard someone pondering whether to buy a weekend first-class upgrade for a fixed £25 extra on the train to Scotland. He decided it was too much as it "brought the total price up to £195". But the total price isn't relevant the £170 standard class fare is a sunk cost. That £25 buys a lot of extra comfort over a five-hour journey. There's still no right answer as to whether you upgrade or not, but the point is the decision rests on the marginal (£25), not total (£195), cost. Equally, when evaluating whether to sell, step away from your shares and ask, "What else could I be doing with my money?" Are you hanging on to dodgy stocks in the hope of a recovery when you could perhaps pick up a better return, for less risk, by taking the money out and investing elsewhere?

3. Use your head, not your heart

As I've noted on this page in previous issues, most of us think we're above-average drivers. The same goes for our investment prowess. That means that we hate to admit it when we make a mistake losses are embarrassing, to put it bluntly. But they are a fact of life. No one gets every investment right unless they are insanely lucky (or don't invest very often). We all think we'll recover a small loss, and perhaps we will. But it's the big ones that cause most trouble. As Columbia University psychologist Eric Johnson puts it, "thinking about the pain a stock has caused can emotionally block thoughts about the benefits of selling it". But how do you avoid getting emotionally attached to a stock? Automating' your selling is one way.

Three ways to bypass your heart

1. Trailing stop-losses. Say you buy a share at £10 and you set a trailing stop at 20%. This would generate an automatic sell at £8 or below. But if the price rises to, say, £14, the stop moves to £11.20. Now if the share plummets you at least lock in a £1.20 gain.

2. Rebasing. Our brain fools us by anchoring' to the price we bought at as the right' price. But you can trick it right back. Say you paid £10 a share three years ago and the current price is £4. Divide the original price by ten that's £1. Now ask yourself whether the firm is worth four times your new imaginary purchase price. If you can't justify it even at that level, dump it.

3. Rebalancing. Say you spent £100 each on four stocks in two sectors (£800 in total). One stock surges to £300; the other seven rise just £25 each. If your plan was to spread your risk evenly, rebalance. Sell £175 of the first stock (to reduce it to £125) so what's left is still an eighth of the total.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why we need a little patience

Why we need a little patienceAdvertisement Feature In volatile markets it’s easy to get spooked and sell your investments. But that could cost you many thousands of pounds. A patient approach can be much more rewarding.

-

The dangers of derivatives as the “Goldilocks era” ends

The dangers of derivatives as the “Goldilocks era” endsEditor's letter This is no longer a benign environment for investors, says Andrew Van Sickle. But – as the recent pension-fund derivatives blow-up shows – not everybody seems to have grasped that.

-

How Warren Buffett built his fortune

How Warren Buffett built his fortuneAnalysis Warren Buffett is considered by many to be the best investor of all time. We examine how much Buffett is worth and how he made his fortune.

-

A simple lesson from Warren Buffett that even children can learn

A simple lesson from Warren Buffett that even children can learnAnalysis Warren Buffett has an incredible investment record. And at the core of his strategy there is one very simple principle. Rupert Hargreaves explains what it is and how it can help you.

-

Why investors should beware of corporate waffle

Why investors should beware of corporate waffleAdvice When top executives try to retreat behind impenetrable jargon, investors should be very sceptical, says John Stepek.

-

A lesson for value investors from investor Howard Marks

A lesson for value investors from investor Howard MarksAdvice Value investors need to open their minds, says US investor Howard Marks. But why is he saying it now?

-

Why investment forecasting is futile

Opinion Every year events prove that forecasting is futile and 2020 was no exception, says Bill Miller, chairman and chief investment officer of Miller Value Partners.

-

What is value investing?

What is value investing?Value investing covers a broad range of bases, but the approach hinges on identifying companies that are worth more than their price suggests.