What is the 'current ratio'?

In his latest video, Ed Bowsher looks at the current ratio, which can help you see whether a company has sufficient resources to pay its bills in the near future.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Any successful company needs to be able to pay its bills. If it cant do that, theres a danger that creditors will take control or shut the company down.

In this video, I look at the 'current ratio', which can help you see whether a company has sufficient resources to pay its bills in the near future.

Transcript

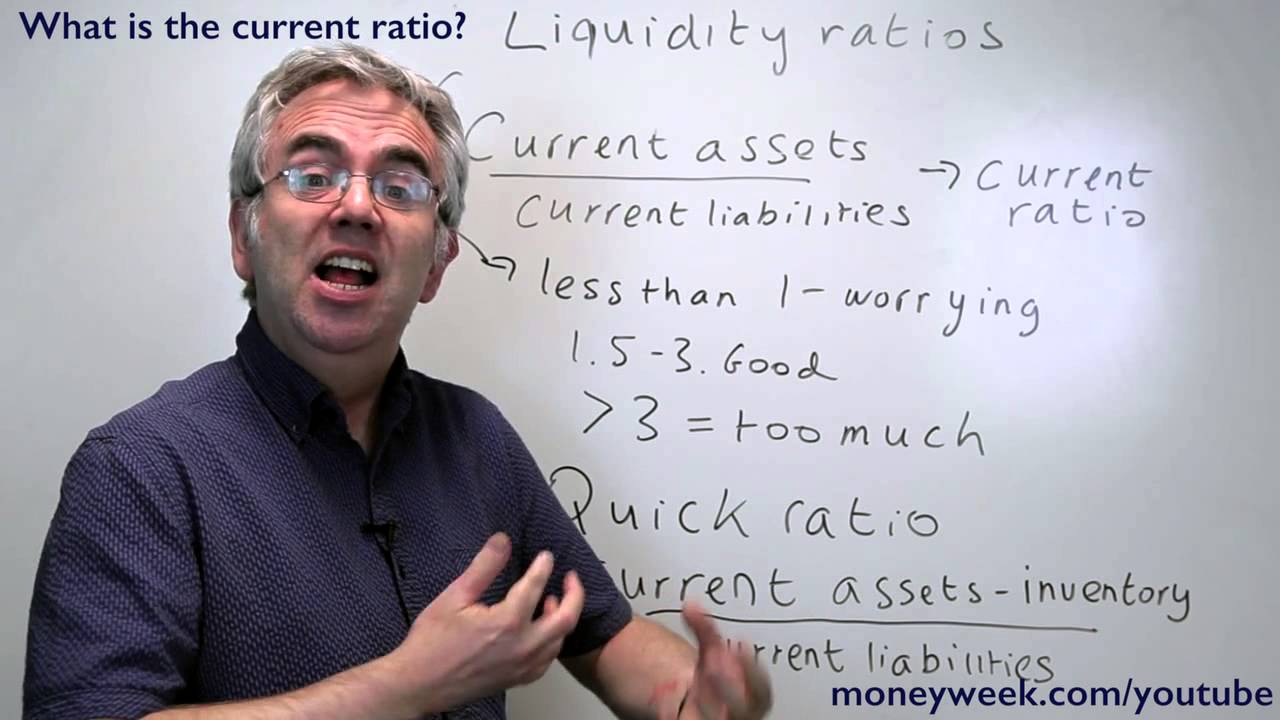

The best known ratio for looking at this kind of liquidity is called the current ratio. So how do we calculate that? We divide the current assets by the current liabilities on the balance sheet.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The current assets are cash that the company has in its bank account. You've got the accounts receivable that's the bills that are going to be paid by the company's customers, money that should come in over the next year. You've also got short-term investments, things like bonds. And you've got stock or inventory that might be in the stockroom out in the back where you've got food or computers or whatever it is that this company is producing.

The current liabilities are the debts that the company will have to pay within the next year. So that's mainly accounts payable, the bills that are going to come in from the suppliers, but it's also a portion of the company's long-term debts that will become due within the next year.

So you get this current ratio, as I say, by dividing current assets by current liabilities. If that ratio is less than one, that's rather worrying the current liabilities are greater than the current assets. And so if all those liabilities came due tomorrow, a company might struggle to pay all these debts.

Now if you see a company with a current ratio less than one, it's worrying, but it's not necessarily a disaster. You shouldn't assume that the company is definitely going to go bankrupt. There are ways that it could get this ratio up from one, potentially quite easily. One thing it can do is to boost up its inventory, start manufacturing more quickly or just get more stuff to sell.

It could also, if it's got good long-term prospects, borrow from another creditor, boost up its borrowings, boost up its cash, and it can get the current ratio up above one. Ideally, though, I think we should look at a current ratio somewhere between one-and-a-half and three. For most companies, that's really the sweet spot.

But whenever you're looking at a company, don't look at that company in isolation. I'd really suggest that you look at current ratios for other companies in that sector. So if this is a supermarket, compare this company's current ratio with other supermarkets. That will give you a better idea of whether this company's liquidity is in a good place or not.

And again, as a rule of thumb, if the current ratio is above three, that's probably too much. It's not a disaster, but it just suggests that the company's got too much cash in the bank or too much stock in the stockroom or potentially both, and that means it's not really sweating its assets for the shareholders.

If it's got too much cash, it should invest that cash in the business trying to make it grow, or alternatively, return some of that cash to shareholders. If it's got too much inventory, well, you know, start selling more of it or start manufacturing a bit less. But, as I say, if it's over three, it's not great but not a disaster. It just suggests that the company is a bit too conservative in the way it manages its assets.

So one more issue we need to look at here. Current assets include, as I said, stocks or inventory. And an issue that you get with inventory is its value today may fall dramatically over the next month or so. This is especially likely if you're looking at things like food, where obviously the value can decline very quickly, or to a lesser extent, to fashion clothing. Fashions can change. And again the value of that inventory can fall quite fast.

So some people say, "Well, the current ratio doesn't really tell you the whole story because it includes inventory, and if it's all down to inventory, suddenly that value could fall and you could go from a current ratio of two, really nice, to a current ratio below one quite quickly."

So the solution to that problem is you look at something called the quick ratio', and here we look at current assets, the cash, the accounts receivable, all the rest of it, but we take out the inventory because that's the one where the value might fall quickly. And then we divide once again current liabilities into current assets minus inventory.

So this is telling us a more rock-hard certain ratio, so you can be even more confident that a company has enough assets to get through the next year. So if the quick ratio is over one, you really don't need to worry because the inventory issue doesn't come into it. There are enough assets excluding inventory to pay those current liabilities.

So I hope that's been useful, a quick overview of these two liquidity ratios. I'm going to come back and look at some more ratios that apply to the balance sheet in the next few weeks so we can get a really good idea of how to measure a company's strength. So I'll be back with another video soon. Until then, good luck with your investing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

By Dan McEvoy Published

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

By Laura Miller Published