What is net gearing?

Ed Bowsher explains what ‘net gearing’ is, and considers whether ‘net debt’ is inherently bad for a company.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If youre analysing a company, its really important that you look at how much debt it has. 'Net gearing' can tell you. In this video I explain what it is.

You might be surprised to learn that a modest amount of debt is often seen as a positive thing for a company, largely because debt can reduce a companys tax bill.

Too much debt is bad news because it means that a company can be very vulnerable if it hits trouble for any reason. However, dont assume that a modest amount of debt is a negative. Debt can reduce a companys tax bill and many large companies have net debt positions for that reason.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Transcript

Now, company debt is really important because if it gets too high, it can become dangerous. If a company is struggling and has too much debt, then it's more vulnerable and more likely to go bust.

Having said that, company debt is not always a bad thing. In fact, some corporate finance theorists argue that company debt in moderation can be positive for a company. Let's look at an example to see why. Let's imagine I'm starting up a new business, say a printing business. I need £10m to get the business up and running. So I raise £10m from investors. And in return for that money, I give investors shares in the company. If things go well, I'll pay dividends to those investors in a few years' time. Alternatively, I could raise some money by getting £7m from investors, and give them shares and potentially dividends, and get £3m from the bank. That's debt. And of course I'll have to pay interest on the debt straight off.

Corporate finance theorists say taking this approach, a mix of equities and debt, is cheaper. That's because if I pay dividends to the investors, those dividends come from the post-tax profits. The interest payments on the debt come from the pre-tax profits. So as a result, it's cheaper this way. Using debt reduces the company's tax bill.

Now, obviously if you have too much debt, it's risky. And actually in a startup, it probably makes sense to raise it purely from equities because it's lower risk. But in a business that's been going for a while, you're much more likely to see this mix of equity, investor's equity, see that mix of equity and debt financing a business.

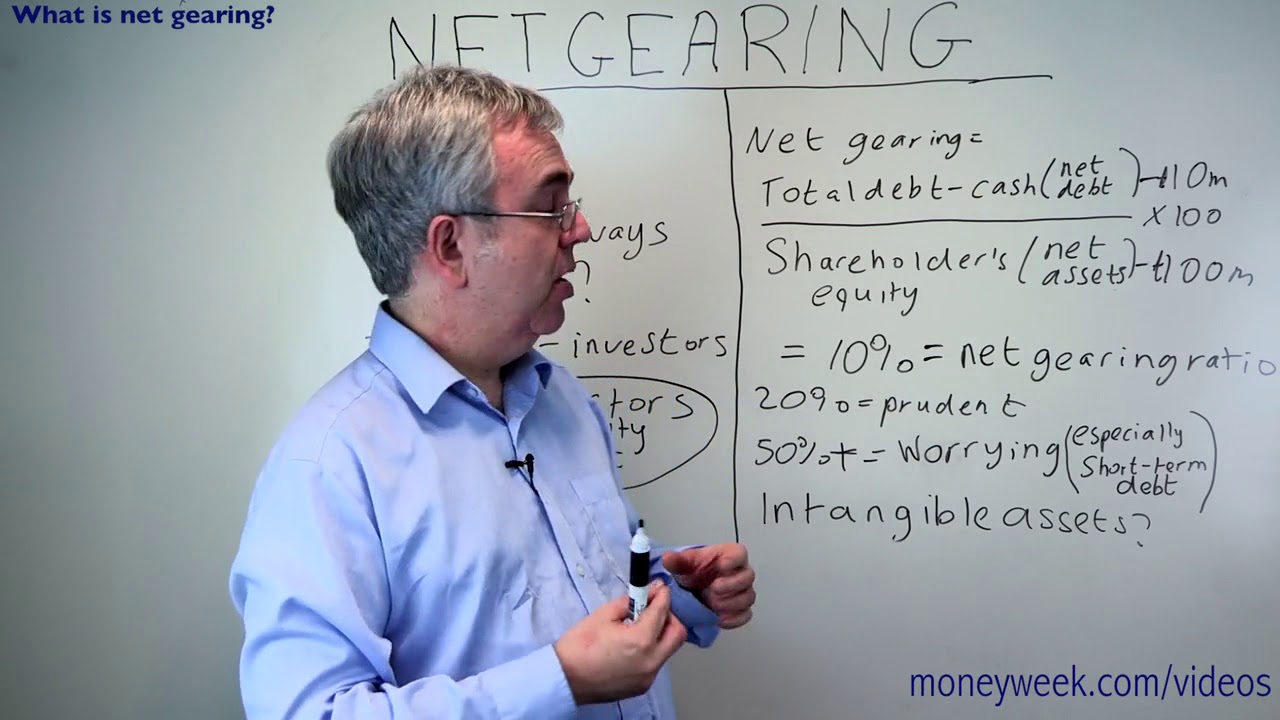

So if we're going to measure the net gearing of the business and see how much is funded by debt and how much by equity, we can use this calculation. On top of the ratio we have total debt minus cash, which is the same thing as net debt. We look briefly at net debt in the video Why you should focus on enterprise value. But you can find total short term debt in current liabilities. You'll find long term debt in long term liabilities. Add those two together, you've got total debt. You'll find cash and total assets or you may even be able to find a net debt figure in the cash flow statement. So that's the top line of the ratio.

On the bottom, you have shareholder's equity, which is the same number as net assets. Now what is that shareholder's equity number? Well in this example with the startup, the shareholder's equity is the £10m that the investors first put in. Or here the £7m.

That equity figure isn't frozen in aspic. It changes by the year. Maybe the company issues more shares, then the shareholder's equity will rise if it gets more money coming in for those shares. Or more likely as the business makes profits, the business won't pay all of the profits out in dividends. The business will keep some of those profits. Perhaps put it in the bank account. Those retained profits in the bank account are then added to shareholder's equity.

So, let's imagine the total debt is £10m. The shareholder's equity is a £100m. We divide ten by 100. Then we times it by 100. And we get a net gearing ration of 10%. That's a low net gearing ratio.

I wouldn't be the slightest bit worried if I saw that with most companies. What it means is it's low risk. But actually the company could save some tax by boosting up the debt and reducing some of the equity.

Now if I saw another company with a 20% net gearing ratio, I'd still consider that prudent. All other things being equal, I wouldn't lose any sleep. If I saw a net gearing ratio of 50% or higher, I'd be getting worried. Especially if a lot of the debt was short-term debt, because obviously if it's short-term debt, it's going to have to be repaid soon. And that's dangerous if a company's in trouble and can't find the money to repay the debt.

Having said that, there's no hard and fast rule on what is an appropriate net gearing ratio. It varies from business to business. It varies from industry to industry. So if you're looking at a company, you see its net gearing ratio of say 35%. You're not sure if that's too much or it's OK. Have a look at some of the other companies in that sector and see what they're doing. And that may give you a better idea whether the net gearing is appropriate or something to fret about.

My last point is some people, when they can't collect the net gearing ratio, take intangible assets out of shareholder's equity. So that's things like the brand and goodwill that may be acquired if a business buys another one.

My view is don't take the intangible assets out. It makes things too complicated; having said that, if you want to dig deep, if the intangible assets are a big percentage of the shareholder's equity, that's a bit of a worry. If that's the scenario, the net gearing ratio should be lower because it'll be harder for the company to pay off debts if it needs too if things go wrong. Banks aren't so impressed by intangible assets. They like good, hard assets.

So that's a quick overview on the net gearing ratio. Hope you'll find it useful. We actually did this video in response to a reader request. So if you can think of another topic you'd like us to do in a video, please let us know. I'll be back with another video soon. So until then, good luck with your investing.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

By Dan McEvoy Published

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

By Laura Miller Published