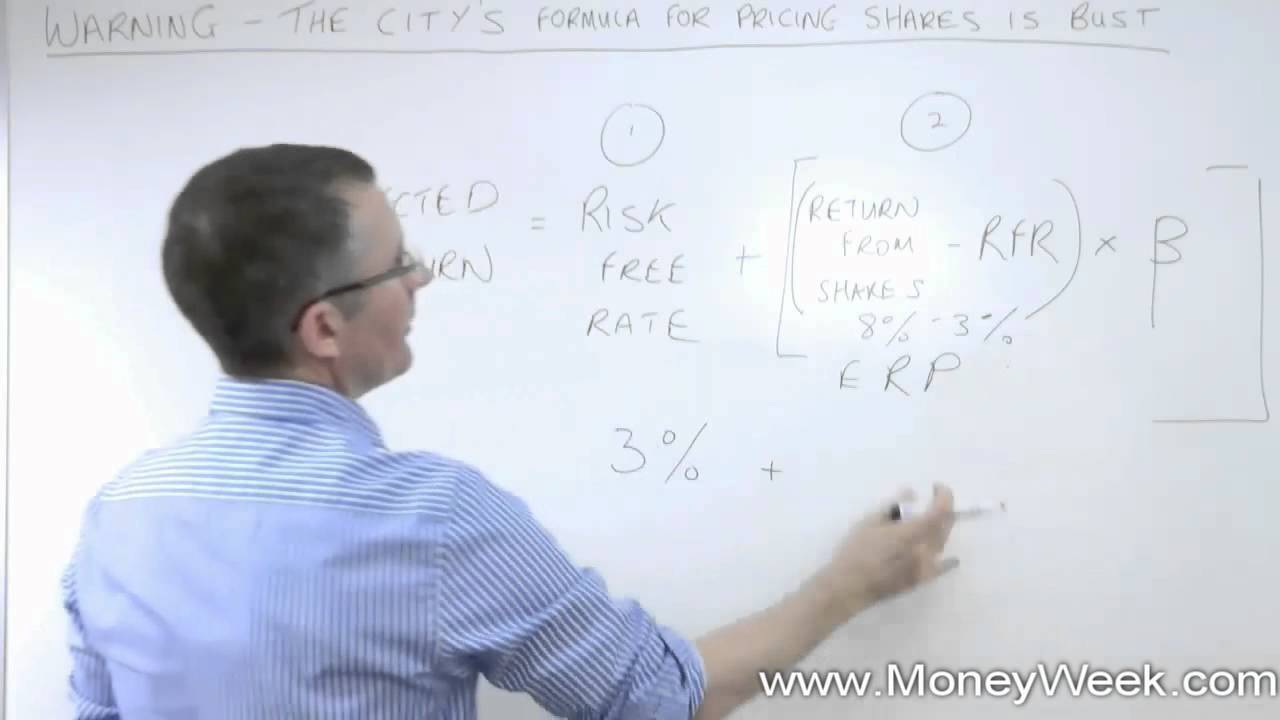

Warning: the City's formula for pricing shares is bust

Tim Bennett explains why the 'capital asset pricing model' (CAPM) - a key tool used to help analysts value shares - doesn't work.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Tim Bennett looks at the 'capital asset pricing model' - or CAPM - a key tool used to help analysts value shares, and explains why it doesn't work.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

By Dan McEvoy Published

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

By Laura Miller Published