What is a swap?

Tim Bennett explains what an interest rate swap is, how it works - and the implications for investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Tim Bennett explains how an interest rate swap works - and the implications for investors.

Entry from MoneyWeek's Financial glossary.

Swaps

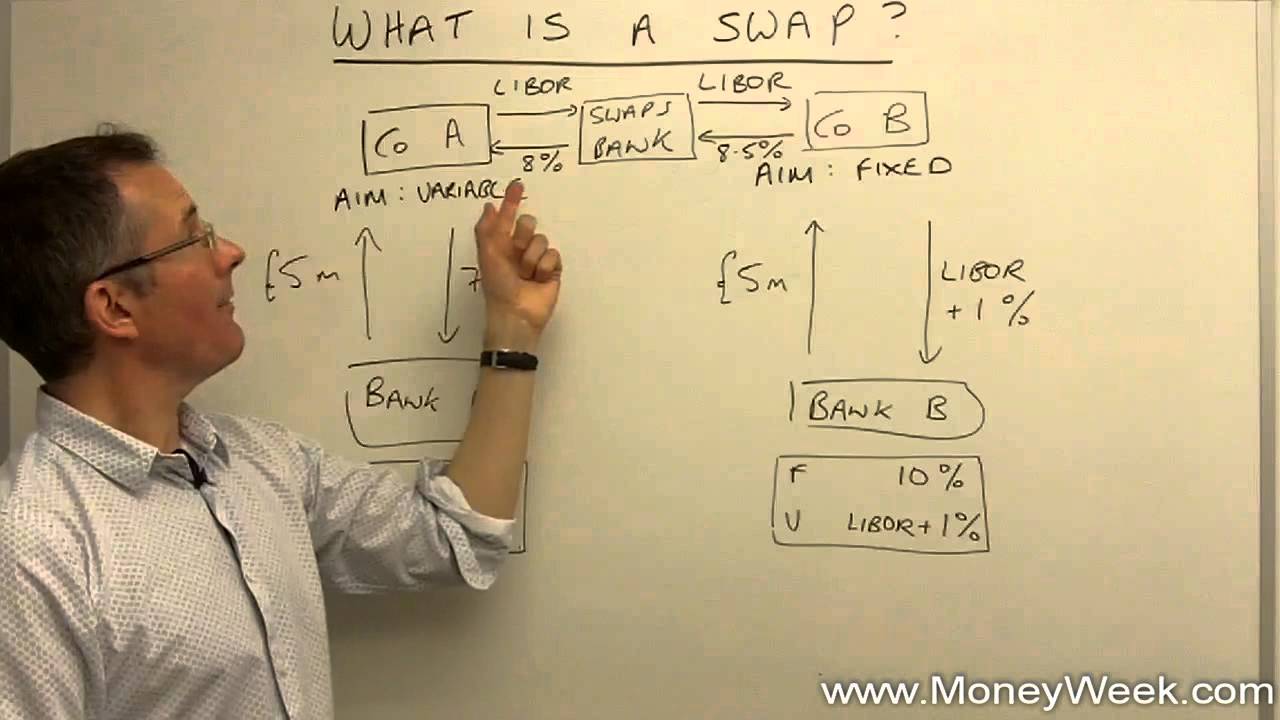

The way a borrower can most easily raise money isn't always best suited to their needs. Imagine two firms need to raise money. Company A might easily be able to raise fixed-interest money, but what it really needs are floating rate funds. The reverse is true for Company B. The solution for them would be an interest rate swap. Company A issues its fixed-interest bond and Company B issues a floating-rate loan.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

They then agree to swap their interest payment liabilities, and so pay one another's interest and end up getting the money in the form they need it at a cheaper rate than if they had borrowed it direct. In practice, rather than finding a direct counterparty for the swap, companies will arrange it with a bank that will either find the counterparty for them or act as counterparty itself. Currency swaps are where Company A wants dollars but can get better trading terms in euros, while the reverse is true for Company B, so they swap so that each ends up with what it needs. With many swaps, both interest payments and currencies are exchanged.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

By David Prosser Published

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

By Dr Matthew Partridge Published