This signals a major drop for the Dow

Even the biggest players can be caught out by big moves in the markets, says John C Burford. But by sticking to your trading methods and watching for sentiment, you can avoid making the same mistakes.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As you know, I rely on the weekly commitments of traders (COT) data from the US Commodity Futures Trading Commission to help me understand how the internal strength or weakness of markets is changing over time. Such information, although reported several days in arrears, adds significantly to the evidence I like to assemble to suggest a trade.

And last Friday's data certainly illustrates a key principle with futures markets that the large non-commercial sector (primarily hedge funds) are mostly trend-followers.

When hedge funds believe they have spotted a trend, they use the momentum to jump on board and in the process, help drive prices their way, as they trade in such large size.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So long as the trends remain intact, they are heroes. But when the trend changes, they can turn to zeroes.

The big players were badly caught out

As it happens, the COT data refers to the situation every Tuesday and that was just prior to the topping process on Wednesday. How very timely!

Thus, we are seeing how the markets were positioned just before the Fed spoke. Remember, markets were generally rising going into the report as the big players guessed the Fed would make no changes to its quantitative easing (QE) agenda, which had been very supportive to markets.

But how wrong they were! The Fed gave the strongest possible hint that they were ready and willing to wind down QE, depending on circumstances.

So let's see how badly the hedge funds were prepared for this change.

The euro set-up

This positive sentiment helped produce the 800-pip rally off the 18 May low of 1.28.

| (Contracts of EUR 125,000) | Row 0 - Cell 1 | Row 0 - Cell 2 | Row 0 - Cell 3 | Open interest: 213,331 | ||||

| Commitments | ||||||||

| 91,304 | 71,274 | 4,883 | 64,586 | 80,432 | 160,773 | 156,589 | 52,558 | 56,742 |

| Changes from 06/11/13 (Change in open interest: -47,087) | ||||||||

| 22,348 | -5,215 | -9,977 | -64,115 | -26,361 | -51,744 | -41,553 | 4,657 | -5,534 |

| Percent of open in terest for each category of traders | ||||||||

| 42.8 | 33.4 | 2.3 | 30.3 | 37.7 | 75.4 | 73.4 | 24.6 | 26.6 |

| Number of traders in each category (Total traders: 165) | ||||||||

| 48 | 50 | 17 | 39 | 42 | 96 | 100 | Row 8 - Cell 7 | Row 8 - Cell 8 |

For the week ending last Tuesday then, the hedge funds piled into the rally by increasing their longs by a massive 20% - and reduced their shorts by 7% - for a net swing to the bullish side of almost 30% on the week.

And the small traders weren't left behind with a big net swing to the bull side.

I guess they were not aware of what was going on in the gold pit. The sinking gold price should be negative for currencies against the dollar. And that divergence was another clue that the euro was primed for a fall.

And since Wednesday, the EUR/USD has lost 300 pips. I call that very poor timing by the hedgies! It only proves that the best brains in the business can get it very wrong and also proves that, armed with the COT data, a small trader can beat the big boys, provided you use a solid trading method.

How tops are formed

The fuel for the decline is the massed army of longs who are getting stopped out of their losing trades.

They were wrong about the S&P too

COT data for the S&P 500 futures market

Prior to the Fed report, the consensus was for the Fed to continue to support equities in the status quo. They were hoping the report would vindicate their bullish position. After all, many have been calling this the start of a 'great bull market', as the 'great rotation' out of bonds would occur.

So let's see how the players were aligned last Tuesday:

| ($50 x S&P 500 index) | Row 0 - Cell 1 | Row 0 - Cell 2 | Row 0 - Cell 3 | Open interest: 3,746,507 | ||||

| Commitments | ||||||||

| 481,489 | 364,545 | 165,241 | 2,678,557 | 2,883,626 | 3,325,287 | 3,413,412 | 421,220 | 333,095 |

| Changes from 06/11/13 (Change in open interest: 349,100) | ||||||||

| 24,918 | 22,796 | 18,793 | 218,141 | 303,750 | 261,852 | 345,339 | 87,248 | 3,761 |

| Percent of open in terest for each category of traders | ||||||||

| 12.9 | 9.7 | 4.4 | 71.5 | 77.0 | 88.8 | 91.1 | 11.2 | 8.9 |

| Number of traders in each category (Total traders: 545) | ||||||||

| 117 | 97 | 76 | 232 | 241 | 385 | 380 | Row 8 - Cell 7 | Row 8 - Cell 8 |

The hedgies increased both their long and short bets, but look at what the small specs were up to. They added mightily to their long positions by a whopping 26%.

Thus, they went into the report with a 26% increase in longs for the week.

Again, this is a likely prelude to a major disappointment, especially since it was the small specs who were betting big. These are the weakest hands, remember.

Markets exist to disappoint the majority, especially if they are small specs.

Eight-to-one longs on the Nasdaq

| Nasdaq 100 stock index x $20 | Row 0 - Cell 1 | Row 0 - Cell 2 | Row 0 - Cell 3 | Open interest: 457,197 | ||||

| Commitments | ||||||||

| 117,095 | 15,008 | 11,250 | 293,539 | 406,753 | 421,884 | 433,011 | 35,313 | 24,186 |

| Changes from 06/11/13 (Change in open interest: 67,952) | ||||||||

| 10,287 | 4,765 | 7,321 | 45,950 | 59,330 | 63,558 | 71,416 | 4,394 | -3,464 |

| Percent of open in terest for each category of traders | ||||||||

| 25.6 | 3.3 | 2.5 | 64.2 | 89.0 | 92.3 | 94.7 | 7.7 | 5.3 |

| Number of traders in each category (Total traders: 211) | ||||||||

| 72 | 17 | 20 | 81 | 72 | 161 | 102 | Row 8 - Cell 7 | Row 8 - Cell 8 |

Just admire the ratio of hedge fund longs to shorts it is almost eight-to-one. That is a lop-sided ship! And both spec groups increased their long bets just prior to the Fed report.

Again, this is a set-up ripe for a major disappointment.

These are just three major markets that are giving a strong signal that if last week did see a genuine major turn, the decline should be fast and furious, since so many spec longs jumped on board recently, newly-converted to the bullish cause.

Has the Dow turned?

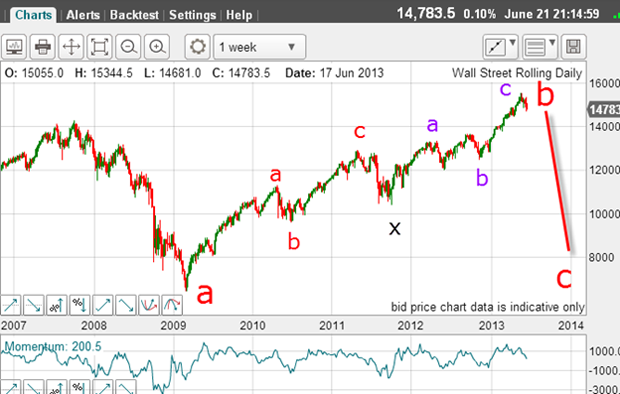

If these labels are correct, this C wave down which is a third wave and therefore long and strong will take no prisoners.

Many will try the old trick of buying the dips, which has worked so well up to now. But C waves can be relentless just observe the two C waves on the way up from the 2009 low in the large b wave. The dips along these two C waves were relatively minor.

But this C wave is of greater magnitude than those two, and should pack a much greater punch.

The second half of 2013 is shaping up to be very exciting.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI will change our world in more ways than we can imagine'

'AI will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China