The sure-fire investment rule for our times

Central banks have had a massive effect on the markets. John C Burford explains the one investment rule all traders should follow to profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

With the US stock market indexes at recent all-time highs (except for the Nasdaq), and with most other global markets falling way short of their all-time highs, that is a wide divergence that I believe all investors should take on board.

Stocks have been the main beneficiaries of central bank money printing and rock bottom interest rates, from the Federal Reserve to the Bank of England, European Central Bank (to some extent), and of course the champ of all asset bubble-blowers, the Bank of Japan.

China has had its own brand of financial 'accommodation' that has led to mega-cities with no-one living in them and huge shopping malls with no stores open. The term 'mal-investment' that the Austrian school economist, Ludwig von Mises, popularised must have been coined for such ventures.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The rule for our times

The central theme behind this simple-minded rule is this: central banks will just not allow stock to fall. If they start a slide, the authorities will prescribe (or threaten) more QE medicine and the patient will recover. Job done. Risk has been eliminated and you can short all rallies in the Vix (fear index) till the cows come home.

And this has worked like a charm for six years. Now six years is an infinite time for algo-traders who race each other to shorten the picosecond (that is 10-12 second) delays in firing their orders into the market (and pulling most of them) in the new black art of high frequency trading.

The point is this: after six years, these algo-traders and their masters, who dominate exchange trading, have been lulled into total complacency. The sentiment readings have confirmed that.

Euphoria and madness

Chart courtesy www.elliottwave.com

At no time during 2014 was this sentiment index (bulls/bulls + bears) less than about 73% - even during the very large dip in September/October of about 10%. Yes sir, the Fed has that big bazooka cocked and ready to fire! Or so the thinking goes.

But many money managers do understand their dilemma. They have been forced to ride the rally (to keep their jobs), but know in their heart of hearts that it will all come crashing down one day when the little dog Toto pulls the screen to reveal the Wizard of Oz as a mortal being. That is when faith in the central banks will have reached its zenith and the market will suddenly realise that the over-injection of the quantitative easing (QE) medicine will be seen to be doing more harm than good.

But by then it will be too late the mountains of debt will be too large to ignore. Then, everyone will be running for the exits at the same time to lock in gains. While leverage is good in healthy rising markets, it is disastrous when they reverse. Remember, it is better to be a few months too early than a few weeks too late.

One recent fact caught my eye: almost 100% of S&P 500 earnings during 2014 has gone towards dividends and share buy-backs. Is this a healthy situation?

When will the inflexion point arrive?

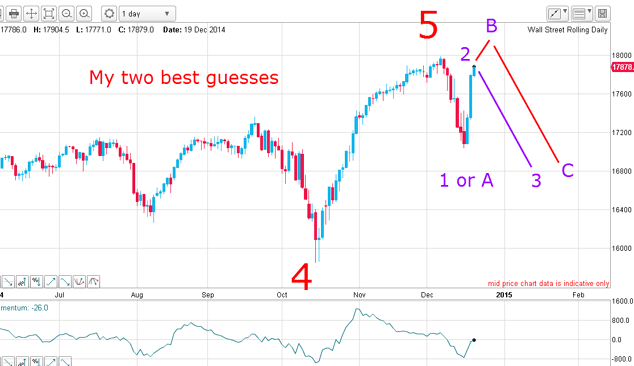

In my postof 19 December, I had this as my best guess for my near-term roadmap of the Dow 1,2,3 or A, B, C:

In my view, the two options had a 50/50 chance of working out. Either the market would turn down directly in w3, or it would make a new high in a B wave and then turn down hard in a C wave, which would be strong as is typical for these waves.

This is the hourly chart of the S&P 500 as of 31 December:

In fact the S&P did make new high, but on the last trading day of the year and in the final hours of trading, the market broke in a cascade of selling.

That is helping confirm my original Elliott wave labels that I have been working all the way from the 2009 low.

Here is the daily chart showing my superb tramlines and complete five up count:

If the market did make its final high on 30 December (26 December in the Dow), the way is clear for a solid third wave down and towards my first target at the lower tramline in the 1,850 1,900 area (16,000 16,500 in the Dow).

The critical point about this chart is that the upper tramline is a three-and-a-half-year line of resistance. At no time has the market penetrated it while in its solid rally phase. The market has respected it every time it has approached the line.

Here is the updated S&P hourly chart:

The market moved down to hit the Fibonacci 38% support on Friday and that completed a five down. This places the odds very high that the December top will not be challenged.

If Friday's low is wave 5, the market should rally early in the week and then begin a more concerted down move to the Fibonacci 62% support level in the 2,020 area.

But if the market is weak early on, the fifth wave hasn't completed and its low will be under Friday's low.

Already, I have drawn tentative tramlines that sport several accurate touch points and a prior pivot point (PPP):

The ideal short entry point was the break of the wave 1 low during wave 3.

Because of the critical juncture I believe stocks are in, I shall be following the stock indexes very closely this year. The story will be exciting!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.