My two big trades for 2015

Spread betting guru John C Burford goes through his two big trades for the coming year - US T-bonds and the dollar.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I have great news we are opening up to new members my Trade for Profit Academy early in the New Year! Be sure to look out for it and make a New Year's resolution to become a truly disciplined trader and take a shortcut to your goal.

US Treasuries will decline

Obviously, the no-brainer trade was going to be short Treasuries, banking on rising yields.

But a funny thing happened on the way to those rising yields the market defied common sense and continued its bear trend in yields into 2014. In fact, 2 January marked a major high in yields and the trend didn't stop until October.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That caught many prominent pundits as well as major bond funds who had bet the wrong way with either egg on their faces or major losses.

In fact, that 2 January high in yields was the end of the final fifth wave up from the 2012 lows. Not only that, but the DSI (Daily Sentiment Index) bullish readings were plumbing depths rarely before encountered well under 10% bulls for several months. Almost everyone hated those bonds!

So the scene was set early in the year for a massive surprise to the majority. I happened to recognise this technical picture and began a campaign of trading Treasuries from the long side, looking for yields to decline. It was my perfect contrary trade.

My scenario for 2014 was this: the market's lack of concern over deflation and with world economies slowing as reflected in declining commodity prices I believed consumer prices would fall in 2014, especially in Europe. This would force bond prices higher and yields lower.

And any bonus would come if stock markets took fright during the year (a most likely event) and drive investors into the safety of Treasuries. In fact, this did occur in late January, July and October.

So where are we as 2015 approaches?

My forecast for Treasuries

Naturally, this is a red-rag-to-a-bull moment for me and is setting me off looking for the contrary trade.

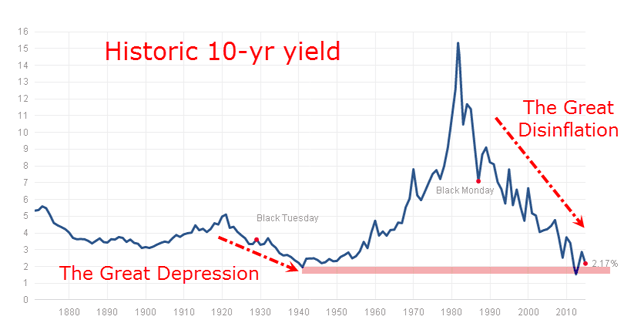

Now, let me examine the technical picture. Here is the chart of the ten-year Treasury yield going back to before the Great Depression:

Quite a mountain, isn't it? From WWII, rates established an uptrend as consumer credit expanded and consumer price inflation became a constant theme in the 1970s especially. This culminated in the early 1980s in the almost hyper-inflationary peak with over 15% yields.

But that was the top, and since then, rates have been in a massive bear trend for over 30 years as disinflation became the major theme. Then, in 2012, an all-time low in yields was achieved, but that was a major support level created from the Great Depression lows.

My conclusion: in the long-term picture, yields have reached major support. The trend will now be up.

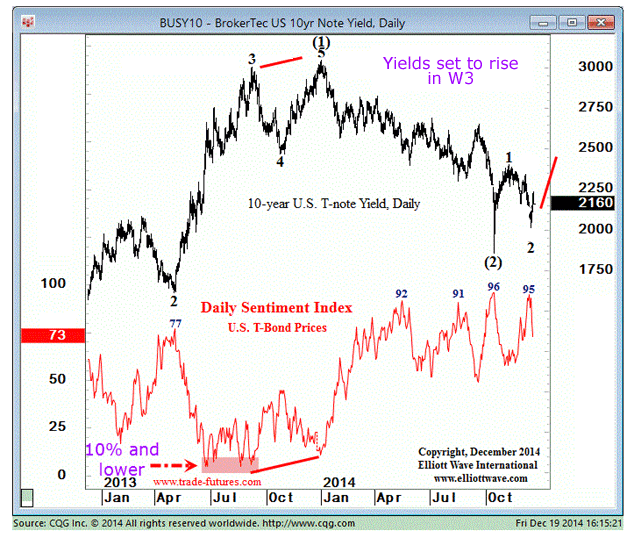

To confirm this scenario, I need to look at the shorter-term picture:

Chart courtesy www.elliottwave.com

The 2 January 2014 top was well flagged by the sentiment divergence (red bars). The October plunge in yields was the final bottom in the large wave 2 down and since then, we have waves 1 and 2.

If this labelling is correct, we are currently in a third of a third up. This is the most powerful pattern in the Elliott wavebook, suggesting huge rallies in yields in 2015.

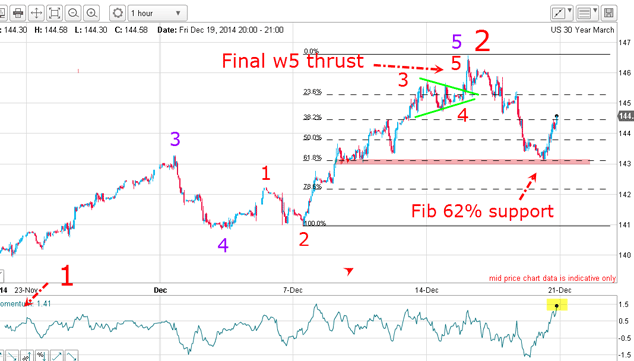

Let's take a look at the hourly chart of the March T-Bond (30-year):

If these labels are correct, the market is on the verge of a huge decline. The key level is the 146.50 high. If this level is exceeded, that would negate all of my labels. But with the hourly momentumoverstretched, the most likely path is down.

- My first trade for 2015 short US Treasuries.

My second trade for 2015 the US dollar

But that is tempered by my belief that today, it is in grave danger of suffering a massive correction. My proxy for the dollar is the inverse EUR/USD trade.

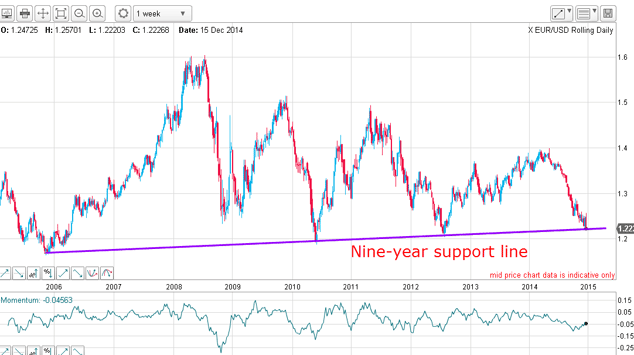

This is the update of the long-range chart I have shown recently:

The market is at the 1.22 level, which is right on the nine-year support line and my target when the market was trading at the 1.40 level earlier this year.

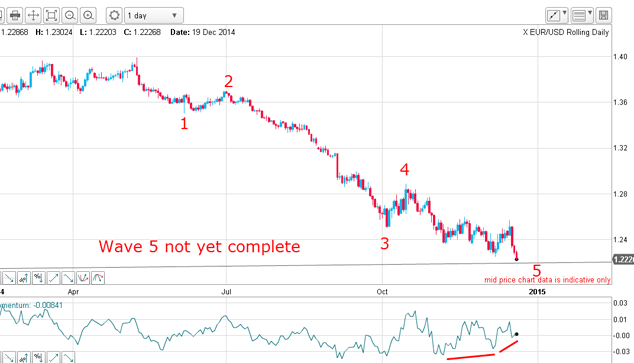

Here is the close-up of the waves off the 1.40 high:

Last week saw a resumption of the fifth wave, but the end is nigh! Take a look at the massive potential positive momentum divergence.This strongly suggests that when the fifth wave low is in, the move up will be very sharp.

Also, sentiment towards the dollar is still very bullish. This makes sense in that many overseas investors want to escape from their own currency turmoil in the petro-currencies.

- My second trade for 2015 first short dollar, then long dollar.

What to watch out for?

If this occurs, I expect gold and silver to catch a bid and rally through my first gold target at $1,250 and towards $1,300.

Ironically, an oil price recovery would send stocks lower with the dollar. And wouldn't it also be ironic that exactly one year later in the first week of January, Treasuries could make a major turn down?

This is my final Trader email for this year. I want to wish all of my readers a Merry Christmas and a most prosperous New Year! Next year promises to offer some fabulous trading opportunities. But remember, stay disciplined!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn