It’ll be an explosive weekend for the euro – but my outlook is bullish

Most people believe 'Grexit' would be bearish for the euro. John C Burford disagrees, and looks to the charts for clues.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In the USA, markets are closed today for Independence Day celebrations. The occasion is observed every year with lavish fireworks displays all over the nation. And by an exquisite coincidence, the Greek referendum this weekend promises its own brand of fireworks in the eurozone.

All eyes will be on the result of this particular vote, and most market observers expect a violent reaction either way when markets open on Sunday night. This weekend, there will be explosive displays globally.

And what a way to mark the historic war which is currently taking place in the financial markets the war between the inflation of debt and its deflation.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In recent years, the global economies (and private households) have been sustained on ever-larger debt obligations. Interest rates have been pushed to the floor by central bank policies, making the debt seem 'affordable'.

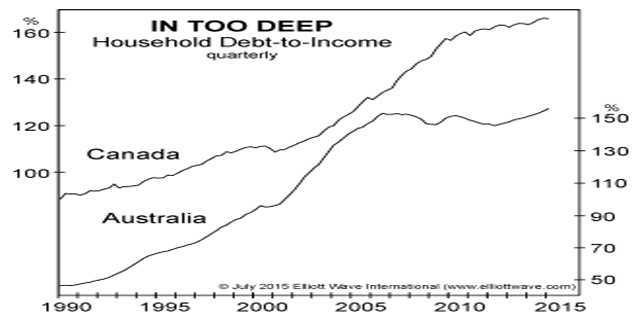

Below is a revealing chart showing the massive growth in household debt in Australia and Canada. Both countries have experienced massive housing price bubbles with prices rising fast while incomes have remained stagnant. Debt has exploded.

Chart courtesy elliottwave.com

The law of financial gravity may be about to kick in

Maybe this weekend will be that moment no-one can say with certainty. But it would certainly be a fitting moment for the law of financial gravity to finally swing into play after years of suspension in a make-believe debt bubble.

Whatever the outcome of the Greek referendum, the nation is bankrupt. The basic question is this: does Germany want to throw even more good euros after bad, knowing that repayment would be virtually impossible?

That issue is the microcosm of the larger question of the inflation/deflation battle. If we are really on the cusp of a deflationary phase, then asset prices that have been elevated by debt are extremely vulnerable.

We are already seeing that in the collapsing Shanghai stockmarket index another market that has been pumped up by enormous levels of margin debt. Panic selling has sent the index down 5% overnight, within 30 minutes of opening.

So my next question is this: is Shanghai a foretaste of things to come closer to home?

Previous market jitters have been met by more central bank 'support', but with the US and UK opposed to further QE and rates at rock bottom, they may have run out of ammo. And even if banks do rush new rounds of QE in a panic reaction, it won't necessarily stem the tide of selling. Has the Buy the Dip' brigade finally met its match?

Once social mood switches from bullish to bearish a process that is taking several years nothing will stop the purge of over-leveraged positions.

That's when the fireworks will look more like a hydrogen bomb. And that's when cash will be king once more.

Grexit' is bullish for the euro

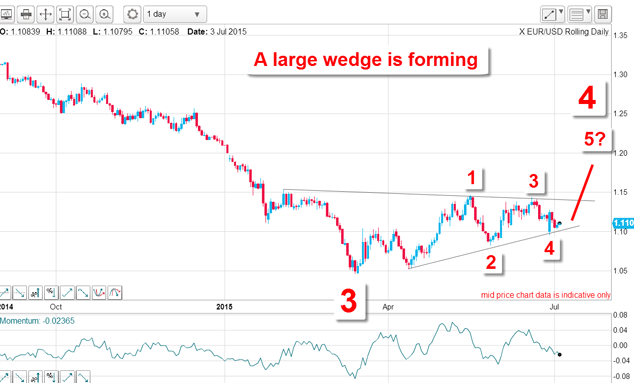

But what do the charts offer as clues? Here is the daily chart:

The long and strong bear move to the March low was my wave 3, and since then, the market has been in rally mode in a complex wave 4 (which I warned against back in March).

But note the lovely wedge pattern now forming with my clear Elliott wave pattern within. A textbook wedge has these five waves (not to be confused with a motive' five wave pattern) with the fifth wave breaking out as shown. The key to this scenario is a break of the upper wedge line that is the level to watch.

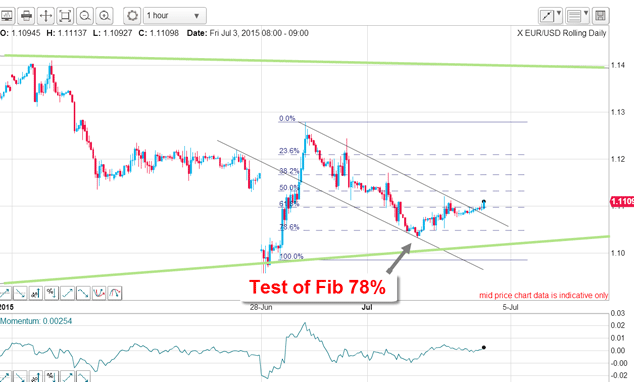

Below is the current hourly chart:

Following the knee-jerk reaction to the Greece referendum news on Monday morning, the market gapped down. But cooler heads prevailed and the market rallied strongly (off my wedge line) before settling down again. The tug-of-war was on.

But this week's decline was another test of my wedge line (green) and held at the Fibonacci 78% before staging its current rally phase. I have tentative tramlines drawn and this morning the market has pushed up past the upper tramline. This is all potentially bullish action and is helping to confirm my bullish outlook.

Finally, bullish sentiment towards the euro is low. This is reflected in the latest Commitments of Traders (COT) data.

| CONTRACTS OF €125,000 | Open interest: 345,427 | |||||||

| Commitments | ||||||||

| 67,867 | 167,173 | 5,022 | 233,162 | 101,253 | 306,051 | 273,448 | 39,376 | 71,979 |

| Changes from 16/06/15 (Change in open interest: -4,718) | ||||||||

| -14,847 | -4,898 | 531 | 7,350 | -1,588 | -6,966 | -5,955 | -2,248 | -1,237 |

| Percent of open interest for each category of traders | ||||||||

| 19.6 | 48.4 | 1.5 | 67.5 | 29.3 | 88.6 | 79.2 | 11.4 | 20.8 |

| Number of traders in each category (Total traders: 238) | ||||||||

| 61 | 87 | 30 | 52 | 62 | 127 | 166 | Row 8 - Cell 7 | Row 8 - Cell 8 |

The speculative money is still lined up massively on the short side, and interestingly, the commercials (smart money) actually swung to a more bullish stance in the most recent week.

I am sure I will have some interesting developments to discuss in next Monday's article.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.