Is this the start of a big downward correction?

Few traders are taking the recent stock-market dip seriously, says John C Burford. Things may be about to get interesting.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The sharp decline off last Friday's all-time Dow high at 16,650 stretched to about 450 points on Tuesday, hitting a low of 16,200. And that leaves me wondering if this is the start of a big downward correction.

Because I believe that market swings are generated not by the fundamentals (or news), but by the traders' emotional responses to factors, which include the news, it is essential to try to assess the reaction of traders to this latest decline.

After all, a bull on Friday morning is likely to have experienced at least a glimmer of doubt about remaining a committed bull on Tuesday. In other words, the action of the market determines how we feel towards it.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A constantly rising market, such as we have seen over most of the past five years, had convinced the majority that it is worth investing in equities. At the major low on 6 March 2009, the very same people would undoubtedly have advised selling shares as they appeared doomed.

Remember, markets make opinions.

Markets crash when everyone expects them not to

Here is a typical quote: "Although we are overdue for a major correction, I don't think that this is the 'big one' - that cataclysmic crash that everyone is waiting for. In fact, it is just that reason, that so many people are expecting a crash, that it will not happen this time. Very simply, markets don't crash when everyone expects them to".

This is an insightful comment, except for one thing. Nowhere have I seen mention of a major crash ahead being forecast by anyone (except for one or two commentators that I follow who rarely appear in the media).

In fact, my impression is that everyone is expecting business to get back to normal following this dip. They're telling you to buy it, as you have done with great success for the last five years. Just yesterday, I read one prominent guru picking four tech stocks to buy that have crashed by 20% or more! The tech sector has led the charge lower this week.

To paraphrase the above author: Very simply, markets crash when everyone expects them not to!

This confusion is typical, especially at the end of a major market move. Many are saying that sentiment is bullish and others say it is bearish.

The confidence expressed in the above quote relies on the US corporate earnings, which are universally expected to be great and propel the market back up. And that is the conventional view of how stock markets work: Higher earnings = higher stock prices.

But history does not support this iron-clad relationship at all times. It really depends on the context.

The moment of truth

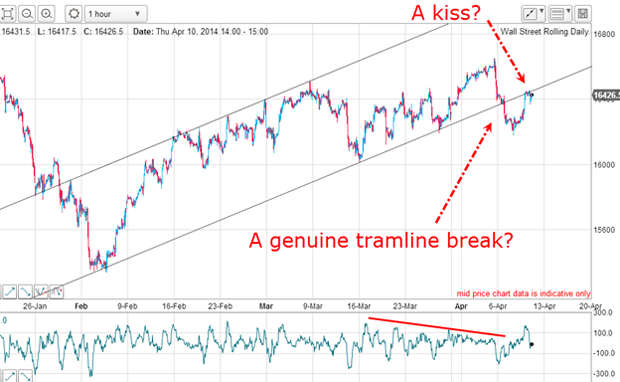

My beat is the technical analysis of the markets. So let's see what the charts are saying. Here is the hourly Dow:

This is the latest rally and I have an excellent tramline pair working. Last Friday's high was confirmed by the large negative-momentum divergence (red bar). On Monday, the market made a sharp break of my lower tramline and has spent the rest of the week rallying to the underside of the line in a traditional kiss.

This is always the moment of truth!

Will the market slice through the resistance provided by the tramline, or will it engage in a scalded cat bounce down? There is no way we can say at this stage.

The key to making a low-risk trade

The point of this style of trading is that you are not making assumptions about the market direction. Experience says that a tramline break is important and a kiss is an opportunity to test the short side.

If the kiss is brushed off and the market rallies, then I suffer a small loss. But if the kiss is genuine, then we are off to the races. If this works out, then I can start to place Elliott wave labels:

The decline in January is in five waves and the rally is a clear A-B-C, which is counter-trend.

This week's low is my wave 1 down and the rally is my wave 2. If this is correct, then we are at the start of a wave 3 down.

What could spoil this picture? A solid move back inside the trading channel would do that and I would then be forced to go back to my drawing board.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King