Is day trading profitable?

John C Burford illustrates how a disciplined day trader could use his simple spread betting techniques to make excellent profits

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

During yesterday's lively conference call for those who purchased my Workshop DVD set, an interesting question came up: can a trader make money by day trading?

My rather glib answer was: the good ones do!

As you know, my trader emails are concerned primarily with swing trading and how you can capture many the great swings that appear in the large markets over days and weeks.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I have avoided mentioning day trading in these emails, where you necessarily must work with much shorter timeframe charts, where sharp moves often occur within minutes.

But as a fun exercise, while I was live on the conference call, I pulled up the one-minute chart of the EUR/USD to demonstrate that a day trader could use my simple methods quite successfully with no additional input.

Of course, I had no idea that the market at that precise time would present me with a superb example of how to use basic Elliott wave theory https://www.moneyweek.com/spread-betting/spread-betting-glossary-00002.aspx#EWT to make a low risk/high reward trade!

Day trading with Elliot waves

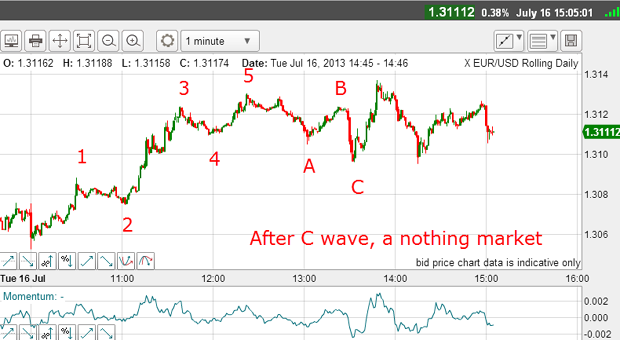

I spotted the major low point at 10.00 am and right away, I could quickly recognise the first move up was a likely wave 1 of a possible five-wave pattern. The dip from there into 11:00 am was a likely wave 2, and when the market rallied strongly from there to move above the wave 1 high, it had all the hallmarks of a wave 3 in progress.

So a good trade would have been to place a buy-stop, to enter just above the wave 1 high in the 1.3090 area. Then, a protective stop around 1.3080 for a ten-pip risk (this is a typical risk level for expert day trading).

What are the primary characteristics of a third wave?

Third waves are long and strong. They produce extremes in momentum (indicating powerful buying/selling with little resistance to the buying/selling), and they carry on for a big price move, compared with wave 1.

You can see that this is indeed the case for this wave 3 move.

From the wave 3 high just after 11:30, the market declined into wave 4 in a clear A-B-C pattern.

Remember, after a thrust up, the most common corrective pattern is in three waves.

Following the wave 4 low, the market moved up into new high ground above the wave 3 high on weakening momentum, thereby indicating that the rally was running out of steam.

That was the place to take profits on the long trade at the 1.3125 area for a tidy profit of 35 pips on a ten-pip risk. The trade took about 1 hours to play out. That is a classic day trade.

But is there more?

What should you expect to see following a genuine five-wave impulse move, such as we have? (Remember, fifth waves are ending waves and indicate the next move is against the trend.)

Yes, an A-B-C correction in three waves!

Did we actually see that?

Yes we certainly did with the C wave low hitting the Fibonacci 38% correction (with a slight overshoot, which is common on one-minute charts).

So there was another trade buying near the C wave low with a protective stop placed just below the 50% level for a maximum 15 pip risk.

Now here is the chart as I write at 3:00 pm on Tuesday:

Let's say I am long from 1.3005 near the C wave low expecting a continuation of the rally. The market has rallied into new high ground, but is coming off. You are concerned with keeping much of your gain so far.

What do I do?

Do I just cut and run near 1.3120, or do I hold and hope the market finds its feet and maintains its rally (a forlorn hope on this one-minute chart!)?

There are no hard and fast rules here, and each trader will have to find the best answer for themselves. If we are of a more nervous disposition, we will probably cut and run it all depends on our character.

But what we should not do is sit by and watch the market move below our entry. So a good policy would be to enter a stop loss at our entry, for a breakeven trade at worst.

So now I have made two trades in the day one a winner, and another at breakeven or better.

The most reliable trading method

And all I have done is use basic Elliott wave ideas and a Fibonacci level to decide my trades.

I have not used my tramline method, either. I find that it is rare to find solid tramlines on the one-minute chart. There are so many overshoots that finding touch points is problematic.

In fact, this little example beautifully illustrates how a trader can make excellent profits by only trading third waves!

As we now know, third waves give the most reliable trending moves and the moves are very often large enough to provide a great risk/reward ratio, as in this example.

Here is another example on the one-minute gold chart from last Thursday:

There are two possible long entries (pink bars) and there is a nice big negative momentum divergence (on the five-minute chart) at the wave 5 high. These trades could have netted 400 and 300 pips each in less than three hours, both at low risk. Of course, you had to be up early to take it!

I hope this gives you a flavoUr of what is possible by day trading my methods. If attracted to day trading, the key is to keep it simple, and exercise absolute discipline in your analysis and execution. This is not a game for those who shoot from the hip!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.