How I took a major profit from the Dow yesterday

Despite the incredibly fast-moving and volatile markets, precise Fibonacci ratios are still being observed, says John C Burford. Which is great news for traders.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Stockmarkets are at a critical juncture. If they don't start a counter-trend rally soon, more severe declines lie ahead. But I have a clue that such a rally is imminent (see later).

I am hardly the first to comment that stockmarkets have been exceptionally volatile in recent days.

For instance, on Wednesday the Dow moved by 580 points and the FTSE by 257 points with big intraday swings.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But despite such incredibly fast markets, precise Fibonacci ratios are still being scrupulously observed in separate markets and as you know, Mr Fibonacci is one of my best trading friends.

The Dow is a US-based index and the FTSE a UK-based one. On the face of it, they should have their own distinct characters.

And if the stockmarkets follow the economy (as so many believe), then the UK market (whose economy is allegedly one of the best performing among the OECD) should be relatively buoyant. But the US economy is considered to be lagging, and so the stockmarket should be relatively weak.

But almost on a tick-by-tick short-term basis, they are in total lock-step. How can that be? Even the pundits have noticed: at the Davos shindig, the IMF's deputy director warned that "asset markets have become dangerously correlated", and that liquidity (which supports them) could dry up.

He added: "If everybody is moving together, we don't have liquidity at all. We have to be ready to act very fast."

That is what happens when everybody tries to escape the burning theatre at the same time plenty of panicked sellers but few buyers.

But note his last sentence is that a warning that central banks are girding for another massive dose of quantitative easing (QE) as ECB boss Mario Draghi indeed hinted? If that rumour got around, we shall see a major snap-back share rally, be assured.

If more QE (or even negative interest rates or "helicopter money") is advocated, this will follow the age-old central bank practice that if a massive dose of medicine doesn't help the patient, even more is sure to be the answer. Naturally, this will not end well, and some of my MoneyWeek colleagues have set out ideas to help you protect your wealth. Tim Price has won awards for his defensive investing nous, and his newsletters are well worth reading if you're worried about the future of the markets.

Correlation is not just a long-term phenomenon

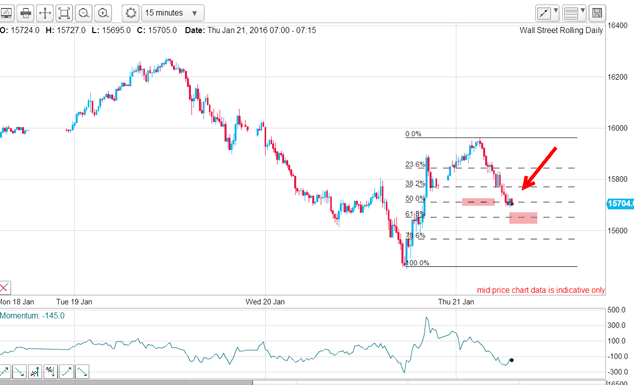

Here is the 15-minute chart of the Dow I took yesterday morning at 7:00 am:

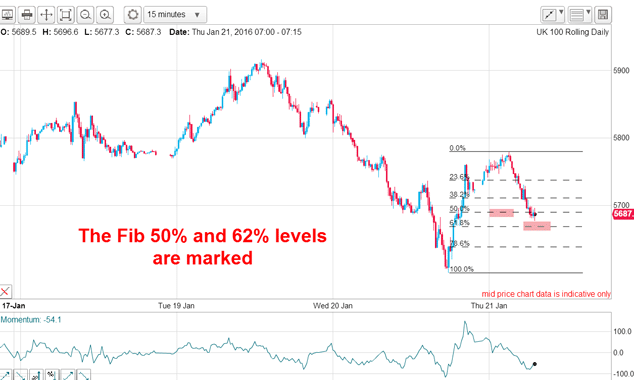

The chart patterns are virtually identical but why is this? Surely, if stock markets follow the general economy of the country, that cannot be.

I have marked the Fibonacci 50% and 62% retraces of the previous wave areas where I always look for possible turn-arounds with the 62% level being my top choice.

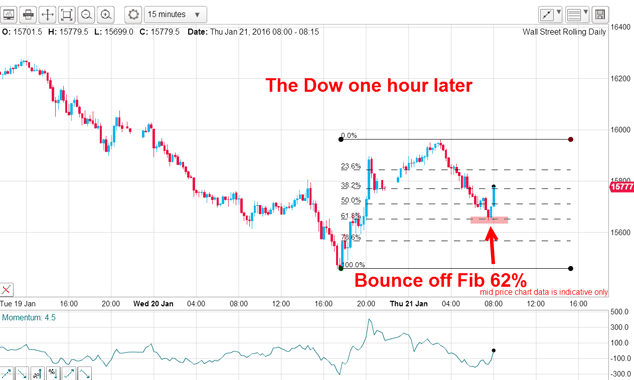

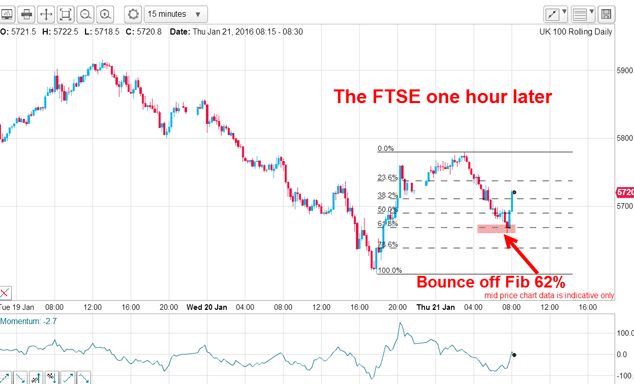

And here are the same charts one hour later:

It is as if they are joined at the hip which they are of course (from the same pool of liquidity).

Note that both markets turned at precise hits on their Fibonacci 62% levels. Isn't that pretty?

I took partial profits here for a 200-pip profit. Since I was using my split bet strategy', I was still holding partial long position with the stop moved to break even with a guaranteed profit of at least 200 pips, and possibly more if the Dow moves higher.

Here are the results as of 6:00 pm (you can check the trade times are genuine from the date line on top left of charts; I took them all in real time):

Now the market has poked above the old high at 6:00 pm and is a great place to take a final profit of about 400 pips for a total profit of 600 pips for a terrific day trade.

This type of trading is totally independent of any macro-economic considerations. You do not need to figure out the meaning of all the data and pundits' pronouncements. I am only trying to find the path of least resistance in the immediate future. That is the essence of swing trading even on this small scale.

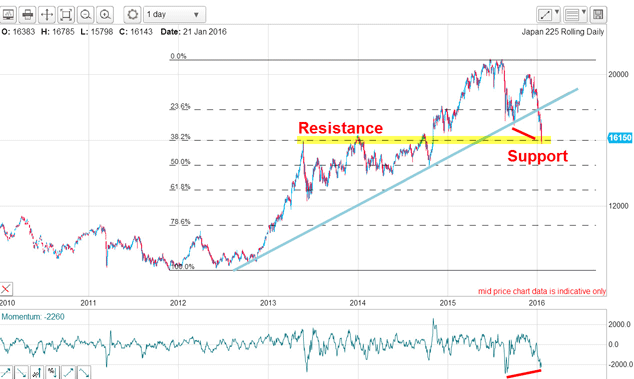

I mentioned above that I believe a relief stockmarket rally is on the cards. Here is the Japanese Nikkei 225 index daily chart I took yesterday:

The trend is definitely down, but at the 16,000 level it has hit major long-term support at the junction of the Fibonacci 38% level and the chart support/resistance line marked. All of the major tops in 2013 and 2014 were stopped at this level and now 16,000 has morphed into major support.

Note also the momentum divergence into this week's low a sure sign a rally lies ahead and this is what we are seeing this morning. That low was a great area to take at least partial profits on your shorts. As I write this morning, the index is up over 400 points and touching the 17,000 area.

What is the upside potential for stocks? The Nikkei could extend to kiss the underside of my blue line (a typical event) and that would certainly set the bears running! But volatility will continue and short-term trading will remain very worthwhile.

Before I end this email, one more point: crude oil is in a hard rally this morning is this the bottom? I hope to cover this market next week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how