Can the dollar really continue its climb?

Sentiment is swinging away from the dollar towards the euro. John C Burford looks at what the charts have to say about where the US dollar is likely to go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It was only a few months ago when the received wisdom was for the US dollar to collapse. The story involved the ballooning weight of massive US debt, approaching hyper-inflation from the Fed's gigantic QE money-printing operations, and a move to eliminate the dollar as the world's reserve currency.

A few months ago, things looked bleak indeed for the once mighty dollar. That was when the euro was flying high towards $1.40 and sterling was in a strong bull run. The story was water-tight, wasn't it? It all seemed to make so much sense. Sentiment towards the dollar plumbed new depths. It appeared doomed.

And it took some nerve to believe the majority had got it all wrong, but I took the other tack and believed the dollar was really due for a massive rally. Let me share some of my reasons with you.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Sentiment towards stocks and other assets was pushing bullish extremes for months and I believed this was unsustainable. When asset prices start to fall in a deflationary phase, the dollar would appreciate at the same time

The world is awash with debt mostly denominated in dollars and when the appetite of investors for even more debt at rock-bottom yields would start to wane, investors who had leveraged their investments to the max would be either tempted or forced to liquidate in a tsunami of selling, pushing up yields. This yield rise would put upward pressure on the dollar. Junk bonds were the most vulnerable to a collapse.

Traditionally, in a period of nervousness from global conflicts, or from a lowering of risk appetite, the dollar has always served as the preferred port of call as a safe haven.

I sensed that until recently, the market had ignored all of these potential problems. I was therefore ready to go long the dollar on the right signal.

But the clincher was the very low bullish sentiment towards the dollar in late 2013 and into 2014. That was the time to go long the dollar, of course, because it has staged a terrific rally since then.

The low in May this year provided the base for a rally in the trade weighted dollar index, which has appreciated by eight percent since May in a near-vertical rise. But if the dollar was on the verge of collapse, which was the majority view during the first part of 2014, why did it not do so?

Will the euro make a major turn soon?

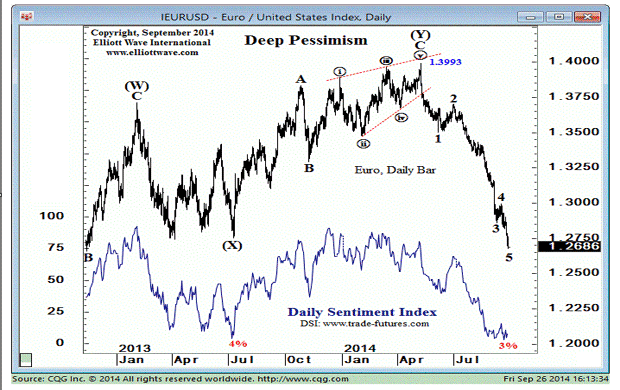

Here is a very informative chart that shows how the sentiment towards the euro against the dollar has swung from an elevated optimism (pessimism for the dollar) in early 2014 to last week's deep pessimism for the euro.

Chart courtesy elliottwave.com

In fact, bullish euro sentiment ranged above 80% several times in late 2013 and into 2014 as the EUR/USD pushed on towards the 1.450 top. But with the amazing freefall action in the past few weeks, bullish sentiment towards the euro has collapsed and reached an amazing rock-bottom 3% reading last week.

The last time bullish sentiment was this depressed back in July, the euro made a major low and promptly staged a vigorous rally. The question is: will the euro make a similar major turn soon?

The above chart shows one possible labelling of the Elliott wavesthat are operating and I want to focus on the decline off the 1.40 high and in particular, the latest action. This is because it is very difficult to pinpoint the end of a third wave in real time.

Remember, genuine third waves are long and strong and you can be fooled into thinking they are over when they are merely pausing before making new lows.

Is the third wave finished?

Here is the move down off the 1.40 high:

I have placed alternative labels which follow the Elliot wave rules. We are currently still in wave 3 down. This wave clearly has a lovely motive five-wave pattern (marked in green) where the minor fifth wave shows a positive momentum divergence (red bar).

The implication is that when the current large third wave terminates, we shall see a fourth wave rally (to perhaps a Fibonacciretrace level) and then a move to new lows in wave 5.

And when wave 5 terminates, a vigorous rally will ensue to relieve the lopsided dollar bullishness. Remember, that is precisely what happened in reverse around the 1.40 top.

The perfect time to leave the party

The question for traders is this: how do we play this rally for profit? As we all know, it is one thing to be able to analyse the setup but another to actually trade it successfully! That is why I have developed trade entry signals that must be flashed before taking a trade.

And it makes a huge difference whether you have a short trade working or not.

So now I have two equally plausible wave label patterns. But from a trading perspective, it matters little which will turn out to be correct. That is because both predict a rally of some sort either a wave 4 up or the start of the relief rally off the wave 5 low, which could morph into an A-B-C rally (the ideal form).

Either way the smart play, if you are short, is to prepare to exit the swing trade for a profit. And if you were short from near the 1.40 top, that would mean a very handy profit of at least 1,000 pips, or $10,000 per £1 spread bet.

You would be exiting just when the vast majority have become ultra-bullish the dollar the perfect time to leave is when the party is in full swing. You had the nerve and skill to bet against the majority opinion at the top and now you are reaping the just rewards.

Those who follow the herd will be short from near current levels and even holding on during the upcoming rally. These are the majority of traders who have no plan and will be joining the army of failed traders. Don't be one of them!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how