Are Mario Draghi's days numbered?

The credibility of Mario Draghi and the European Centran Bank is now in tatters, says John C Burford. Just looks at the markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Yesterday's much-anticipated announcement from the European Central Bank (ECB) was the spark that fired up the EUR/USD rocket. It gained a massive three cents plus on the day. And that sharp rally immediately following the news was surely not a total surprise to my readers.

But it certainly was a surprise to most observers who had convinced themselves that Draghi had just about given them a cast-iron guarantee that the 'stimulus' he would unleash would be a game-changer. In the event, it was more a damp squib than a big bazooka.

Just yesterday, headlines blared that Draghi had been given the 'green light' to unleash massive 'stimulus' following the just-released negative inflation data for the eurozone. How wrong can you be?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But this could be a game-changer alright. The credibility of Draghi and his ECB is now in tatters and should never recover. He had wound the markets up to expect that big bazooka in the form of aggressive Nirp (negative interest rate policy)and massive expansion of bond-buying, yet delivered a pale imitation.

The markets took it very badly with stocks and bond yields collapsing as the euro exploded.

Central banks can only fight reality for so long

Stock valuations have been pushed to the limit by faith in the central banks to keep hosing as much liquidity as the money managers require to keep them happy. Suddenly, they are very unhappy and money managers will start to have the veil lifted from their eyes. The Wizard of Oz really is a fake.

In my postof last Friday ("Speculators are massively short the euro and I think it's about to turn"), I laid out my case to expect a vigorous change of trend very soon. And my firm view was verified in spades yesterday.

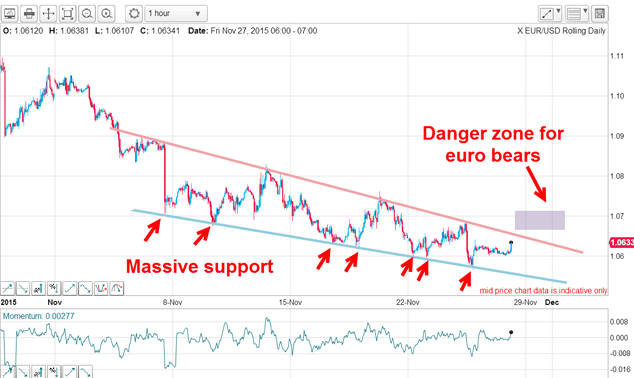

My forecast was partly based on the extreme sentiment picture, but also on the chart patterns forming last week. The last part of the decline off the early November high was forming a very convincing falling wedge pattern. My lower line was a superb line of support having those seven very accurate touch points.

Here is the hourly chart I showed:

My line in the sand was my upper wedge line and once that line could be broken, I forecast it was off to the races northwards. I plotted the price area where the army of bears would start to get worried and begin aggressively covering some of their shorts. Of course, that was also an area for my small band of euro bull compatriots to clamber on board the rocket.

This is the updated hourly chart:

And that is what you get when too many passengers run to one side of the ship: it capsizes.

To illustrate, here is the latest COT (commitments of traders) data (although it is a little out of date as it was compiled on 24 November when the euro was still in decline):

| (Contracts of EUR 125,000) | Row 0 - Cell 1 | Row 0 - Cell 2 | Row 0 - Cell 3 | Open interest: 557,979 | ||||

| Commitments | ||||||||

| 78,344 | 244,663 | 66,411 | 363,374 | 153,317 | 508,129 | 464,391 | 49,850 | 93,588 |

| Changes from 11/17/15 (Change in open interest: 8,750) | ||||||||

| -2,769 | 6,970 | 520 | 11,960 | 1,347 | 9,711 | 8,837 | -962 | -87 |

| Percent of open in terest for each category of traders | ||||||||

| 14.0 | 43.8 | 11.9 | 65.1 | 27.5 | 91.1 | 83.2 | 8.9 | 16.8 |

| Number of traders in each category (Total traders: 271) | ||||||||

| 62 | 125 | 73 | 58 | 65 | 164 | 219 | Row 8 - Cell 7 | Row 8 - Cell 8 |

On that date, money managers (non-commercials) were over three-to-one short and were adding to their short bets in style. The data for 1 December will be released later today and I am willing to bet that even more managers have been joining their bearish colleagues.

What's more, with the DSI reading coming in at only 3% bulls recently, the market was primed for a turn.

What next for the euro?

So how does this fit into the bigger picture? On the daily chart, the November plunge is wave 3 and yesterday's spike is part of wave 4 up which should be in the form of an A-B-C. When complete, a fresh decline will be wave 5:

But there is a valid alternative! Instead of waves 1, 2 and 3 we really have an A-B-C which is counter-trend. This count implies a much higher rally potential perhaps up to make a kiss on the centre tramline above the 1.12 area.

In either case, a decent rally is in prospect and will end when ironically the money managers have turned much more bullish the euro!

But looming is the US Fed meeting on the 16th which is at least of equal importance. The market is convinced that Yellen will raise US rates. But now that the dollar is being knocked off its perch, will she really go ahead with that plan? After all, a declining dollar will be seen as helping the struggling US export sector which needs all the help it can get.

Expect more fireworks this month.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how