Water companies blocked from using customer money to pay bonuses – here's how to cut your water bill

The regulator has blocked three water companies from using billpayer money to pay £1.5 million in exec bonuses

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Three water companies including Thames Water, Yorkshire Water and Dŵr Cymru Welsh Water have been blocked from using billpayer money to fund “undeserved” executive bonuses. It comes at a time when water bills are already expected to rise by 21% a year over the next five years.

Ofwat, the water regulator, used new powers to step in after determining the bonus payments were not appropriate in light of performance challenges. The blocked payments amount to £1.5 million across the three companies.

Six other companies acted voluntarily, with shareholders funding bonus payments. Had this not been the case, Ofwat says it would have acted to ensure the bonuses were not funded by customers.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In total, it means 73% of bonus payments (totalling £6.8 million across the nine companies) will not be paid for by customers. In the other 23% of cases, Ofwat says it “did not identify any significant indicators of poor performance” to justify the use of this mechanism.

“In stopping customers from paying for undeserved bonuses that do not properly reflect performance, we are looking to sharpen executive mindsets and push companies to improve their performance and culture of accountability,” says Ofwat chief executive David Black.

On 10 December, the boss of Thames Water defended executive bonuses. Chris Weston said the supplier needed to offer "competitive packages" to attract talent. His comments came as the company saw a 40% increase in pollution incidents in the six months to 30 September.

The regulator’s powers could be extended further going forward, after the government introduced a new bill to parliament in September. If passed, this will allow Ofwat to prohibit performance-related pay entirely in some circumstances.

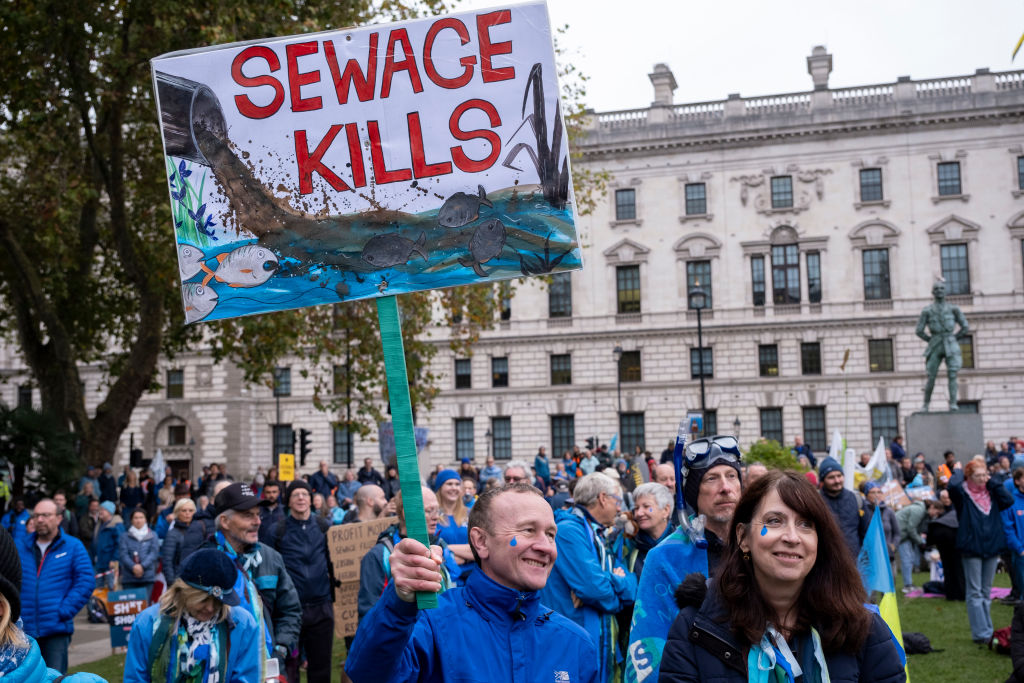

The legislation follows a series of public controversies, including financial mismanagement, steep bill hikes, and sewage being pumped into waterways. “Under this government, water executives will no longer line their own pockets whilst pumping out this filth,” environment secretary Steve Reed said earlier this year.

Will water bills go up?

“Blocking water companies from using customer money to pay ‘undeserved’ executive bonuses may be a positive move but it is unlikely to prevent water bills from going up over the long term,” says Alice Haine, personal finance analyst at Bestinvest, the online investment service.

“Ofwat’s decision does not apply to all water companies and the regulator has already indicated that water bills are set to rise in the coming years,” she adds. “This is despite water companies being ordered to repay £158 million to customers in October due to their consistent poor performance on sewage and leaks.”

Ofwat sets price limits to control what water companies can charge customers. The 2025-30 review is taking place at the moment, with a final decision due in December. Initial estimates suggest bills will rise by £19 a year on average over the next five years, a 21% annual increase.

Haine points out that households already struggling with higher bills may be concerned about the jump in costs. “While it might be comforting for a customer that their money is not being used to fund bonuses for executives working for water companies with poor performance records, what consumers really want is lower bills,” she adds.

How to cut your water bill

You can’t shop around when it comes to water, unlike energy. You have to use the provider that supplies your local area. Despite this, there are some steps you can take to reduce your water bill.

A water meter could be worth considering if you don’t have one already. You can ask your water supplier to install a meter for free. Metered customers are charged for what they actually use rather than through an estimate. Plug your details into an online calculator for an idea of what your bill could look like based on your usage.

If you find you are paying more once a meter is installed, your supplier may allow you to go back to your old billing system. You usually need to request this within one or two years of having the meter fitted.

Once a meter is installed, there are some simple steps you can take to cut your bill like opting for a quick shower instead of a bath, fixing any dripping taps, or using water-saving devices.

Not all properties are suitable for a water meter, but if you can’t get one, you can ask your provider for an assessed charge bill. This is a bill which is customised to your situation based on factors like the size of the property and how many people live there.

Meanwhile, low-income customers can request a social tariff. “Each company has its own scheme and eligibility criteria, so those worried about the prospect of higher bills should contact their provider to find out what options are available,” Haine says.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how