Investing in space: a fund for the final frontier

The space sector is not simply about launching rockets to Mars or the moon. A new fund aims to cash in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Early next month sees the launch of a new exchange-traded fund (ETF) that aims to boldly go where no other ETF has gone before: space. ETF specialists HANetf and Procure Innovation are about to launch the Procure Space UCITS ETF in London with the irresistible ticker of YODA.

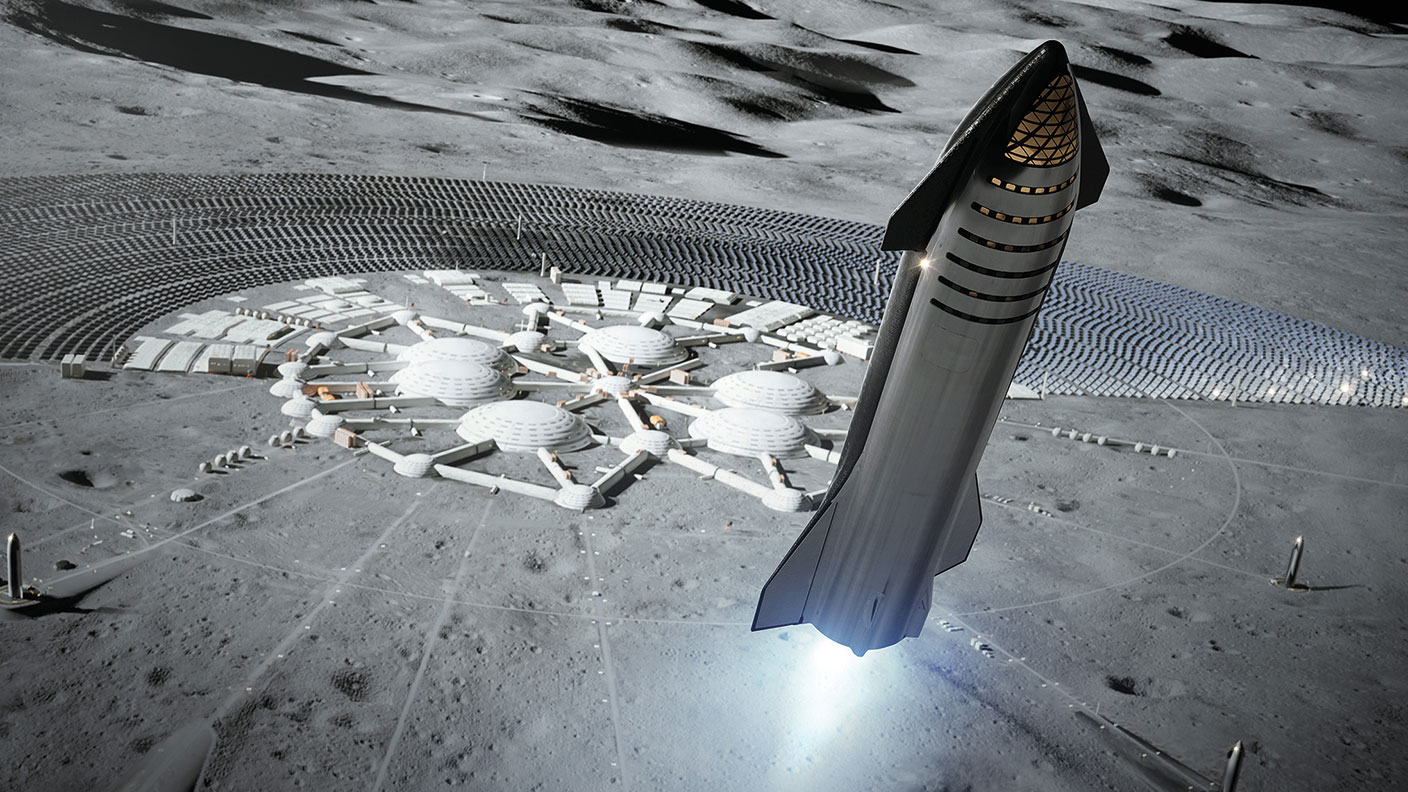

Inevitably, science-fiction geeks focus on the adventurous end of this well-established industry, notably missions to Mars and the moon. And much of the time SpaceX, Elon Musk’s rocket company, crops up in the discussion.

In April, for instance Nasa announced that it had selected the company’s Starship vehicle as the lunar lander for its Artemis programme to return to the moon. Musk’s launch business was up against Jeff Bezos-backed Blue Origin and Dynetics.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A tiny market

For all the excitement, however, the space launch market is tiny. By some estimates it is only worth around $6bn. And prices have been dropping like a failed rocket as competition has intensified.

Defence contractors involved in the sector, such as the United Launch Alliance of Boeing and Lockheed Martin, have felt the strain.

According to a recent Economist report on the sector, this long-established alliance recently cut jobs and costs as the price for rockets was reduced from $225m a launch to just over $100m. SpaceX has been able to undercut its rivals, charging $62m for a fresh rocket or $50m for a used one.

For the time being, the key area to watch may be a more terrestrial market: broadband. Huge swathes of the UK are struggling to be connected to fibre-optic internet networks. BT and its Openreach business says its has plans to fill the gap but most rural customers are rightly suspicious. Enter space internet. Sending internet signals through satellite dishes is another way to supply areas that have struggled to get connected. SpaceX’s Starlink programme has recently been introduced in several rustic areas in the UK and although pricing isn’t exactly a bargain at £89 a month plus the cost of buying a dish, speeds are much more impressive.

And Starlink isn’t the only service chasing this market. The government has backed OneWeb, a satellite business that went bust but has recently been relaunched. Like SpaceX, it is planning a low-orbit network of smaller satellites that will give fast, comprehensive coverage to rural areas. SpaceX is rumoured to be planning as many as 42,000 satellites in all.

However, the business model at OneWeb seems to be slightly different. Its base stations are more expensive and likely to be aimed at existing broadband providers, who will then distribute traffic to local customers via local Wi-Fi networks.

Yet even within this huge broadband-connectivity market, challenges remain. Plenty of other businesses have attempted to tap this market and gone bust in the process. Iridium went under trying to offer similar services as has Intelsat and Speedcast, all using higher-orbit satellite networks. Unlike many tech-based business models, this is a high-risk investment proposition with massive upfront costs and increasing competition.

Cash is pouring into the space sector

But it’s also clear that the space industry is attracting ever more investment, not all of it from tech billionaires such as Musk and Bezos. According to Seraphim Capital, a venture-capital group, the sector attracted $8.7bn of venture investment in the year to March 2021, up by 95% from the year before.

SpaceX is the highest-profile private investment in this area. The Economist reports that in its latest funding round, completed in April, the business was valued at $74bn, up from $46bn in August 2020. UK-listed venture capital outfit Schiehallion (managed by Baillie Gifford and quoted on the specialist-funds segment of the London Stock Exchange) has about 5% of its fund invested in SpaceX.

These numbers suggest that a large number of savvy investors think that this new commercial space sector is about to grow rapidly, despite the many and obvious challenges. This is a classic disruptive sector that boasts what I would call the joker card – niches such as launch or rural broadband are likely to be tough, competitive markets but at some stage someone in the sector will come up with a set of products that sparks a huge commercial opportunity, kicking off a new space race of possibly epic proportions. Whether that entails supplying broadband to northern Scotland or African communities, or paying space tourists (or even mining asteroids) I don’t know, but there is the sense that something big is coming. Whether that justifies the valuations on many of these businesses I will leave to your judgement.

A wide-ranging portfolio

But this ETF is a sensible way of accessing the niche via a portfolio of around 30 stocks. It includes the full range of industry players varying from long-established satellite network operators to businesses engaged in the early stages of space tourism.

The index powering the fund has some rigorous rules to make it properly space-oriented as opposed to a fund claiming to invest in space but actually focusing merely on aerospace and defence.

According to the index rules, to be included in the index, space-related revenue must either account for at least 20% of the total or exceed $500m annually. Crucially, 80% of the index is allocated to companies that generate 50% (but typically 100%) of their annual sales from space-related activities.

The remaining fifth of the index is allocated to diversified companies that generate less than 50% of total revenues from space-related businesses: in terms of geographical mix, 70% of the value of the fund is US based and 30% international.

Clearly this is one only for the truly adventurous amongst you willing to place a small bet on an exciting industry that is quite literally going places. I am not sure that the valuations ascribed to SpaceX make sense but it is worth recalling that plenty of people said that about Tesla and were wrong. My hope is that all the investment interest does finally result in products and business services that are useful for the rest of us, especially in rura

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive