Software giant Adobe will keep beating the rest

Adobe is in perfect position to profit from the remote-working revolution, says Stephen Connolly.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

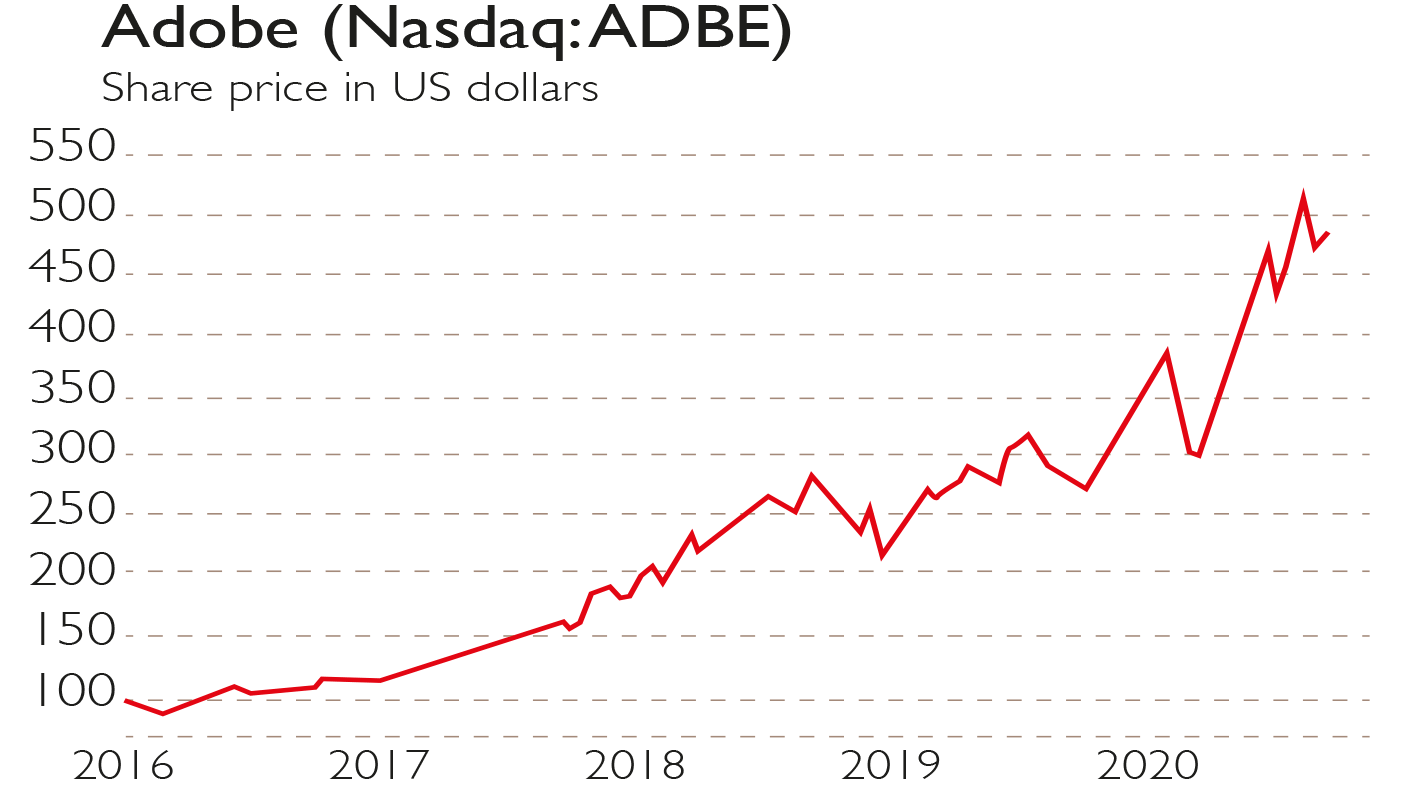

Creative-software group Adobe (Nasdaq: ADBE) came out with record-breaking results this week, beating analysts’ expectations yet again. Exceptional businesses are rare but Adobe is one of them. Over the past five years, profits have leapt 60% annually and cashflow is up over 300%, while gross margins have averaged an eye-catching 86%. And that was before the pandemic. Covid-19 has clearly triggered the need for even more digitisation, and at a faster pace as technology plays an increasing role in our lives. Adobe, which makes this happen, will be enjoying tailwinds for years to come.

An obscure giant

Despite being extremely profitable and a top-performing stock – the shares have grown 26.5% a year since floating in 1986 – Adobe isn’t that well-known. For many, it’s simply the maker of the Acrobat software that creates and reads PDF documents. For others, it’s the publisher of Photoshop, the program for editing pictures. Both are very important. Over 250 billion PDFs are opened a year in Adobe software, and 90% of the world’s creative professionals use Photoshop, which is to images what Microsoft Word is to text. But today Adobe is broader, offering a suite of software for document management and storage; website design, content and e-commerce; and image and video editing.

These have been highly successful as Adobe’s profit history shows. This growth should continue because they plug directly into the theme of the digitising world.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

First, we know many professionals are working from home. People will start to go back to the office as the pandemic is contained, but many won’t do so full time. It’s clear that a degree of remote working is here to stay: employees want it, productivity seems to increase and smaller office spaces mean lower costs. Businesses are using PDF documents that can be edited, stored, searched and retrieved. They can also be signed electronically. With Adobe, all this takes place seamlessly across the cloud that connects computers and devices wherever they are, making offices virtual as staff don’t have to be together in one brick building.

Second, Adobe’s creative software also connects collaborators when it comes to creativity, again across the cloud. Design teams from large studios and agencies as well as freelancers are working together on images, videos and general design. This is serious work and will become more so – a digital world is a visual one, in which businesses and organisations are competing for attention.

Taking this further, Adobe helps users large and small build, and capitalise on, their digital presence, including creating innovative content for websites as well as carrying out transactions and analysing all their internet traffic. This is the future and Adobe is a leader. Its products let users analyse their visitors and customers in real-time to generate personalised experiences and engagement – this is a critical growth area for ecommerce.

Subscription software

Adobe’s unique software is now offered as a software-as-a-service (SaaS) product, meaning it is rented, not bought (see below). Market analysts reckon this is a $158bn sector expanding at 12% a year to hit $307bn by 2026. Given that Adobe is the world’s third-largest SaaS after Microsoft and Salesforce, it is well-placed to share in this strong growth.

Adobe’s own outlook is equally upbeat. It sees its potential market as worth around $128bn by 2022. Its sales of $11bn last year are only a small part of this, so there is plenty of scope for growth.

Technology companies are flying high because the world is rapidly digitising. Volatility is to be expected but the numbers are coming through strongly. Adobe’s dominant position will mean further growth as digitisation progresses, so its returns should continue outpacing the wider market.

Reliable and recurring revenue

Adobe has been one long success story. Founded in 1982 with origins in printing software, desktop publishing, typesetting and fonts, it joined the stockmarket in 1986. Today it’s a $233bn company that employs 22,000 people. The shares were priced at the equivalent of 17 cents then (allowing for stock splits) and are almost $500 today: a compound rate of 26.5% a year over nearly four decades. A $1,000 investment back then is worth $2.94m today – a 294,000% return.

Any company whose products are so widely used that they become everyday words have a good (though not guaranteed) chance of success – think Google or Skype. Adobe has two. Most of us talk of “PDF-ing” a document or ask if an picture has been “photoshopped”. Hardly analytical, but deep brand embedding suggests a product is here to stay.

What made Adobe something of a standout business for long-term investors was its early adoption of the subscription-based revenue model. Users no longer buy software; instead they rent access to it. Over 90% of Adobe’s revenues are now recurring. This predictability and reliability of income is one reason why it merits a premium valuation: at today’s share price, it trades on 60 times trailing earnings and 48 times forecast earnings. And whether the world is expanding or in full lockdown, Adobe has proved it keeps delivering. Its latest results show revenue ahead of management expectations, strong profits and expanding margins. Importantly, the company affirmed further growth in the next quarter in line with existing expectations.

Analysts were warming to the stock even before the latest results. Adobe’s strong record and the potential for deals to add more client offerings mean it continues to offer long-term upside.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton