Profit from document shredding with Restore

Restore operates in a niche, but essential market. The business has exciting potential over the coming years, says Rupert Hargreaves

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Some of the best investments are in businesses that operate in relatively unknown but essential markets, working in the background and fulfilling functions that other companies either don’t want to, or can’t afford to do themselves.

One such business is Restore (LSE: RST), the leading provider of physical and digital document-management services in the UK. It stores documents for public- and private-sector organisations, such as the NHS, and destroys old documents. There’s also a document-processing business (called Synertec), which helps companies send electronic and physical communications and a technology division (Restore Technology). All of these help the company’s customers manage their data, whether it’s on paper or in digital form.

Restore is beating expectations

In 2024, Restore generated £275 /million in revenue. The largest proportion of revenue (£170 million) came from the information management division, the one responsible for storing and managing documents. Despite the global shift over the past 20 years away from physical to digital documents, there’s still a vast and steady market for this kind of storage and Restore, as the largest operator in this area, has the economies of scale required to make it work.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The City has raised questions about the sustainability of this business multiple times over the past few decades, yet despite these concerns, the firm has consistently outperformed expectations. It’s helped that Restore has been able to move into new markets, such as operating a “digital mailroom”, which scans and digitises inbound and outbound mail for clients. It also manages exam papers and physical document processes within government agencies.

The second-largest division is a business called “DataShred”. This does exactly what it says on the tin. It’s the largest document-shredding operation in the UK, servicing tens of thousands of companies every year. The third and fourth key divisions are Harrow Green, which helps companies move office, and the technology business. Restore has found that companies moving offices need to digitise and destroy physical records, although they often choose to store old records as well. Despite this, the company agreed this week to sell Harrow Green for £5.5 million in cash to focus on the core business.

Restore's exciting potential

The technology business helps clients manage their tech assets, such as laptops and desktop computers, to ensure security throughout the asset’s life cycle. Some of its biggest clients here are public bodies, such as the Department for Work and Pensions. Restore helps the department set up new laptops, test laptops in use, and erase as well as repurpose laptops when they come to the end of their life. It can process thousands of laptops a day and has a two-week turnaround window to get each computer back into the workforce. Laptops that are not going to be repurposed for new joiners can be securely and responsibly disposed of.

This division currently accounts for just 11% of group revenue, but it has vast potential. Management has highlighted the AI product cycle, the release of Windows 11 and the beginning of the post-Covid technology refresh cycle as structural drivers for growth. The current best practice is for companies to refresh technology every three to five years. Overall, the firm has 500 active customers at present, served by 310 employees, with the capacity to refresh 13,000 assets a week.

The technology business has exciting potential over the coming years, but investors shouldn’t overlook the document side of the organisation. To bulk out this division, in March, Restore paid £33 million to acquire Synertec, which owns a proprietary software platform that helps clients communicate with their customers across different channels. Using the software, clients can upload customers’ communications to Synertec’s systems and select how they want the information to be distributed.

This can include documents printed in braille, for example, or communications sent out via text message. Synertec can turn around the client’s data request overnight, a key selling point for its largest client, the NHS, with which it recently agreed a new four-year framework set to start in the first quarter of next year. Synertec also works with clients such as P&O Ferries, Screwfix and Hotpoint.

A new direction for Restore

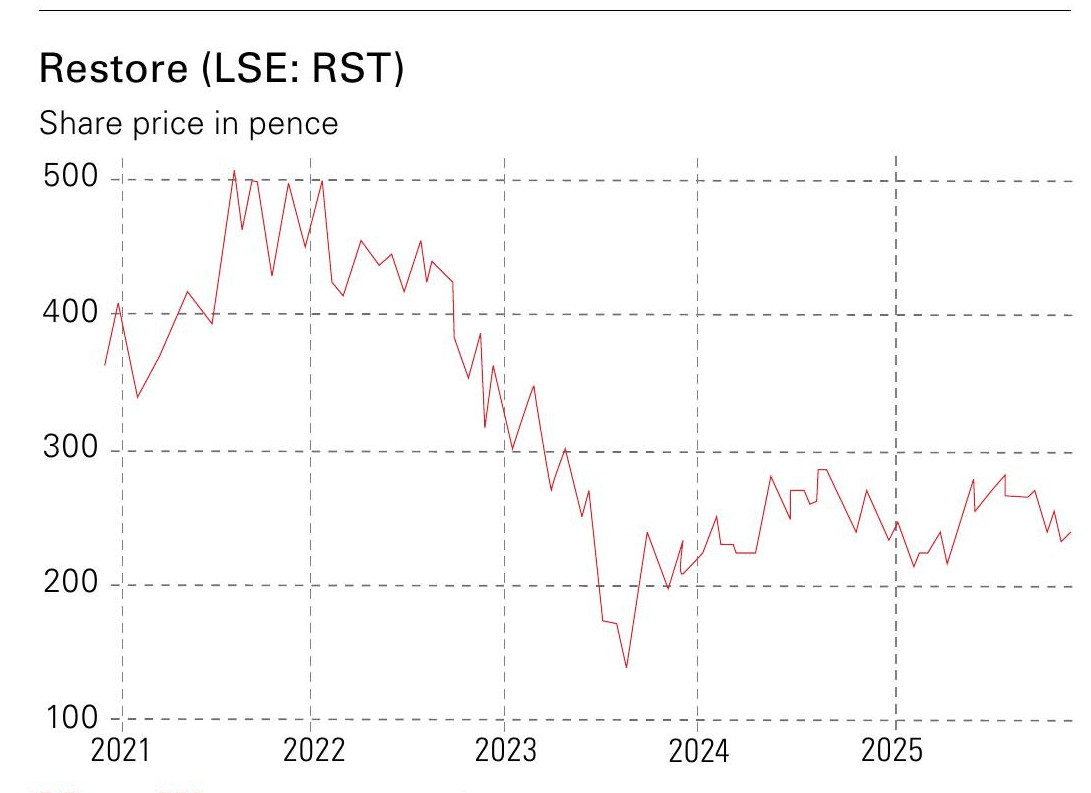

Despite its strengths, shares in Restore have declined by around 50% since the pandemic, even as adjusted profit before tax has risen from £23.2 million in 2020 to £34.4 million in 2024. Lack of confidence in the company’s strategy, multiple compression and general apathy among investors towards UK small caps all appear to be to blame.

However, after a change of management two years ago, the City is starting to come around to the growth story. Charles Skinner returned as CEO in 2023, after Charles Bligh, who joined as CEO in 2019, resigned. Skinner stepped down in 2019 following a decade at the helm of the group, during which time the shares returned more than 2,200%. Skinner has spent the past two years refreshing the group and its strategy, but the market is yet to factor in the changes.

According to analysts at Berenberg, the shares are trading one standard deviation below the 10-year average price-earnings (p/e) ratio of around 15; the same is true on an enterprise value to Ebitda basis. Berenberg has the stock trading at a 2026 p/e of 9.9 and a free cash flow yield of 8.3%.

Canaccord Genuity takes a similar view, with a p/e of 10 pencilled in for 2026 and a free cash-flow yield of 8.3%. What’s more, in its latest trading update, Restore reported growth ahead of market expectations, with margins returning above the medium-term 20% target, prompting a wave of analyst growth upgrades. This growth, coupled with a return to the company’s 10-year average valuation, could generate an upside of nearly 70% for the shares in the best-case scenario.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton