Pearson will switch from selling to schools to selling to students

Educational publisher Pearson is to change from selling mainly to schools and colleges towards selling directly to consumers, including students.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

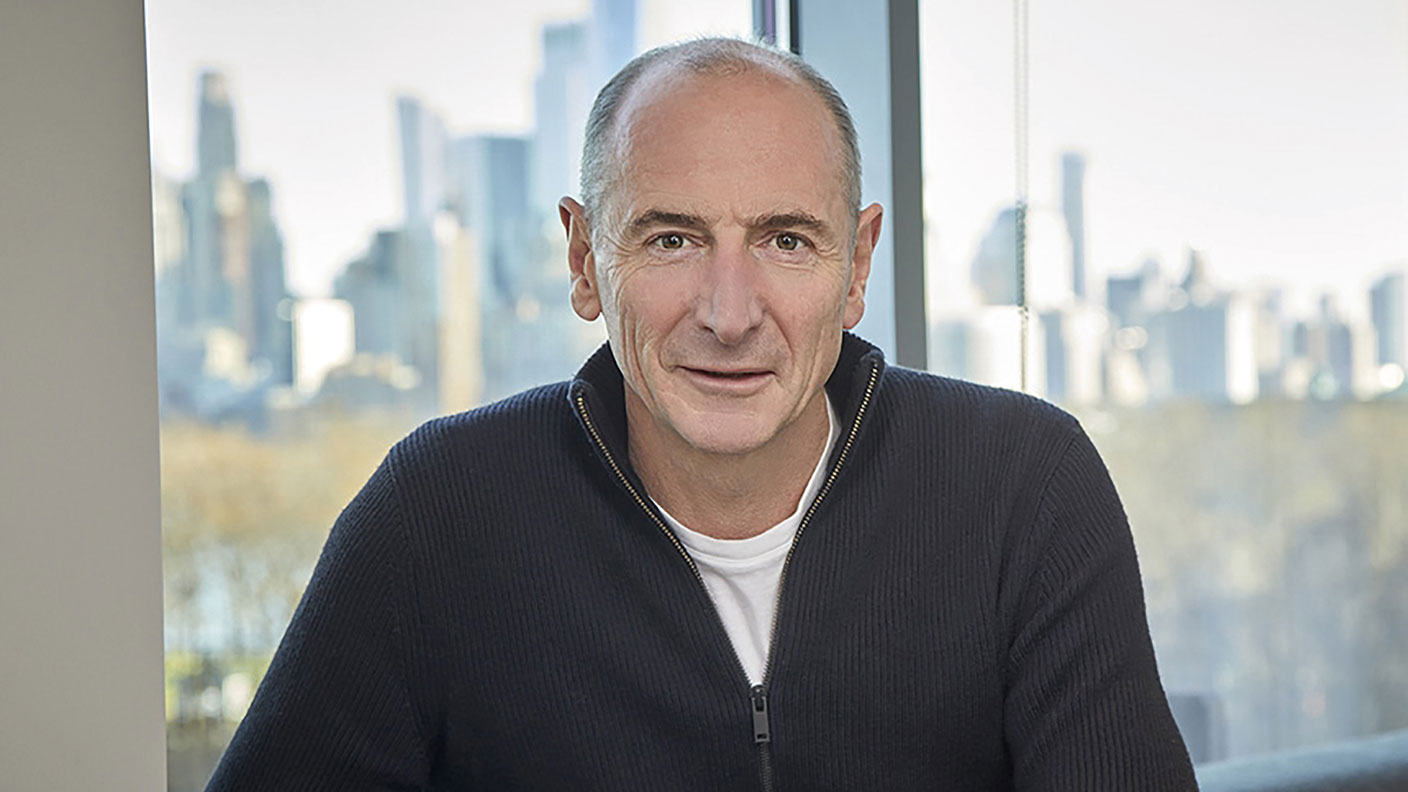

Pearson’s CEO Andy Bird (pictured) has announced that the educational-publishing company will overhaul its business to draw a line under a “tumultuous decade”, says Bethan Staton in the Financial Times: it “issued seven profit warnings in as many years”.

The plan is to shift from selling mainly to schools and colleges towards selling directly to consumers, including students. The company is also looking to take advantage of what it sees as the growing demand for “lifelong learning” as workers start to spend more time continuously upgrading their skills throughout their careers. These changes may cause Pearson some short-term pain, says Simon Duke in The Times. Bird says restructuring the company into five divisions, including a new consumer division, will cost “between £40m and £70m this year”. At the same time the decision to slash office space, to take advantage of a move towards remote working, will “reduce reported profits by about £130m this year”, although it will also cut long-term overheads.

Bird will have to “move quickly to keep investors on side”, especially when patience has already been “tested” over his pay packet, says Ben Woods in The Daily Telegraph. Another concern is whether Pearson’s success in selling to the college market can extend to the “super competitive” lifelong-learning market, especially since the company has “stoked up expectations” of a “Netflix of Education”-style revolution before, only to leave investors “wanting”. Still, it’s a necessary gamble: lifelong learning “is clearly where the growth is”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom