Three ideas for Lloyds Bank's new boss

The Black Horse needs whipping into shape. A change at the top provides a great opportunity, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

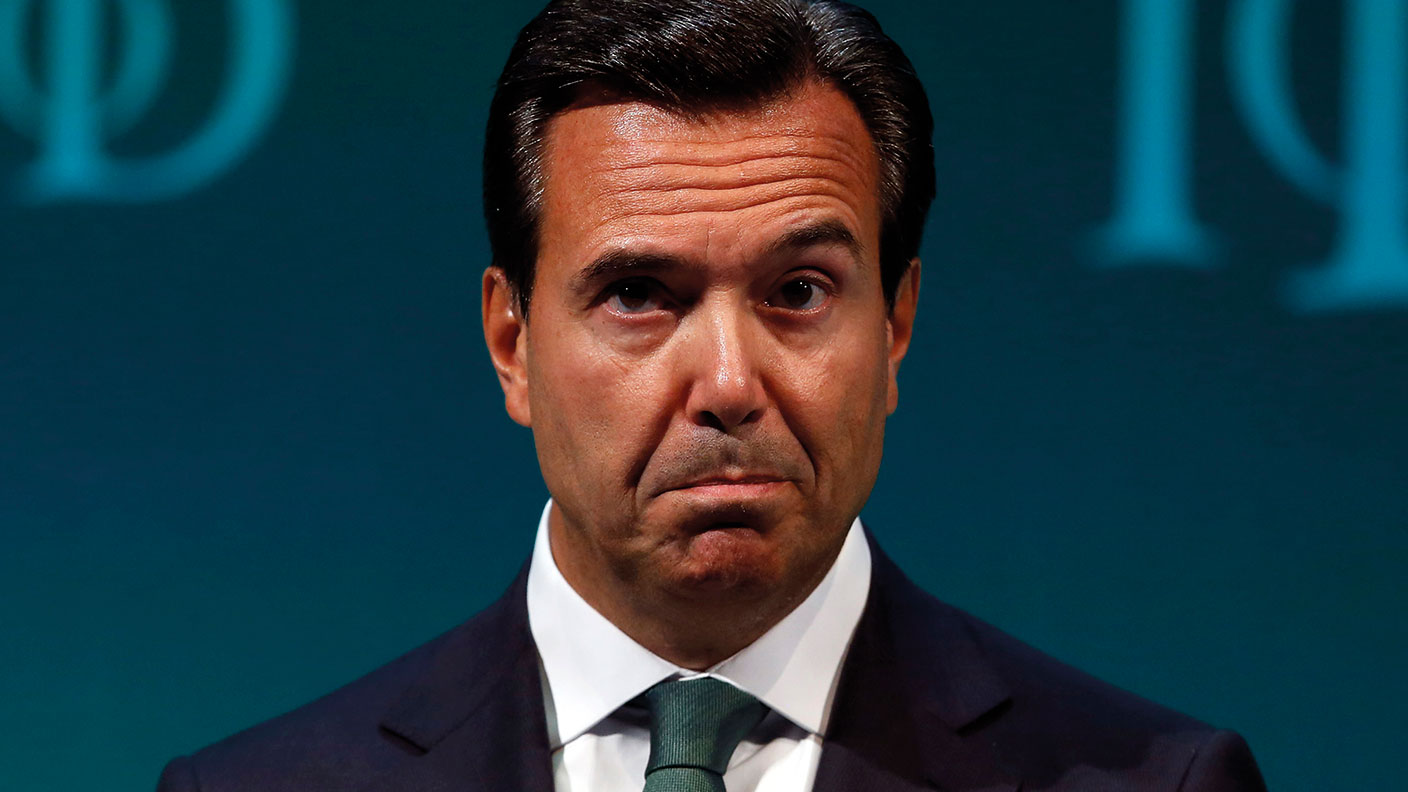

António Horta-Osório did a decent enough job as chief executive of Lloyds Bank. But whether shareholders will be all that sorry to see him leave office is open to question. The bank is back on a stable footing, but it has hardly been making a fortune for investors. Over the last five years the shares have plunged from 80p to 30p and while much of that was lost during the Covid-19 crisis, the price was still at 60p before any of us had heard of Wuhan. With the dividend now scrapped for this year in response to the epidemic, it has hardly been a great asset to own. After all that, shareholders might well feel it is time for a change.

Safe and dull is not good enough

Whoever takes on the job will inherit a leading position in the UK’s retail finance market. Including the Halifax and Bank of Scotland brands, Lloyds has 22 million current accounts, making it the largest in the UK, and it is also the biggest mortgage lender, with a quarter of the market for home loans. There is a problem, however. All Horta-Osório has really managed to do in his decade in charge is get the group back to where it was before the crash – a safe, steady but dull retail bank. That isn’t going to be good enough for the 2020s. Retail banking needs radical reinvention. Here are three ideas for his successor.

First, Lloyds needs to keep closing branches. Ignore the campaigners who try to keep them open and brush aside the lobbyists who argue cash needs to be protected. It is not the job of a bank to save the high street, or to keep a system of payment alive after it has become technologically obsolete. After the Covid-19 crisis, local branches are going to be more irrelevant than ever. Apart from collecting cash from small businesses – and even the smallest of them are rapidly embracing contactless cards – a bank branch doesn’t have much to do anymore. And in a world where cash is dying out, cash machines are increasingly irrelevant. But the branch network is still a huge cost. The best companies don’t simply react to change, but get ahead of it. Lloyds can only do that by closing branches quickly.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Next, work out how to respond to technology. Traditional retail banks are under assault from every direction. App-based start-ups are providing far simpler, better-designed current accounts. Fintech companies are chipping away at once-lucrative lines of business such as currency transfers and small-business lending (insurance will be next). The technology giants are increasingly moving into finance. Amazon has launched a current account, Apple and Google have payment systems and Facebook has even tried to launch its own currency. The start-ups have agility on their side and the tech giants have a mass of customer data, and deploy it brilliantly. A traditional retail bank has some residual strengths, such as a customer base, a payment system and lots of relationships. It has to figure out how best to use them.

Time for a rebranding

Finally, it needs to reinvent its brand. All the high-street banks spend a fortune on marketing and Lloyds is no exception. Sure, it has a lot of name recognition, but there is not much in the way of affection, or respect, and customers are only loyal because it is usually a hassle to switch account. Decades of mis-selling products and sneaky charges have trashed the trust between banks and their customers and, apart from paying out billions in compensation, not much has been done to fix that. A brand needs to stand for something solid. It could be trust, or innovation, or value – or something else entirely. But the bank needs to work out what it is, and how to make it happen.

Over the next few weeks there will be lots of speculation about who will replace Horta-Osório. The name doesn’t matter as much as whether he or she will be willing to push for a radical change of direction. If Lloyds makes an ambitious choice, it might be able to reinvent a tired business model – and set an example that the rest of the banking industry can follow.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?