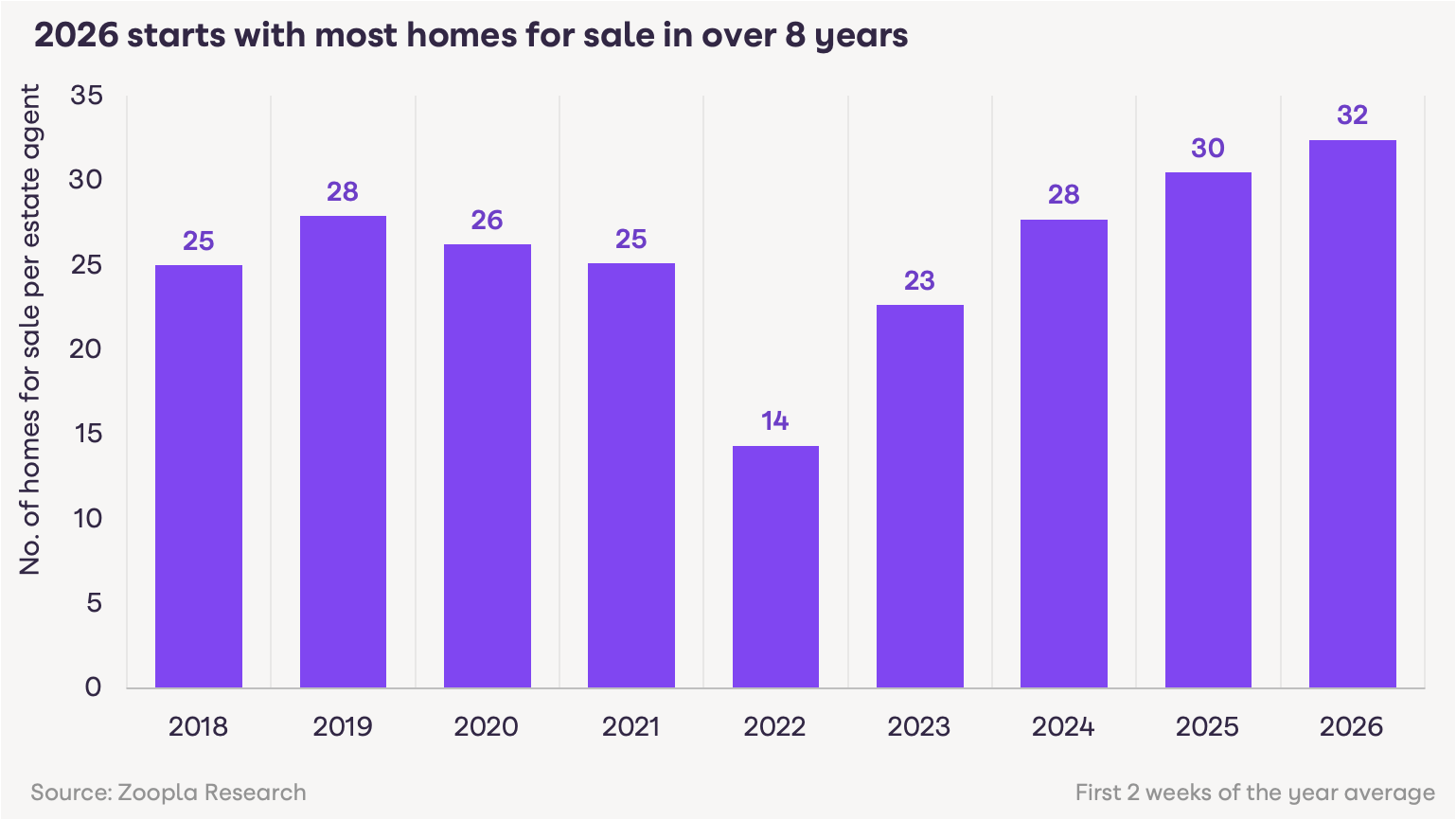

Zoopla: Number of homes on sale at eight-year peak – but demand lagging behind 2025

The average number of homes listed for sale per estate agent at the start of the year breached 30, property portal Zoopla said

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The number of homes listed for sale on Zoopla is at its highest level in eight years as stock comes back onto the market following a turbulent 2025.

Estate agents listed an average of 32 homes for sale on its website over the first two weeks of this year, Zoopla said, up from 30 in 2025 and 28 in 2024 over the same time period.

Zoopla said 33% of the homes on the market at the start of this year had been listed in 2025, taken off the market then relisted. It said this had been caused by uncertainty over what the Budget would mean for the housing market.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Richard Donnell, executive director at Zoopla, said: “After a sluggish end to 2025 it is positive to see a strong rebound in buyer demand over the first weeks of the year across all parts of the country.

“Growing numbers of homes for sale is evidence of a strong underlying appetite to move home for many households.”

Homes for sale in Southern England lead the charge

The abundance of homes for sale in London and the South East on the Zoopla website has pushed up this year’s overall figure, the property portal said.

There were 16% more homes on the market in the first two weeks of January this year compared to 2025 in the capital, followed by 9% in the South East.

Zoopla said homes in the southern regions were the most impacted by Budget uncertainty, leading to stalling sales in the final months of 2025.

The mansion tax, for example, which was announced in the Autumn Budget and will be imposed on homes worth more than £2 million, will impact homeowners in the south more where house prices are generally higher than the rest of the UK.

The higher levels of housing stock in the south are keeping house prices in check, Zoopla said.

Conversely, in other parts of the UK, the supply of homes on sale is similar year-on-year, which means greater scope for house price growth.

Despite the higher number of homes on the market at the start of this year, and Zoopla’s latest data showing a strong bounce in buyer demand post-Christmas, demand is still 10% lower compared to 2025.

However, demand is still high relative to historic levels, and is 20% higher than the start of 2023.

What’s happening in the rental market?

Not everyone is in the market to buy for themselves and others might be more keen to buy-to-let.

Separate data recently published by Rightmove showed average rents outside London rose by 2.2% between 2024 and 2025. Inside the capital, this figure was 0.8%.

This was the lowest amount rental prices had risen outside London and inside London since 2018 and 2020, respectively, the property website said.

It predicts rental prices will have another subdued year, rising by 2%.

There is reason for optimism among landlords though, Rightmove said.

The latest UK Finance data shows the number of new buy-to-let mortgages taken out to buy rental homes in the year to October was 13% higher compared to the same period in 2024, while the number of remortgages increased by 23%.

Nathan Emerson, chief executive officer of Propertymark, said improving buy-to-let mortgage affordability, due to falling mortgage rates, was an encouraging sign.

He added: “Moving further into 2026, a steady increase in rents reflects a market that is calmer, but still constrained, underlining the need for continued investment in the private rented sector.”

We explain how the Renters’ Rights Act affects landlords in another piece.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sam has a background in personal finance writing, having spent more than three years working on the money desk at The Sun.

He has a particular interest and experience covering the housing market, savings and policy.

Sam believes in making personal finance subjects accessible to all, so people can make better decisions with their money.

He studied Hispanic Studies at the University of Nottingham, graduating in 2015.

Outside of work, Sam enjoys reading, cooking, travelling and taking part in the occasional park run!

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how