How to use philanthropy to make your mark on the world while investing in what matters to you

Giving to charity is a personal matter, but one philanthropist explains how sharing his wealth can make a difference that is worth talking about, particularly when it comes to funding life-saving cancer research.

Cancer is a disease that affects millions of people, so what if you could make a difference with your money in helping to tackle it through philanthropic investing?

Scientists may be at the forefront of tackling cancer but charitable investors and donors such as Robert Easton play a vital financial role in research and development.

Easton, a former partner at private equity firm Carlyle, is one of the philanthropists supporting Cancer Research UK with its plan to raise £400 million through its More Research, Less Cancer campaign.

Invest in what matters

There are plenty of forms of impact or sustainable investing where a fund manager will put your money towards companies or projects that align with your values, or you could even have a direct debit set up for charity.

But if you want more direct involvement in choosing and tracking how your money is used, another option is philanthropic investing. This is where you give money to a charity such as Cancer Research UK to fund particular projects you are passionate about and are given regular updates to follow the progress.

With around 18 million cancer cases each year globally, Easton sees the opportunity to make the biggest impact for good, by using his wealth to try and speed up cancer survival.

He explains that he feels duty-bound to use his wealth for good and invest in a better future.

“While wealthy people can afford to give, scientists and cancer patients cannot afford to wait.”

In the UK, nearly one in two people will get cancer in their lifetimes, so it is hard to find someone who hasn’t been impacted.

“I have friends who have suffered, and some are fighting the disease now,” he says.

Making and monitoring your impact

Cancer Research UK’s research, supported by philanthropic funding, has meant that while in the 1970s only one in four people in the UK survived their cancer for 10 years or more, now, twice as many survive. “That’s real, tangible progress” says Easton, "and Cancer Research UK has played a huge part in that progress”.

One of Cancer Research UK’s ambitions is that by 2040, around 20,000 cancer deaths will be avoided each year, helping to bring about a future where everybody lives longer, better lives, free from the fear of cancer and Easton knows that by supporting the charity, he will be helping to make that future a reality.

“There is a very real and present issue regarding cancer survival, treatments and prevention but the UK government is funding less and less, which is where private donations and philanthropy come in.”

"We have to get on with it as donors, and we have to get on with it now. Our support is vital to make sure research happens.”

And for him the rewards are twofold; both seeing the impact and progress of research, as well as meeting the scientists at the forefront of breakthroughs.

“The reward is in improving cancer outcomes and seeing the difference Cancer Research UK is making after all the hard work of research and clinical trials.” He says, “But, I also love meeting the people involved in researching new treatments and saving lives. They blind me with the science!”

The importance of track record

But it’s not all about following your heart when it comes to donating to charity, Easton says. He still invests privately for profit and the approach is similar for the non-profit philanthropic side.

“I pay a lot of attention to track record when investing for philanthropic outcomes,” he says.

Cancer Research UK has helped develop more than half of the world’s essential cancer medicines while more than 8 in 10 people prescribed cancer drugs on the NHS in England receive a drug linked to the charity’s work.

Easton adds: “There is strong oversight and monitoring from the experienced staff and officials at Cancer Research UK when choosing treatments and research to back, so you can be reassured that all the science has been through lots of decision making.”

"This means you can be as confident as you would want to be with any investment."

Tax benefits of philanthropic investing

You get Gift Aid on your contributions at your own tax rate. Plus, if you leave 10% of your estate to charity in your will then the inheritance tax rate reduces to 36%. So, it can provide handy inheritance and tax planning benefits.

Additionally, with tax allowances on dividends and capital gains being cut, philanthropic giving can be an effective use of your money rather than giving it to the taxman.

‘My latest philanthropic investment’

Easton has just invested in Cancer Research UK’s new campaign, More Research, Less Cancer which is the largest ever philanthropic campaign by a UK charity, aiming to raise £400m for cancer research.

You can help fund Cancer Research UK’s important research at the Francis Crick Institute, back its Cancer Grand Challenges campaign to tackle specific types of the disease, help back startups to bring drugs to market through its Translation and Innovation division or support scientists at every stage of their career through the Future Leaders Initiative.

This enables more innovation that translates into effective therapies and diagnostics for patients.

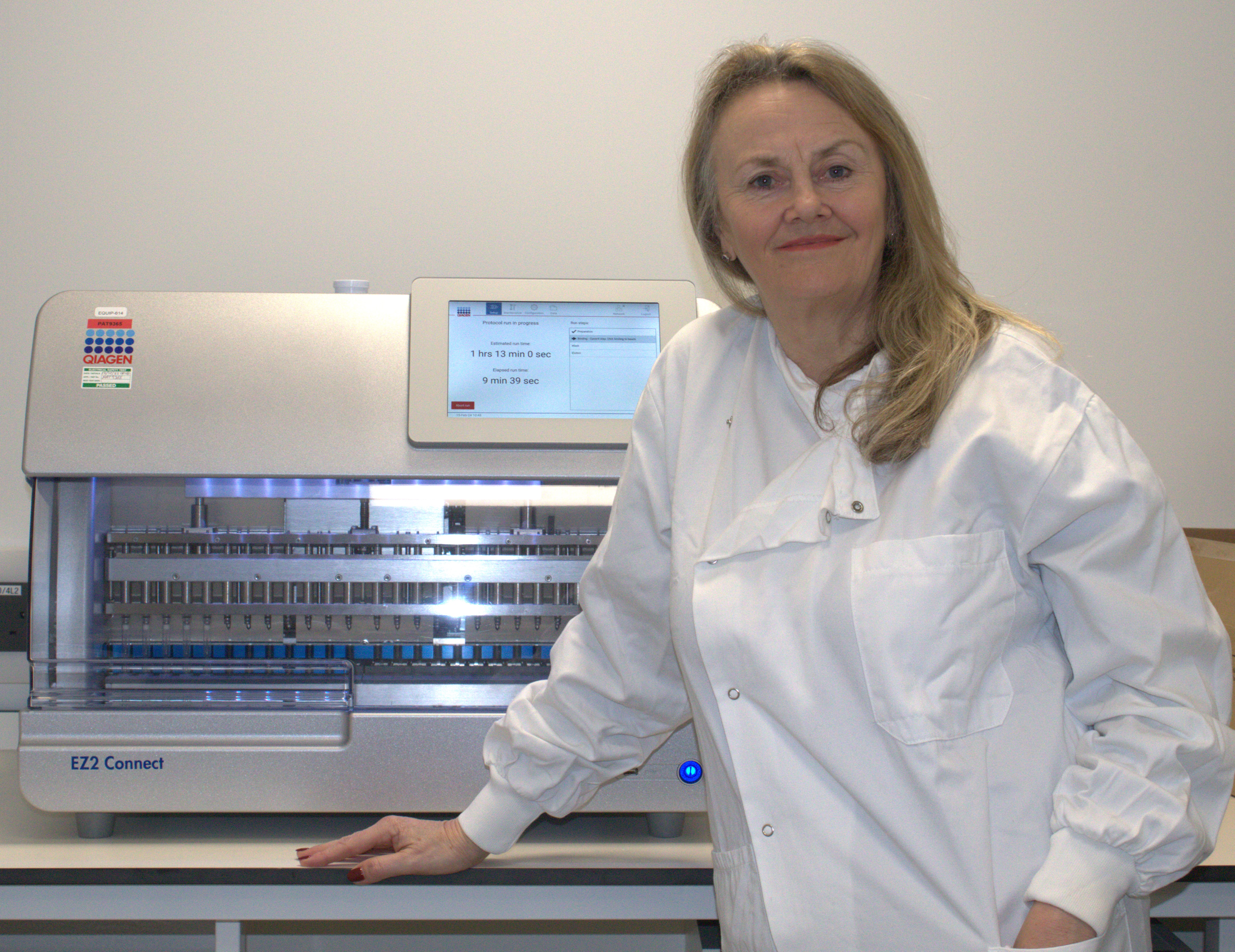

One of the scientists Easton supports through Cancer Research UK is Professor Caroline Dive, director of the Cancer Research UK National Biomarker Centre in Manchester, who is playing a key role in early cancer detection. Easton’s generosity will help accelerate Professor Dive’s work and ensure there is the vital funding needed for research and development to create treatments that can help patients faster.

Together, scientists and philanthropists are building a life-changing legacy that will change the lives of patients for generations to come. The future course of life-saving cancer research is truly in their hands.

For more information on how to invest in Cancer Research UK’s More Research, Less Cancer campaign: visit Cancer Research UK.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how