Can the outperformance of the US market continue?

SPONSORED CONTENT – The US has rallied far more aggressively than its peers. Why have European equities fallen so far behind?

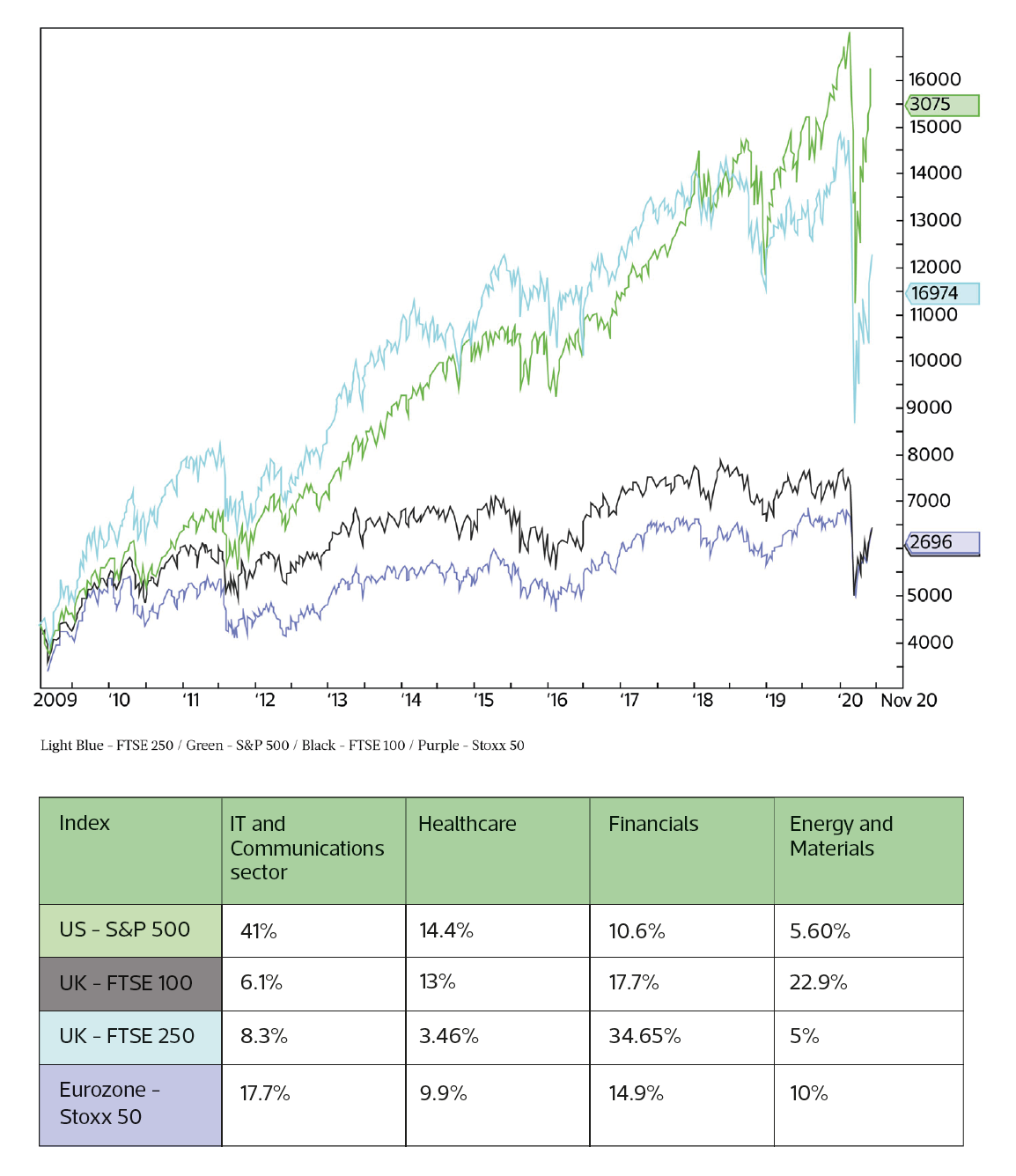

If stockmarkets were in a race, the Americans would be taking all the gold medals while the Europeans would be lucky to collect a handful of bronze. To grasp just how far US equities have raced ahead of the pack, just look at the chart accompanying this article. It looks at returns from major national stock market indices since the end of the global financial crisis in 2009. Green indicates the S&P 500 in the US, black the UK’s FTSE 100, light blue the UK mid-cap index, the FTSE 250 (more on that one in a moment), and purple the eurozone’s Stoxx 50 index.

Even if we look at returns since the coronavirus-induced sell-off, and subsequent rally, it’s clear that while all of the key benchmarks sold off in synchronised fashion, the US has rallied far more aggressively than its peers. So, why have European (and especially UK equities) fallen so far behind? The table below, showing the makeup of the individual indices, sheds some light on the topic.

Technology stocks have been on a tear, and in the US they dominate the two subsectors – IT and communications – which account for 41% of the S&P 500. Meanwhile, banks and insurers have fallen out of favour, while resources businesses (energy companies and miners) have also been in something of a funk. That’s bad news for the FTSE 100 index – financials and resources businesses account for over 40% of its total market capitalisation. In the US by contrast, these two sectors account for just 16%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Information technology businesses have turned into cash machines with high profit margins, whereas profits at financial services and resources businesses have been strained. Given these stark differences, one could argue that US stocks are simply riding high on expectations of increased earnings (profits) growth and higher margins.

It’s not just about tech stocks

On the chart, you may have noted that the FTSE 250 index has actually seen returns that have mostly matched, and at some points exceeded, those of the S&P 500. That’s because the FTSE 250 index is full of fast-growing mid-cap businesses which have produced bumper profits over the last decade.

By contrast, if we look at the top 20 stocks – by market capitalisation – in the FTSE 100 index of UK-listed large caps, there is not one blue chip that hasn’t been around in one guise or another for at least the last 40 years. Vodafone (a veritable whippersnapper compared to BP) comes in at number 12, followed by National Grid, and tech-focused credit group Experian at 19. In comparison, both the S&P 500 and the FTSE 250 are chock full of businesses that didn’t exist 40 years ago.

However, it’s worth leaving the topic with a final caveat. The US focus on growth businesses has come with a catch. The valuations attached to tech stocks are now strained, bordering on expensive in the US. By contrast, UK large caps look dirt cheap. According to equity analysts at French investment bank Societe Generale, UK large-cap stocks trade at around 12 to 14 times 2019 and 2020 earnings, whereas US stocks trade at around 20 times earnings. Not just that, but French, German and Japanese stocks all trade at higher valuations than UK ones.

If there’s one lesson from financial history, it’s that eventually valuations do revert to their long-term average – and UK large-cap equities are currently very cheap.

Discover more of the latest investment views and ideas from Liontrust’s experienced fund managers

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how