Investing in the future of European defence

Investors could benefit from exposure to European defence businesses as the continent prepares to ramp up its spending in the defence sector

European defence spending is skyrocketing, creating new opportunities for investors to back the continent’s most innovative and experienced businesses.

Between 2023 and 2024, defence spending increased by 11.7%. In Germany, spending grew by 23.2%, giving the country the world’s fourth-largest defence budget. Poland is now the world’s 15th-largest spender on defence, up from 20th place in 2022. This growth has principally been driven by the growing sense of vulnerability following Russia’s invasion of Ukraine in 2022. The outbreak of the war shook European leaders out of their complacency regarding their defence capabilities, prompting many countries to correct historic underspending on defence.

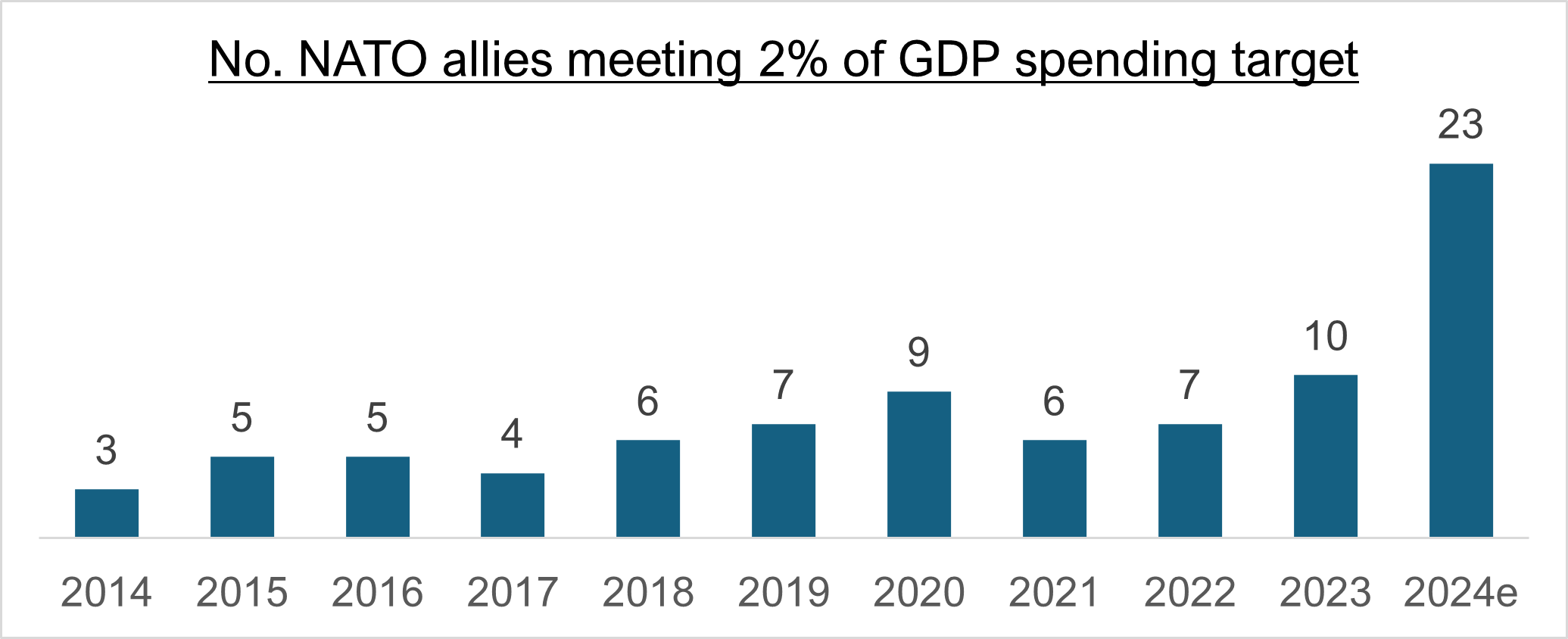

In 2021, just six members of Nato had defence budgets that surpassed 2% of GDP; by 2024, 23 NATO members were at or above this target.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Even so, there is a growing consensus that this 2% figure is still too low, given the potential threats to the continent. US President Donald Trump has demanded European Nato members go to 5% of GDP; Mark Rutte, the head of Nato has suggested closer to 4% as a target.

The Trump effect

Growth in defence spending may, therefore, only just be getting started. Europe’s defence establishment was shaken by Donald Trump’s suspension of US military aid to Ukraine, which also saw intelligence-sharing paused and left Kyiv unable to use certain American weapons. This delivered a clear warning to European leaders: the United States is no longer the unwavering security guarantor Europe once assumed it to be. As a result, a new sense of urgency has emerged among European leaders.

In the UK, the Government recently committed an extra £2.2 billion to defence, setting a course towards defence spending worth 2.5% of GDP by 2027. The Government aims to reach 3% of GDP by the next parliament.

One of the most significant shifts has come from Germany. The country’s next Chancellor, Friedrich Merz, has announced a sweeping defence spending package and amended Germany’s debt rules to partially exempt military expenditure. For years, Germany’s arms industry has been restricted by political hesitancy and strict rules on government borrowing. Merz’s reforms change that. German manufacturers such as Rheinmetall, Hensoldt, and Renk are now expected to ramp up production to meet surging demand. Germany, long criticised for underinvesting in defence, is now positioning itself as a major player in European rearmament.

At the EU level, the ReArm Europe initiative, an €800 billion defence programme, will be deployed to strengthen the continent’s security and reduce dependence on non-European suppliers. The plan will direct European defence spending towards domestic manufacturers, securing long-term investment in European military capabilities. This is particularly significant for firms such as Thales, Leonardo, and Saab.

After years of debate over “strategic autonomy,” the EU is putting capital behind the concept.

The road to 5%

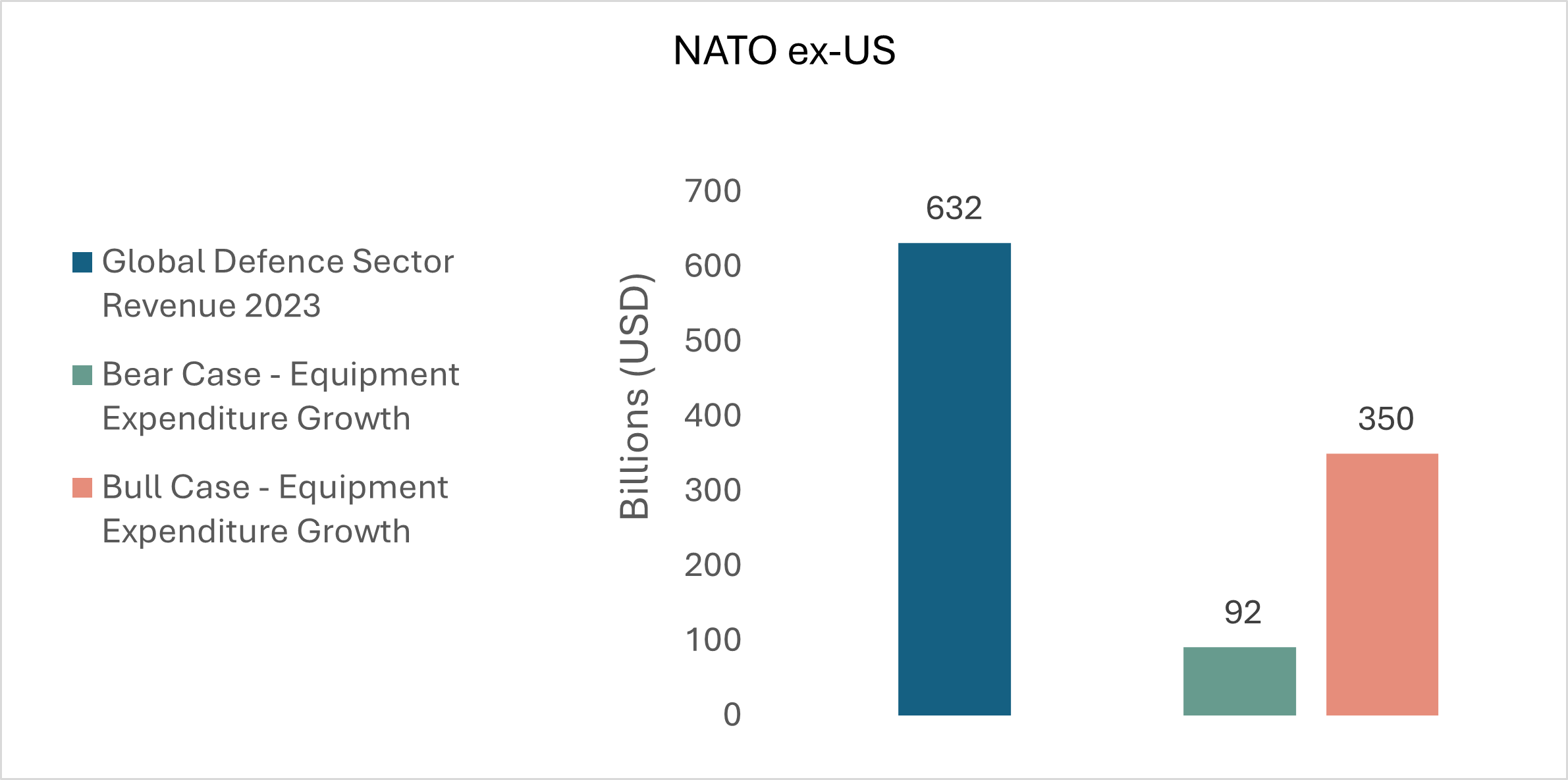

HANetf recently modelled several scenarios to determine how much extra Nato members (excluding the US) may spend on defence equipment in the coming years. In our “bull case” scenario, we assumed that Nato (ex-US) defence budgets rise to 5% of GDP by 2029, with equipment spending as a share of those budgets increasing by one percentage point each year, and collective GDP growing at 2% annually.

This would result in an additional $350 billion of spending on defence equipment. That equals more than half the global defence sector’s revenue in 2023. Even in our “bear case” scenario, there will be a significant rise in spending on defence equipment. In this context, we assume that Nato (ex-US) defence budgets reach 3% of GDP by 2029, with equipment spending remaining at 31.6% of total budgets, and collective GDP growing at 1% annually. That would result in an increase in defence equipment expenditure of $92 billion, a still significant portion of global defence revenues.

The future of European defence

For investors, this could represent a significant opportunity a multidecade tailwind for European defence companies and military technology innovators. This will be driven by both the huge uplift in defence spending and the reorientation of that spending towards European companies. Investors considering this theme may want to consider an exchange-traded fund (ETF) that includes exposure to the future of defence - not just traditional hardware. This sector will continue to grow with European suppliers coming to the fore as reliance on US companies is reduced over time. Investors may also want to consider a European defence fund that is issued by a European company to be consistent with Europe’s broader push for strategic autonomy in defence, energy, and capital markets.

For professional investors only. Capital at risk. For information on European Defence ETFs, contact your professional financial advisor.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how