Investing in defence as the world rearms

As countries in Europe and worldwide increase military spending amid mounting geopolitical tensions and risks, investors are taking a fresh look at defence companies

In a highly uncertain world, increased military spending, both in Europe and globally, is boosting the earnings of defence companies. And as this new “defence supercycle” continues to gather pace, many investors are seeking to increase their exposure to the defence sector.

It has been a remarkable 10 years. In 2014, when Russia illegally annexed Crimea, the reaction of NATO members in Europe was a commitment to move towards spending at least 2% of their GDP on defence. Progress was initially slow, with the majority of countries still a long way off the 2% spending goal when Russia launched its full-scale invasion of Ukraine in 2022.

That moment decisively changed attitudes. From Polish Prime Minister Donald Tusk to the UK’s former defence secretary Grant Shapps, leaders across the continent now routinely describe Europe as being in a new “pre-war era”. Accordingly, European NATO members have materially increased their defence spending.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

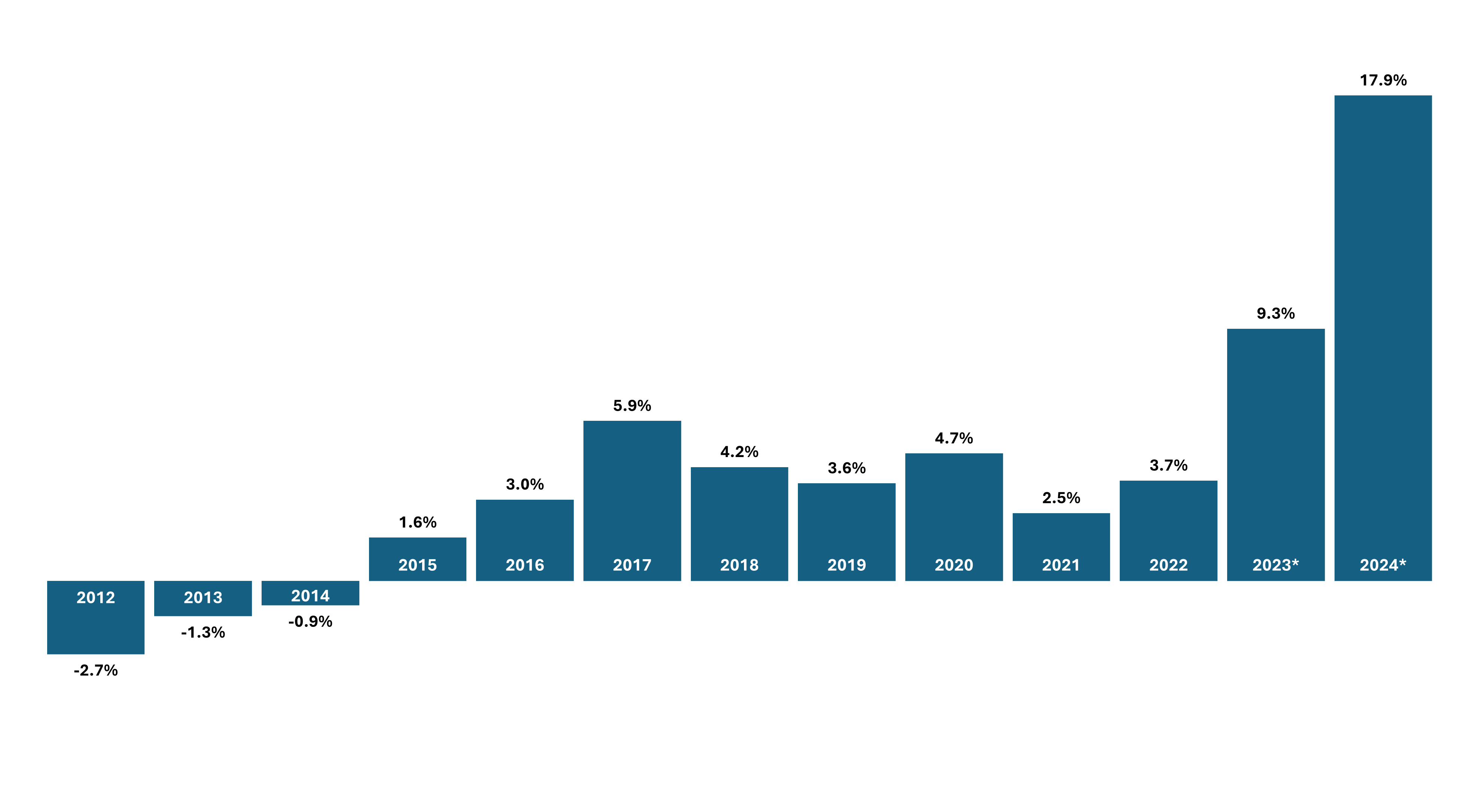

Today, 23 out of the 32 NATO members spend at or above the 2% target. Poland, for example, is expected to spend 5% of its GDP on defence in 2025. Excluding the US, NATO members are this year due to increase their collective defence spending by almost 18% compared to 2023. Defence companies have rarely seen such rapid spikes in demand.

Change in defence spending among NATO (excluding US) members

Source: NATO, June 2024. Data excludes the U.S. % year-on-year change in spending based on 2015 prices. For illustrative purposes only.

*Forecast figures

Trump back in office

Europe’s sense of vulnerability is further heightened by the re-election of Donald Trump. In his first term, Trump often questioned NATO’s purpose and implied that US support could wane for members not meeting their financial commitments. This will add further momentum to Europe’s defence spending push.

However, investors who see increased defence spending as a solely European phenomenon may miss broader opportunities. In fact, US commitment to European security has already reduced compared to the Cold War era. At the end of the Cold War, US Army troops in Europe numbered almost 300,000. By 2014, just one tenth of that force remained.

The shift reflects the realities of today’s geopolitics. As President Trump returns to office, US attention is no longer focused on the great power competition between the US and USSR. Rather, China is the US’s primary global rival; the ground zero of this competition is the Asia-Pacific region rather than Europe. And should a major crisis break out over Taiwan, that will intensify.

Worldwide, defence spending is on the up. Global military spending grew by 6.8% in 2023 compared to the previous year. Total spending hit a record level of $2.4 trillion. Just as in Europe, states are spending more on defence not just because of an immediate threat but also the perception of increased danger to come.

One way to access the investment potential of this opportunity is through an exchange traded fund (ETF) that provides exposure to this theme. Contact your financial adviser or search ‘NATO Defence ETF’ to find out more.

For professional investors only. Capital at risk. For information on defence ETFs, contact your professional financial advisor.

Your capital is at risk when you invest, never risk more than you can afford to lose. Forecasts are not reliable indicators for future results.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how